9.1 Introduction

The importance of the copper mining sector in Chile is unquestioned and is reflected in many production, international trade and fiscal revenue indicators. The sector, however, faces major challenges, namely deeper mines, scarcity of (and consequently more expensive) key inputs such as water and energy, lower-grade ores, concern for neighboring communities and respect for the environment. Innovation appears to be key to tackling these issues.

Given the well-documented causal relation between innovation and productivity gains,Footnote 1 it is very important to determine whether there is also a correlation between intellectual property (IP) protection and innovation rates. Although this seems theoretically plausible (intellectual property rights are, in effect, temporary monopoly rights and thus incentives for innovation), there is little supporting empirical evidence.

This chapter contains the findings of an online survey of 300 resident mining equipment, technology and services suppliers (METS) that are covered by EXPANDE, a public–private program on open innovation in the mining sector. The main survey objective was to collect information on the number of patents and other intellectual property rights (IPRs) filed, the firms’ consideration of IP protection in their commercial strategies and the factors that underpin decisions on IP protection.

The survey analysis was complemented by semi-structured interviews of senior executives from a sample of 13 entities (four mining companies, seven METS and two universities). Four case studies on the firms interviewed have been selected because they interestingly reflect different types of innovation that should thus relate to different IP management strategies.

The literature on the subject has hitherto focused on high-income countries. Little, and rather, anecdotal, evidence is available for middle-income countries (Reference Hall, Abud, Fink and HelmersHall et al. 2013). The only exception is the comprehensive report published by the National Institute of Industrial Property (INAPI) in 2010 and providing data on the patenting practices of companies participating in the Copper Mining Cluster Program from January 2000 to December 2009.Footnote 2 This chapter complements and updates INAPI’s 2010 analysis and raises new questions.

This chapter differs from earlier endeavors by focusing on METS, while drawing on suggestions in the literature that they could play a major role in the mining sector’s innovation patterns (see, Reference Bravo-Ortega and MuñozBravo-Ortega and Muñoz (2015, Reference Bravo-Ortega and Muñoz2017), Reference NavarroNavarro (2018), Reference Meller and GanaMeller and Gana (2016), Reference Scott-KemmisScott-Kemmis (2013) and references therein). METS’ innovative capabilities have been largely confirmed, but the findings show that they hardly rely on IP protection mechanisms.Footnote 3 Some evidence of the likely underlying factors is provided and policy implications suggested.

It must be stressed, however, that the information gathered yields only preliminary evidence on the importance of IP as a driver of innovation practices in the mining sector. The chapter should generally be viewed as a starting point and an invitation to conduct new research in greater depth.

Section 9.2 highlights the importance of the copper mining industry in Chile, while Section 9.3 adduces some preliminary evidence on the sector’s innovation capabilities, with particular emphasis on resident suppliers. Section 9.4 outlines the methodology and sources of information, while the fifth contains the main findings. The chapter ends with the conclusion and policy recommendations in Section 9.5.

9.2 The Mining Sector in Chile

The importance of the mining sector in Chile is reflected in many production, international trade, employment and fiscal revenue indicators. Chile holds 29.2 percent of the world’s copper reserves and accounts for 30 percent of world output. The Chilean State owns the National Copper Corporation (Codelco), the world’s largest copper producer, and the world’s largest copper pit (Escondida, owned by Broken Hill Proprietary Company Limited (BHP) and Rio Tinto), is in northern Chile.

In 2016, mining production accounted for 11 percent of gross domestic product (GDP), with copper production amounting to 10 percent. These figures were stable throughout the 2013–16 period. Copper exports accounted for 45 percent of total exports in 2016.Footnote 4 The latter figure does give some cause for concern, as the high share of copper exports in total exports leaves the country extremely sensitive to the international business cycle.

Table 9.1 Share of global production and reserves (%, 2015)

| Production | Reserves | |

|---|---|---|

| Chile | 30 | 29 |

| Peru | 9 | 11 |

| USA | 7 | 5 |

| China | 9 | 4 |

| Russia | 4 | 4 |

| Australia | 5 | 12 |

| Canada | 4 | 2 |

| Zambia | 4 | 3 |

| Congo Democratic Republic | 5 | 3 |

Mining companies in Chile face challenges in a wide variety of areas, all of which are critical to productivity gains. First, lower-grade ores and mines that are hard to exploit (the resources are at greater depth than in the past), the shortage of key inputs (mainly water) and relations with local communities (made more contentious, among other environmental problems, by air and water pollution) are all factors that raise production costs.

Moreover, the sector’s total factor productivity (TFP) fell at an average estimated rate of 4.7 percent per year between 1993 and 2015, according to a recent report by the Organisation for Economic Co-operation and Development (OECD, 2018). It also fell in other “mining countries,” but the negative trend was sharper in Chile, as stressed in the report, and seemed to be the main factor of TFP stagnation in Chile’s economy.

Owing to all of these factors, firms should become more innovative (Reference BáezBáez, 2015) and, for that reason, it is very important to understand the factors that can raise the sector’s innovation rate.

9.3 Innovation in the Mining Sector

9.3.1 Preliminary Observations

Interestingly, several authors have written that the sector (and extractive industries in general) is a canonical example of a noninnovative sector, at least in the case of big mining companies (Reference MurphyMurphy, 2015). This view is consistent with the idea that it is more of a curse than a blessing for a country to be rich in natural resources (Reference Sachs and WarnerSachs and Warner, 1995 and Reference Sachs, Warner, Meier and Rauch2001), but it has been contested by Reference Bravo-Ortega, de Gregorio, Lederman and MaloneyBravo-Ortega and De Gregorio (2007), Reference Lederman, Maloney, Lederman and MaloneyLederman and Maloney (2007) and Reference Manzano, Rigobon, Lederman and MaloneyManzano and Rigobon (2007), among others. Suffice it to say here, without delving into the debate, that, other factors being equal, innovation seems to make a difference in resource-rich countries’ reasons for taking differing development paths. It is therefore important to try to understand how innovation can be triggered in this sector.

The following issues appear to be critical in this regard: (i) development of linkages between end producers and input suppliers; (ii) collaboration by both end producers and input suppliers with universities and research institutes; and (iii) in-house innovation which, in the case of suppliers, is crucial to the development of knowledge-intensive mining services (KIMS); for supporting evidence, see Chile Foundation (FCH) (2014), Reference Fessehaie and MorrisFessehaie and Morris (2013) and Reference Bravo-Ortega and MuñozBravo-Ortega and Muñoz (2015). In Chile, public and private efforts have been made under these three heads. Examples of collaboration between the public sector and private firms include the World Class Mining Suppliers Program,Footnote 5 developed by BHP Billiton and Codelco (FCH, 2014), and the Alta Ley Mining Program, which is jointly administered by the Production Development Corporation (CORFO)Footnote 6 and the Ministry of Mining and is designed primarily to strengthen productivity, competitiveness and innovation in the national mining industry and to build national KIMS-exporting capacity.

9.3.2 The Role of Specialized Suppliers in Chile

Although the sector has been described as not very innovative, this might be an untenable view because it focuses only on end producers (mining firms) whereas most mining innovations seem to be actually developed by specialized suppliers rather than big mining operators (Reference MurphyMurphy, 2015). Reference Klevorick, Levin, Nelson and WinterKlevorick et al. (1995) point to the technological opportunities arising in various sectors as a major cause of poor innovative performance and conclude that metal production is indeed one of the sectors in which technological opportunities are low.Footnote 7 Reference Hall, Abud, Fink and HelmersHall et al. (2013) reinforce this point and attribute Chile’s low patent intensity partly to an industrial specialization pattern dominated by sectors with a low propensity to patent, such as the mining sector.

Suppliers have grown in importance as innovation drivers, moreover, because mining firms are increasingly outsourcing nonstrategic tasks such as transport, by-products, information technology (IT) services and equipment maintenance so that they can focus on their core business areas (FCH, 2014). According to FCH (2014), METS innovation rates are higher than recorded national economy and mining industry averages.Footnote 8 Moreover, 25 percent of the companies surveyed, by category, were classified as Essential Innovators, which are companies (METS) that have high levels of innovation and capabilities for new technology and equipment development.

Table 9.2 Percentage of firms that innovate (mining suppliers vis-à-vis the industry and the economy)

| Type of innovation | METS firms | Mining firms | National economy |

|---|---|---|---|

| Product | 60 | 12 | 12 |

| Process | 41 | 35 | 16 |

| Management | 51 | 27 | 14 |

| Marketing | 31 | 10 | 10 |

In terms of innovation capabilities and performance, however, this sample might not be considered very representative of the METS universe. As a matter of fact, the sample covered companies which had taken part in the World Class Supplier Program and which are characterized by being more sales- than mining-intensive and by having higher levels of professionalization and of innovation and export capacity than the average supplier.

Despite this likely bias, the findings have been largely confirmed by a recent report by the Industrial Mining Suppliers Association (APRIMIN) and the Chilean Copper Commission (COCHILCO) on the innovative behavior of 108 resident METS (APRIMIN/COCHILCO, 2017). According to the report, innovation is highly valued by companies, 75 percent of which reportedly have an innovation budget, and there are no apparent differences between national and foreign companies, although foreign companies had higher innovation rates. Among other findings, most of the respondent companies (83 percent) reported that they had experience of piloting, although there was scope for even greater cooperation with other competitors and research centers. Lastly, CORFO was most widely recognized as the institution that channeled public support for innovation activities.

According to FCH/PROCHILE (2017), METS’ exports to a total of 39 countries in 2016 amounted to nearly 3 billion dollars. The main destinations were Peru (43 percent), the United States of America (28 percent) and Mexico (6 percent). The supplier sector mainly exported mining design and engineering consultancy services, which accounted for 44 percent of services exported in 2016. Original software design services ranked second at 25 percent and IT consultancy services and technical support ranked third at 22 percent. Export capacity was high, despite the low copper cycle (prices), as local companies had maintained product development and international mining market share and had exported significant amounts.

9.3.3 IP in Chile’s Mining Sector

As stated, the mining sector faces major efficiency, productivity and sustainability challenges. Innovations leading to improvements in one or more of these areas may give a great competitive edge to firms and, to retain that advantage, consideration must be given to IP protection.

IP protection not only constitutes an effective tool for resolving appropriability issues,Footnote 9 but also affords an opportunity to raise a firm’s commercial value because IPRs are an asset that can be used strategically. For instance, patents can be licensed and even sold. This added value can also be used as fund-raising collateral. Codelco’s experience illustrates this point. IP comes into play when Codelco develops mining equipment prototypes and enters into supplier agreements. Once tested, the prototypes are incorporated into Codelco’s production processes. Under the agreements, Codelco transfers IPRs to its commercial partner in order to optimize product development. Moreover, IP plays a major role in a firm’s network of alliances with various companies, research centers and universities (Reference BáezBáez, 2015).

Mining is one of the sectors that contribute most to patenting in Chile, together with the chemical and pharmaceutical sectors. Codelco and its technological division (Codelco Tech), both included in the sample of companies interviewed for this chapter, are the leading patent holders (see Table 9.3). Box 9.1 covers Codelco’s innovation and IP strategy.

Table 9.3 Mining-related patents filed in the Chilean Patent Office

| Year | Non- Residents | Residents | |

|---|---|---|---|

| Total | Of which Codelco | ||

| 2009 | 85 | 59 | 11 (19%) |

| 2010 | 35 | 49 | 12 (24%) |

| 2011 | 130 | 49 | 2 (4%) |

| 2012 | 187 | 41 | 1 (2%) |

| 2013 | 188 | 41 | 2 (5%) |

| 2014 | 200 | 55 | 10 (18%) |

| 2015 | 177 | 67 | 4 (6%) |

| 2016 | 169 | 43 | 1 (2%) |

| 2017 | 117 | 39 | 8 (21%) |

| Total | 1.288 | 443 | 51 (12%) |

In the preceding nine years (2000–9), 1,090 patents were filed (INAPI, 2010). In the period under review, 1,731 patents were filed, an increase of 58 percent. In 2000–9, 41 percent of the applications filed were national patent applications, which fell in the following nine years to 26 percent but remained higher than the average for national applications within the economy as a whole.Footnote 10 Most national patent applications therefore originated in the mining sector.

According to INAPI (2010), in the 2000–9 period, 93.3 percent of applications were filed by firms domiciled in 10 different countries. Chile led the ranking with 41.4 percent, followed by Finland (12 percent) and the United States of America (11 percent). The most recent data for the 2009–17 period paint a similar picture, with the United States of America replacing Finland in second position. Table 9.4 shows the 10 countries that have filed the greatest number of patents in Chile in the last nine years.

Table 9.4 Major 10 nonresident (NR) firms filing patents in Chile, by country of origin

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | Total | |

|---|---|---|---|---|---|---|---|---|---|---|

| United States | 23 | 11 | 22 | 47 | 44 | 43 | 43 | 32 | 25 | 290 |

| Germany | 7 | 2 | 19 | 24 | 25 | 26 | 14 | 19 | 6 | 142 |

| Finland | 3 | 2 | 15 | 13 | 8 | 23 | 18 | 26 | 12 | 120 |

| Australia | 8 | 2 | 14 | 12 | 11 | 14 | 11 | 10 | 6 | 88 |

| Switzerland | 1 | 1 | 6 | 10 | 16 | 16 | 8 | 14 | 10 | 82 |

| Canada | 3 | 1 | 7 | 12 | 8 | 10 | 8 | 9 | 11 | 69 |

| Japan | 14 | 2 | 3 | 9 | 7 | 4 | 12 | 4 | 3 | 58 |

| France | 1 | 1 | 9 | 4 | 7 | 12 | 5 | 10 | 2 | 51 |

| Brazil | 3 | 3 | 2 | 7 | 7 | 7 | 4 | 2 | 8 | 43 |

| United Kingdom | 3 | 5 | 5 | 11 | 2 | 4 | 6 | 1 | 37 | |

| Total | 63 | 28 | 102 | 143 | 144 | 157 | 127 | 132 | 84 | 980 |

| (percent of NR) | 74 | 80 | 78 | 76 | 77 | 79 | 72 | 78 | 72 | 76 |

Codelco’s importance to mining in Chile merits further examination of how the company is organized for innovation.

In 2016, Codelco merged its technological companies (IM2, BioSigma and Codelco Lab) into a single division known as Codelco Tech.

The new company is wholly owned by Codelco and has devised an open solutions development model that incorporates and promotes contributions by suppliers, research centers, start-ups and other entities.

Each of Codelco Tech’s many units is tasked with seeking solutions in areas such as pyrometallurgy, hydrometallurgy, water, energy, underground mining, pit mining, biotechnology, automation, robotization, remotization, data science and new uses of copper, lithium, molybdenum, sulfuric acid and by-products.

The company has established an innovation management system in order to measure its impact over time in relation to a 2016 baseline.

By 2015, Codelco had filed 250 national and international patent applications, 134 of which have been granted in Chile and 21 in other countries. The company has focused its innovation strategy on developing smart mining technologies for use at every stage of production in order to raise productivity and operational efficiency and achieve significant cost savings. These technologies include remotely controlled mineral-extracting robotic machinery that considerably reduces miners’ occupational hazards, and new digital technologies for ever greater integration and automation of remotely managed processing operations (Source: Reference BáezBáez, 2015 and interview of senior Codelco Tech and Codelco executives).

9.3.4 INAPI’s Role

INAPI is Chile’s IP Office. Its current policy agenda, of relevance to the mining sector, includes statistical data (Analiza),Footnote 11 capacity-building, awareness-raising, advice to small- and medium-sized enterprises (SMEs) and public policy. Under the first component, INAPI conducts surveys and issues reports on the current status of IP in the mining sector, as exemplified by the aforementioned publication (INAPI, 2010), which complements other reports on mining issues.

The second component consists of training programs for mining sector entities, including operational and innovation management staff. The achievements of the “INAPI in the field” project have been considerable in the north of the country, which is the predominant mining region. For example, INAPI provides training in IP strategies to member companies of the Antofagasta Industrial Suppliers Association that are at the technology-development and product-packaging stage (an advanced stage of the innovation pipeline).

Lastly, INAPI contributes to public policy formulation on the subject as a permanent advisor on CORFO-based programs that provide funding for large-scale and long-term innovation in mining sector projects. This is the case of the Innova Chile committee, the Technological Capabilities subcommittee and the Alta Ley Council, through which the major stakeholders (academia, suppliers and mining companies) meet to draw up a roadmap to solve industry-wide problems (the roadmap is used by CORFO in drawing up its technological support programs). On INAPI’s recommendation, all beneficiary companies under CORFO-administered innovation support programs are required to have IP management strategies in place and to keep available technologies under technological surveillance. These rules are necessary because many mining industry technologies have not been protected owing primarily (if not only) to a lack of awareness of IP protection mechanisms and the myth about their costs and complexity (lack of knowledge leads naturally to immobility).Footnote 12

9.4 Methodology

Inputs were gathered from three main sources, namely online surveys, semi-structured interviews and case studies. Each information source is covered below.

9.4.1 Survey: EXPANDE Program

An online survey was conducted of 300 resident suppliers that form part of EXPANDE, which is the first ever open-innovation mining program. Led by BHP, AMSA, Codelco and FCH, the program was established in 2017 and builds on the lessons learnt from the World Class Suppliers Program (2008–16). EXPANDE seeks to link mining companies that require technological solutions not only to suppliers but also to other stakeholders in the ecosystem such as investment funds, banks, export promotion agencies and international knowledge nodes.

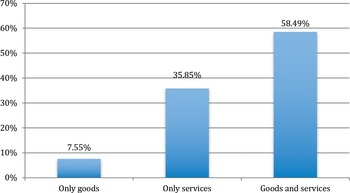

The firms were interviewed about their innovation practices, their use of IP instruments (if any) and their opinion of the IP protection system in Chile. Basic corporate financial information, such as gross domestic expenditure on research and development (GERD), exports and number of employees, was gathered. As Figure 9.1 shows, most firms produce both goods and services, followed by those that only produce services. A small proportion of firms (7.5 percent) produce only goods.

Figure 9.1 Types of firms surveyed by products supplied.

Note: Out of the 57 firms that responded the survey, 53 gave an answer to this question

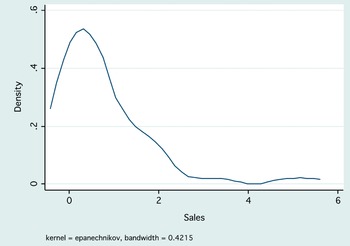

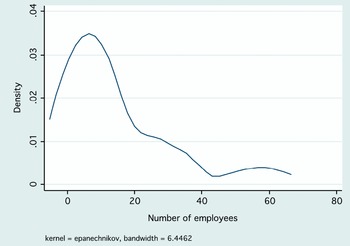

Table 9.5 shows some descriptive corporate statistics. The sample was restricted to the 42 firms recorded in the database as having positive sales.Footnote 13 Although the standard deviation (column 3) suggests that the firms are highly heterogeneous, closer examination shows that only a few “outliers” influence the result. The four biggest firms effectively account for 83 percent, with a single firm accounting for 37 percent, of total sales (Figures 9.2 and 9.3 illustrate the highly skewed distribution of the data on sales and number of workers). If the sample is narrowed down to 38 firms (excluding the largest four), the resultant statistics are those shown in the last three columns.Footnote 14

| Full sample | Excluding five larger firms | |||||

|---|---|---|---|---|---|---|

| (1) Mean | (2) Median | (3) St Dev | (4) Mean | (5) Median | (6) St Dev | |

| Sales | 4,100,835 | 463,333 | 11,723,221 | 775,133 | 425,000 | 1,023,938 |

| Exports* | 211,024 | 50,000 | 333,055 | 163,940 | 45,412 | 322,443 |

| Workers | 47 | 9 | 110 | 15 | 7 | 16 |

| GERD | 81,718 | 8,333 | 124,774 | 80,607 | 12,500 | 140,183 |

| GERD / Sales (percentage) | 12 | 2.1 | 23.8 | 13.3 | 2.3 | 24.8 |

* Among exporters

Figure 9.2 Sales (frequency distribution, excluding the largest four firms).

Figure 9.3 Employees (frequency distribution, excluding the largest four firms).

One result that does not significantly change from one table to the other is the GERD-to-sales ratio, which is higher than that of the mining sector as a whole and that of the general economy. This finding is consistent with the tendency for METS to be more innovative than other firms in the sector and in other industries.

Most respondent METS engaged in product innovation (81 percent) and process innovation (55 percent). Mining companies seem to require these types of innovation the most, as illustrated in the case studies in Section 9.5.4.

9.4.2 Semi-structured Interviews

In an analysis of mining industry patents, Reference FrancisFrancis (2015), mindful of the wide array of technologies involved, classified patent applicants into three groups, namely miners, METS and major publicly funded entities such as universities. This classification was followed when conducting semi-structured interviews of senior executives from a sample of four mining firms, seven METS and two universities.Footnote 15

All of these organizations consider themselves to be innovative, have collaborated on innovation projects with universities or nonacademic research centers at least once and are active users (beneficiaries) of public innovation-supporting instruments. As to IP protection mechanisms, most rely on patents, which they have registered both nationally and internationally through procedural formalities delegated to external lawyers.Footnote 16

The interview questionnaire contained questions designed to elicit information on these organizations’ innovation and IP protection practices. The interviews usefully corroborated some survey findings. It is noteworthy, however, that although the sample is very small, the companies were not selected at random.

9.4.3 Case Studies

Two case studies are similarly structured. They set out the innovation idea and its expected impact, any difficulties encountered during the innovation process and the way in which each organization has handled related IP matters.

The two METS were selected from the sample of interviewees. The case studies are particularly interesting because they concern different types of innovation for which different kinds of protection could be sought. The scope of application, too, varies: the first concerns a process innovation that is applicable to all copper mines worldwide, while the second concerns a product innovation that is tailored to the particular mine and could hardly be sold abroad.

9.5 Analysis

This section provides some preliminary ideas on the IP protection practices of the suppliers surveyed. The interviews yielded valuable complementary information.

9.5.1 Do METS Rely on IP Protection Mechanisms?

As noted earlier, the METS surveyed considered themselves to be innovative. This has been borne out by their responses on the type of innovation and the average GERD.

The next question of interest was whether the firms protected their innovations. As shown in Table 9.6, the answer to this question is in the negative: METS do not protect the outcome of their innovation efforts. Most firms have not filed IP applications either in Chile or abroad.Footnote 17 This is particularly true of industrial designs and utility models.

Table 9.6 IP applications filed in the Chilean Patent Office and abroad, by instrument (%)

| In Chile | Abroad | |||||

|---|---|---|---|---|---|---|

| 0 | 1 | 2 or + | 0 | 1 | 2 or + | |

| Patents | 52.9 | 26.5 | 20.6 | 60.9 | 17.4 | 21.7 |

| Utility models | 91.3 | 4.4 | 4.4 | 90.0 | 0.0 | 10.0 |

| Industrial design | 87.5 | 12.5 | 0.0 | 85.0 | 0.0 | 15.0 |

| Trademarks | 79.2 | 16.7 | 4.2 | 84.2 | 0.0 | 15.8 |

Although most METS do not protect their innovations, nearly 90 percent of them stated that they take IP issues into account when appraising new business opportunities, as Table 9.7 shows. The table also shows that most METS are fully aware of IP protection costs and regulations.

Table 9.7 Questions on IP practices and regulation (%)

| Yes | No | |

|---|---|---|

| Do you know the legislation that regulates IP in Chile? | 74 | 26 |

| When appraising new business opportunities, do you consider the IP involved? | 88 | 12 |

| Do your company’s employment and supplier contracts contain any clauses on confidentiality and/or other IP ownership matters? | 74 | 26 |

9.5.2 Why Do Innovative METS Not Rely on IP Protection Mechanisms?

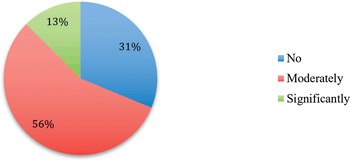

The literature suggests that the major reasons for this situation are patent costs, the perceived complexity of the patent system and some companies’ preference for soft forms of protection such as trade secrets.Footnote 18 As shown in Table 9.8, the analysis has confirmed that this holds true for METS, as respondents have pointed to costs as the major reason for not protecting an innovation. It has also been confirmed by Figure 9.5, which shows that 69 percent of respondents identified costs as a major factor in their protection decision, possibly because resident METS in Chile tend to be SMEs. Conversely, protection is standard practice (especially through patents) among large mining companies, as confirmed by some mining firms’ senior executives during the interviews.

Table 9.8 Innovating firms’ reasons for not protecting innovations (%)

| The cost (including money spent and time involved) is too high | 40.0 |

| Not applicable to this innovation (e.g. software) | 33.3 |

| Does not know of IP protection opportunities | 16.7 |

| Another (softer) type of protection (e.g. trade secret or copyright) | 10.0 |

NB: Of the 57 survey respondent firms, 31 answered this question.

Figure 9.5 Do IP registration costs affect protection decisions in Chile?.

NB: Of the 57 survey respondent firms, 48 answered this question.

Moreover, Table 9.8 shows that nearly one fifth of the firms surveyed lacked knowledge of IP protection mechanisms and utilization; this interesting finding casts light on the need for information and training policies in this area to be more effectual.Footnote 19

As noted above, some METS preferred “softer” forms of protection. METS surveyed seem to rely on trade secrets as a form of soft protection. Figure 9.6 indicates that 55 percent of the respondent firms actually have trade secrets.

Interest in IP protection differed among firms, depending on whether they were exporters and on their export intensity. The number of exporting firms is so small that this point could not be tested in the analysis. A survey question was nonetheless drafted to gather information on firms that intended to export goods or services. Figure 9.7 shows that most METS (73 percent) that wished to sell goods/services abroad were interested in filing for a patent through the international IP registration system and in other means of IP protection such as trademarks (58 percent) and industrial designs (33 percent). The importance ascribed to trademarks is consistent, moreover, with most respondent METS’ tendency to invest in product innovation, inasmuch as the significance of trademarks becomes apparent when a new or improved good is to be marketed and a mark is to be devised for that purpose.

9.5.3 Does the Capacity for IP Protection Suffice?

The interviewees seemed to share the view that Chile’s expertise for proper legal and technical advice on IP strategy management sufficed.

Some interviewees considered, however, that the country lacked the required capabilities to develop business models to take full advantage of the economic potential of IP assets and that IPRs should be regarded as assets which had a clearly defined life cycle and which must give a return on time. For instance, many innovators of process and product innovations should consider ways and means of finding new markets and/or of licensing or even selling their IPRs. Capabilities must be built to take up those challenges effectively.

Universities are a good example of the country’s efforts to develop such skills and they are major stakeholders in the transfer of new knowledge and technologies to the production sector. They develop new knowledge, some of which is protected by IPRs. Engineers and managers with advanced knowledge of innovation business models are being recruited in order to take full advantage of those rights.

9.5.4 Case Studies

As it has been previously suggested, resident METS (which are probably less internationalized) don’t rely much on the patent system. This could be because they mostly work with local firms developing location-specific technologies. But there are some METS that are more oriented toward and internationalization strategy, and for them the IP system might appear more beneficial. In what follows, we analyze two good examples of this type of METS.

iFlux (Innovaxxion)

Innovaxxion has excelled as a supplier of innovative solutions based on technology and applied engineering. It operates mostly in the mining sector, although it also develops applications for other industries (defense, energy and agro-industry). It has filed 15 patents in the past 24 months in the 10 countries in which the 20 largest copper operations are concentrated.

The firm has developed a knowledge creation model under which it generates and patents innovations and then forms companies to market the new good. It invites investors to enter into the ownership of the new companies, but it retains the controlling share.

This company’s innovation model is based on the “design thinking” method, which relies on seven steps and five scales, from identification of the innovation challenge to hypothesis testing. The company works with other firms and with universities. Initial ideas undergo digital prototyping, which roughly 15 percent survive and move to the next stage (three-dimensional prototyping). The idea that best meets requirements is selected, a full-size prototype is made and large-scale testing (in an industrial environment) is conducted. If all is successful, a spin-off is formed and Innovaxxion outsources manufacturing to a “partner company.” The firm usually files two patents – one to protect the specific solution (which has a clearly determined physical appearance) and the other to protect the formulation (i.e. the specific range of parameters); this is common practice in the pharmaceutical industry when laboratories protect new drugs.Footnote 20

Applying its innovation model, the company has devised and successfully marketed iFlux, an innovative solution that optimizes processes in foundry furnaces. iFlux is based on components that, under a briquette format, penetrate the surface of the bath inside furnaces and generate a series of chemical reactions to recover a higher percentage of copper than is usually possible in the smelting process.

The product is sold in sacks of different tonnages. Its proposed value also factors in expert professional services provided throughout the injection of the solution into smelting furnaces, as well as special industrial dosing equipment designed by the company to inject the product efficiently into the copper smelting furnaces.

The innovation was developed in response to a problem of competitiveness. Chile’s foundries were in the last quartile of global industry in terms of unit costs and they even exhibited negative cash margins. Why were they losing money? This question drew the attention of Innovaxxion. As the innovation team noticed that copper recovery capacity was very low, thorough research was conducted into the state of the art. With its team of lawyers, the firm reviewed copper-recovery processes in foundries and found that the problem had not been properly addressed worldwide. It led the research for two years and the related applied R&D was performed by pyrometallurgy experts based at Federico Santa María Technical University (UTFSM), a Chilean university well known for the reputation of its Science and Engineering faculty.

iFlux is expected to increase copper recovery and to raise smelting efficiency: in initial testing, the percentage of “left over” copper fell from 38 percent to 20 percent and currently accounts for only 10 percent of residue. iFlux could, moreover, lead to improved and cleaner operation of foundry furnaces.

The first difficulty was encountered at the beginning of the innovation process. Innovaxxion had applied for public funding, which had been denied; it therefore decided to risk its own capital. Second, owing to conflictual relations with academia, the innovation advanced slowly.

Potential customers to which Innovaxxion plans to roll out the solution include nineteen smelters found in Chile, Peru, Brazil, Mexico, the United States of America and Canada, which have an overall output capacity of 3.4 million tons per year. Chile holds 50 percent of that capacity. The project is currently in its first implementation stage in three Chilean furnaces. The objective was to serve the entire market in Chile by the end of 2018. The commercial model was supposed to be validated in 2019 so that it could be launched internationally.

Patents (both national and under the PCT) are being filed for the product. Furthermore, the company expects to be granted a triadic patent (registered in the United States of America, Europe and Japan). It understandably wishes to protect this process innovation internationally because it seems to be applicable to all copper mines worldwide. IP registration has been conducted ably both nationally and abroad. Lastly, the firm is open to the possibility of licensing or selling patents as an option conducive to developing new businesses abroad.

Intelligent Skids (RIVET)

RIVET supplies equipment and components to the mining sector. With more than 100 years on the market, RIVET is currently the main supplier of metal mesh to mining companies in Chile and has a leading position in the conveyor-belt business.

Conveyor belts are the most economical means of transporting ore. They can transport a large quantity of ore over long distances and great heights, while keeping energy consumption low. The spotlight here is on RIVET’s work in this area, particularly in the manufacturing of one of the key conveyor-belt system components, the skids.

Skids must be reliable and durable because they bear the belts. The company manufactures skids to withstand extreme mining conditions in Chile, such as harsh environments, high tonnages and high speed. RIVET has launched a series of intelligent skids with integrated sensors that form part of a data analysis platform for ascertaining operating conditions and predicting failures.Footnote 21 Mining companies can thus save resources by reducing the number of unscheduled plant shutdowns.

As to the main innovation difficulties encountered, it is noteworthy that it was difficult to find the appropriate technologies and to train a suitable technical team. Data transmission technologies that met specific energy consumption and signal reliability criteria were required but were not available on the market. This hurdle could be overcome only by working with electrical engineers (RIVET specializes in mechanical engineering). Working relations with the initial team of expert engineers broke down owing to lack of agreement on ownership of IPRs in the innovation. A team of experts, with whom the innovation was developed, was ultimately found.

The potential customers are large and medium-sized mining firms. RIVET intends, first of all, to market this innovation in the countries in which it has operated with other products, namely Chile (where most of its output is sold), and Peru.

RIVET is at the final patent application stage. From the beginning, it seemed clear that it was a radical innovation and, for that reason, the firm opted for patent protection (rather than a utility model). RIVET, which first applied for a patent in Chile (INAPI), is now filing for PCT registration and plans to apply for protection in other countries. The company is very open to licensing the patent afterwards.

According to Enrique Celedón, the company’s Chief Executive Officer (CEO), it was very difficult to draft the patent. “It is as if it were a new literary style,” Celedón said. RIVET was therefore obliged to hire an engineer expert in patent drafting. Celedón has suggested that INAPI “organize and/or subsidize training courses so that firms can acquire the necessary patent drafting skills.”Footnote 22

9.6 Conclusions and Recommendations

This chapter has provided information on the IP protection practices of METS in Chile’s mining sector. The analysis was based on an online survey of approximately 300 mining suppliers that were covered by the EXPANDE Program. The information pointed to some preliminary conclusions, some of which were corroborated by opinions gathered from semi-structured interviews of executives from mining companies and suppliers, including universities.

Most of the firms are small and medium-sized (in terms of sales and number of employees). They consider themselves to be innovative and their self-reported opinions are consistent with both the GERD-to-sales ratios and earlier surveys and literature. Nevertheless, only a minority of these seemingly innovative companies relies on IPRs to protect their innovations. The most crucial factors that account for this finding are the cost and expected complexity of registration.

We have also presented two case studies describing innovation efforts of two mining providers, the partners with which those bodies have engaged, the difficulties that they have encountered and the IP protection strategies that each has implemented. Some of the firms had established cooperation agreements with researchers based in universities or research centers, while one firm had relied mainly on its own research expertise. The form of IP protection selected and firms’ sale or licensing intentions related largely to the type of innovation and the market served.

Outcomes from the interviews indicate that in Chile there is enough legal expertise and that it is relatively easy to get that sort of advice in the area of IP rights. However commercial capabilities (expertise in innovation management and business plans addressing the questions of commercialization and licensing of IP rights) are much less developed. Universities are expected to play a role in order to tackle this skills shortage.