1 Introduction

Decision makers frequently make judgments about what will help them engage in regular self regulatory behaviors such as saving money, exercising, or studying for an exam. These judgments are important because they may guide associated behavior such as opening a particular type of savings account, wearing a pedometer, or setting a schedule for studying. The current paper focuses on judgments about saving money toward a specific goal. Whereas some savings goals require a one-time action, such as enrolling in a retirement savings plan with automatic paycheck deductions, other savings goals require frequent actions over a relatively short period of time. For example, saving for a new refrigerator or a used car often entails regularly putting away money that would otherwise be spent on other things. A consumer might, for instance, decide to forgo her daily latte or weekly dinner out on a consistent basis in order to put that money toward a short-term savings goal. What factors do decision makers predict will affect their willingness to forgo potential immediate consumption utility in favor of saving the available money for the later, larger desired purchase?

Short-term savings can entail a specific goal, such as saving enough to buy a car by the time one graduates from college, or saving enough for a vacation before the planned vacation date arrives. Setting goals has long been recognized as a way to motivate behavior (Reference Mento, Steel and KarrenMento, Steel & Karren 1987; Reference Rawsthorne and ElliotRawsthorne & Elliot, 1999; Reference Harackiewicz, Barron, Pintrich, Elliot and ThrashHarackiewicz et al., 2002). Setting a savings goal has been found to positively affect savings behavior (Reference Fry, Mihajilo, Russell and BrooksFry et al. 2008). However, setting savings goals may not always have the desired motivating effect. Saving towards multiple savings goals at once has been shown to be less effective at motivating savings than saving towards a single savings goal (Reference Soman and ZhaoSoman & Zhao, 2011). Motivating savings can be difficult, as the long-term savings goal is typically much larger than the small steps that can be taken to reach it (Reference Bandura and SchunkBandura & Schunk, 1981). A goal of saving $3,000 to buy a used car can seem frustratingly far away when saving $5 at a time. Buying today’s latte would not really set one far behind on the goal. This problem may be solved, however, by setting more obtainable subgoals. Setting and achieving subgoals has been shown to increase perceived self-efficacy, interest in a task, and task persistence (Reference Stock and CervoneStock & Cervone 1990; Reference Bandura and SchunkBandura & Schunk 1981). In some cases consumers seem to be strongly motivated by the ability to achieve partial success through smaller goals, such as paying off individual debt accounts (Reference Amar, Ariely, Ayal, Cryder and RickAmar et al. 2011), although it has also recently been demonstrated that achieving subgoals can decrease motivation and performance in some circumstances (Reference Amir and ArielyAmir & Ariely 2008).

Reference Ariely and WertenbrochAriely and Wertenbroch (2002) demonstrated the beneficial effect of subgoals in the context of proofreading essays. Subjects were randomized to receive only the final goal (proofread three essays in three weeks), to receive subgoals (proofread one essay every week), or to schedule their own binding deadlines (select due dates for each of the three essays). Accuracy and timeliness of performance were higher for the subgoal group than for the final goal group, indicating that subgoals facilitate goal achievement. Furthermore, those in the self-imposed deadline group usually set subgoals for themselves, setting the due dates prior to the final deadline. This provides evidence that individuals can accurately predict that subgoals will help them achieve long-term goals. In another study, subjects in an executive education class were given the opportunity to choose deadlines for turning in three short papers over the course of the semester. Nearly three-quarters of the students chose to impose subgoals on themselves, making at least one of the papers due before the final deadline. Thus, not only can subgoals help improve performance, but lay people are aware of this and use subgoals to help improve self-regulation.

In the current paper we explore subgoals as a method for enhancing the motivating effects of savings goals and investigate the mechanism behind it. Specifically, setting smaller savings subgoals may be a way to increase willingness to forgo small immediate consumption opportunities in favor of saving towards a larger goal. For example, rather than setting a goal to save $3,000 for a used car, one might have the goal of saving $60 per week for a year. With this subgoal, the $25 saved by forgoing lattes every day this week may seem like a more significant contribution to the savings goal.

If subgoals have a motivating effect, it may be because they serve as a reference point. Prospect Theory has at its core the concept of the reference point, against which possible outcomes are assessed (Reference Kahneman and TverskyKahneman & Tversky 1979). In most cases the status quo serves as the de facto reference point, but this need not always be true. Reference Heath, Larrick and WuHeath, Larrick and Wu (1999) suggest that goals can act as reference points, with failure to attain the goal experienced as incurring a loss on the value function. Reference van Osch, van den Hout and StiggelboutVan Osch, van den Hout and Stiggelbout (2006) further support this concept with experimental evidence that people use life goals as reference points when evaluating length-of-life gambles. We similarly propose that decision makers who have set a goal but not yet achieved it view their status in the loss domain, with goal-achievement as the reference point. According to Prospect Theory, decision makers are more sensitive to changes near the reference point than those far from the reference point. Thus, a subgoal acting as a reference point could make a decision maker sensitive to changes in amount of money saved even if those amounts were far from the final goal.

The current research examines the effect of subgoal setting on judgments about savings behavior in hypothetical scenarios. In two experiments we look at the effect of weekly subgoals on judgments about willingness to forgo short-term consumption in favor of saving for a larger later purchase. We hypothesize that subgoals will change the reference point against which outcomes are evaluated, resulting in changed judgments of willingness to save.

2 Experiment 1

The purpose of Experiment 1 was to examine whether the presence of a subgoal had an effect on predicted willingness to save. Willingness to save was operationalized by asking subjects how likely they would be to forgo a planned dinner out with friends. Scenarios asked subjects to imagine that they were planning to spend $20 on dinner but were considering saving the money instead. Because we suspected that asking subjects a simple yes/no question about saving would be subject to a high level of experimenter demand, we provided subjects with an 11-point scale and asked them how likely they were to skip the dinner and save the money.

Our hypothesis was that, because the presence of the subgoal will set the reference point to a smaller dollar amount, saving $20 will seem more appealing in the subgoal than in the no subgoal condition.

2.1 Method

2.1.1 Subjects

Three hundred and sixty-nine Rutgers University undergraduates participated for credit towards a research participation requirement for an introductory level psychology class.

2.1.2 Design

This study used a 2(subgoal experimental manipulation) × 2(counter-balance condition) mixed design. Each subject read four scenarios, two of which described a subgoal. The experimental manipulation was the presence or absence of a savings subgoal, presented as a specific weekly savings goal, with an amount between $35 and $60. Subjects were asked to imagine that they had been planning to go out to dinner and expected to spend about $20, and that they were also saving for a future purchase. Each subject saw four separate scenarios with saved-for items of an iPod, Wii, shoes, or a cruise. Saved-for items ranged in cost from $100 to $500. Each scenario specified an amount already saved during the week for that item, such that in the subgoal versions the addition of the $20 would allow the weekly subgoal to be met exactly. For example, in the iPod scenario, all subjects were told that the iPod would cost $180 and that they had saved $40 so far this week. Subjects in the subgoal condition were also told that they had a goal to save $60 per week, such that the additional $20 from forgoing dinner would allow them to meet their weekly goal.

Subjects were asked to rate their likelihood to forgo the dinner in favor of saving the money for the item. Reponses were expressed on a scale that ranged from 0% (definitely will not) to 100% (definitely will) in intervals of 10%. Subjects were given four total questions, two with a subgoal present and two absent a subgoal. There were 2 between-subjects counterbalanced conditions (iPod and Wii with subgoal, cruise and shoes without subgoal, and vice versa), such that across all subjects, each scenario appeared in both the subgoal and no-subgoal conditions.

2.1.3 Materials

Subjects completed this study on their own computers via the internet. Instructions were provided, then questions were displayed one at a time. Subjects were randomly assigned to one of the two counterbalance conditions described above. Each version included two subgoal-present and two subgoal-absent scenarios. Question order was randomized for each subject. The four questions of interest in this study were presented with 16 additional filler questions (see Appendix).

2.2 Results

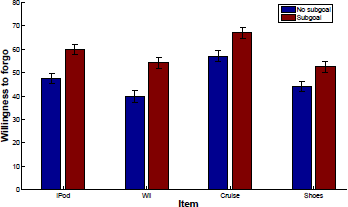

As shown in Figure 1, subjects reported a higher likelihood of forgoing dinner in the presence of a subgoal across all four of the savings scenarios. We conducted a 2(subgoal vs. no subgoal) × 4(scenario) mixed model ANOVA with judged likelihood to forgo dinner as the dependent measure. Both factors were within-subject variables, but because of the mixed design, their interaction was between subjects (and corresponds to the counterbalance condition). There was a main effect of subgoal condition, F(1,368)=48.47, p<0.0001 and a main effect of scenario, F(3,1100)=18.07, p<0.0001 but no interaction (F<1). Follow-up two-tailed t tests showed a significant subgoal effect for each of the four scenarios, t(367), all ts>2.5, all ps<.012.

Figure 1: Mean subject rating of likelihood of forgoing the dinner out with or without a subgoal for each of the four savings scenarios in Experiment 1. Error bars represent standard error of the mean.

Because Experiment 1 used a within-subjects manipulation, one might be concerned that the subgoal effect is only manifest when subjects can compare the subgoal and no subgoal conditions. To address this concern, we repeated the mixed model ANOVA described above, adding a 4-level order variable indicating which of the four scenarios the subject saw first. The effect of subgoal, F(1,365)=39.22, p<0.0001, was not moderated by the order variable, F(3,365)=0.33, p=.803. We repeated the mixed model ANOVA once more, this time including a between-subjects variable that indicated whether the first scenario the subject saw was in the subgoal or no subgoal condition. This order variable interacted with the within-subject subgoal condition variable, F(1,367)=13.30, p=0.0003, indicating that overall subjects gave higher ratings in the subgoal condition than in the no subgoal condition, but that this difference was larger when the first scenario seen was in the no subgoal condition (n=212, means [sd]: 60.07 [30.62] vs. 43.56 [30.05]) than when it was in the subgoal condition (n=157, means [sd]: 56.08 [32.48] vs. 51.53 [32.12]). Contrasts indicated that the difference was significant in the former case, F(1, 367)=58.85, p<0.0001 and marginal in the latter case, F(1, 367)=3.23, p=0.07.

We also performed a between-subjects 2 (subgoal condition) × 4 (scenario) ANOVA using only the first scenario each subject saw. There remained a significant effect of subgoal, F(1, 361)=12.75, p=0.0004. Similarly, the effect of subgoal remained if the analysis included the first one or two scenarios in the same condition for each subject, F(1,367)=20.14, p<0.0001. (That is, the first two scenarios if both or neither had subgoals; otherwise the just the first scenario.) Thus, the subgoal effect does not appear to be an artifact of the within-subject manipulation.

2.3 Discussion

Consistent with our hypotheses, subjects judged that it was more likely they would forgo the planned dinner in favor of saving for a future purchase when a subgoal was present than when it was not. This finding suggests that, in the absence of a subgoal, the reference point is the total savings goal, but when a subgoal is present, the reference point is the subgoal. Figure 2 shows the Prospect Theory value function in which subjective value is an S-shaped function of money saved and outcomes are evaluated as gains or losses relative to the reference point.

Figure 2: (a)The Prospect Theory curve without a subgoal and (b) with a subgoal.

In the absence of a subgoal, the reference point is the total amount needed to purchase the item. The $20 savings is evaluated on the flatest part of the curve.

In the presence of a subgoal, the reference point is the amount of the weekly subgoal. The $20 would allow the achievement of the goal, so it is evaluated on the steepest part of the curve.

Once the reference point is set, the prospect of saving $20 would then be evaluated against this reference point. Because the reference point is a savings goal that has not yet been reached, the relevant area of the value function curve is the loss domain. In this case, because saving money is reducing the amount that still needs to be saved, the individual can be seen as moving up the negative part of the curve.

The evaluation of how much utility would be gained from the additional savings of $20 should drive the judgment of how likely one would be to forgo the dinner to save the money. If the utility of saving the $20 is large it would overwhelm the utility projected to accrue from the dinner, making skipping the dinner more appealing. If the utility gained from saving the additional $20 is small, the projected utility from the dinner with friends would overwhelm it, making the dinner the more appealing option.

When only the large dollar amount of the total savings goal is present, the $20 would be evaluated as a small part of the total amount. Because the amount that had already been saved was small in each case, the area of the loss curve on which the $20 is evaluated is nearly flat, with each additional dollar saved providing little marginal utility. By contrast, when the reference point was the smaller dollar value of the weekly subgoal, the amount already saved is a much larger portion, and the area of the loss curve on which the $20 is evaluated is much steeper. Because the additional $20 savings would allow the subject to meet the subgoal, the relevant area of the curve is that touching the origin: the steepest part of the curve, providing the highest level of marginal utility. (See Figures 2(a) and 2(b) for a visual representation of this point).

3 Experiment 2

Experiment 1 demonstrated that the presence of a subgoal increases reported willingness to save money by forgoing consumption. We propose that the mechanism underlying this effect is based on shifting reference points on the Prospect Theory value function. However, alternative explanations are possible, including the fact that the description of the subgoal may communicate a demand effect to save or provide information on the appropriate rate of savings, the decision maker’s commitment to making the purchase, or the decision maker’s funds available to meet the savings goal. Consequently, the purpose of Experiment 2 was to provide a more specific test of the reference point account of the subgoal effect.

In Experiment 1, in the subgoal condition the money available to be saved ($20) was always exactly enough to reach the weekly subgoal. In Experiment 2, we tested whether the mere presence of a subgoal is enough to encourage saving behavior, or if instead it is the impact of actually achieving the subgoal that has the effect. Based on Prospect Theory, our hypothesis was that the presence of a subgoal would increase subjects’ ratings of their likelihood to forgo the dinner out primarily when the additional savings would allow the decision maker to meet the subgoal exactly. We predicted that savings achieved from a foregone dinner that undershot or overshot the weekly subgoal would not be as motivating. The shift in reference point caused by the presence of a subgoal causes the $20 to be evaluated on a steep portion of the value function, and the steepest portion is achieved at the reference point. That is, in the conditions where $20 meets the weekly subgoal, the evaluation occurs on the steepest part of the loss curve, leading to the greatest perceived benefit from saving. Alternative mechanisms for the subgoal effect would not necessarily predict it to be critical whether the $20 met the subgoal exactly or over- or under-shot it.

3.1 Method

3.1.1 Subjects

One hundred and seven individuals at the Rutgers University student center participated in this experiment in exchange for a small candy bar.

3.1.2 Design

The experiment used a 2 (subgoal: present vs. absent) × 3 (total savings: low, medium, or high) within-subject design. Each subject read six versions of a single scenario (the iPod scenario from Experiment 1). Thus, each subject saw each of the six experimental conditions. As in Experiment 1, subjects were asked to imagine that they had been planning to spend money on dinner out and were also saving for an iPod costing $180. Half of the scenario versions presented a subgoal as a savings goal of $60 per week. Different versions of the scenario described the amount the decision maker had already saved during the current week as $25 (low), $40 (medium), or $55 (high). When a subgoal was present, forgoing the dinner and saving the $20 would therefore result in weekly savings of either $15 under the weekly savings goal (low condition—i.e., $25 already saved + $20 additional saving = $45, which is $15 shy of the $60 goal), the exact amount of the weekly savings goal (medium condition), or $15 over the weekly savings goal (high condition). When the subgoal was absent, the same amounts of previous savings were used ($25, $40, and $55), but saving the $20 in addition to the amount already saved would result in a sum well below the total goal of $180. Subjects were asked to rate on a scale of 0% (definitely will not) to 100% (definitely will) in intervals of 10% how likely they would be to forgo the planned spending and instead save the money for the iPod.

3.1.3 Materials

Each subject was given a one-page, two-sided paper-and-pencil questionnaire with six scenarios. A balanced Latin-square design with six between-subjects versions was used to vary the order of the six scenarios across subjects.

3.2 Results

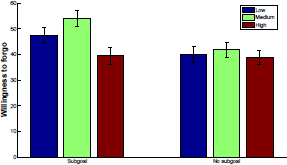

A 2 (subgoal) × 3 (total savings) × 6 (counterbalance condition) ANOVA with repeated measures on the first two factors revealed the expected main effect of subgoal F(1,101)=15.59, p<0.001 (Figure 3). Subjects gave significantly higher judgments of likelihood to forgo dinner in the presence of a subgoal (M=46.93, SD=32.08) than in its absence (M=40.21, SD=28.83). There was a main effect of total savings, F(2, 202)= 8.59, p<0.001, qualified by an interaction between presence of a subgoal and total savings, F(2, 202) = 6.08, p=0.003. Planned contrasts indicated a significant quadratic form to the interaction, F(1,101)=10.36, p=0.002, indicating that rated likelihood to save was higher when the $20 allowed the decision maker to reach the subgoal exactly than when the savings would under- or over-shoot the subgoal. However, this quadratic effect was not present in the no subgoal condition where equivalent dollar values were used. Pairwise comparisons indicated that the mean rating when the subgoal was present and could be met exactly (subgoal/medium) were significantly higher in both the subgoal/high condition where the $20 saved overshoots the subgoal (t(106)=4.46, p<.001) and subgoal/low condition where the $20 saved undershoots the subgoal (t(106)=2.52, p=0.013). Footnote 1

Figure 3: Average subject rating of likelihood of forgoing the dinner in experiment 2 with low ($25), medium ($40), or high ($55) previous savings. Error bars represent standard error of the mean.

3.3 Discussion

Experiment 2 revealed the expected main effect of subgoal and the interaction between amount already saved and presence of subgoal, indicating the importance of exactness of reaching the subgoal. We propose that the presence of the subgoal shifted the reference point from the total amount necessary to be saved to the smaller amount of the weekly subgoal. This caused the $20 available to be saved to be evaluated on a much steeper part of the loss curve. When the $20 savings was evaluated against the reference point of the total goal, the part of the curve on which it was evaluated was so flat that a difference of $15 more or less caused by the different amounts already saved had only a small effect on utility (see Figure (4a)).

Figure 4: (a) The prospect theory curve without a subgoal and (b) with a subgoal.

When the reference point is the total goal the difference in amount already saved does not make a significant difference in how attractive saving the additional money would be.

When the reference point is the weekly subgoal the difference in amount already saved significantly changes the utility from saving additional money. The additional money saved past the subgoal is evaluated on the positive area of the curve.

With a reference point of the smaller weekly subgoal, however, the amount already saved had more of an impact. In the “low” condition (where the decision maker had saved $25 in the previous week), having only saved a small amount towards the subgoal meant that the $20 was evaluated on a lower, flatter area of the curve, making the $20 savings relatively less attractive compared to the medium saved amount/subgoal condition. In the “medium” condition, meeting the subgoal exactly provided the maximum amount of utility given the available $20, because in this case it was evaluated on the steepest area of the curve, the area bordering the origin (Figure 4b).

In the “high” condition, the $20 saved would cause decision makers to over-shoot the subgoal, because only $5 of the $20 was necessary to meet the subgoal. Here, subjects trended toward being less likely than in either of the other subgoal conditions to forgo the dinner. In this condition only $5 of the $20 would be evaluated in the loss portion of the curve with the reference point of the subgoal. The other $15 would be evaluated on the positive portion of the curve. Because, due to loss aversion, the gain portion of the value function is less steep than the loss portion, the utility of this $15 overshoot would be relatively less appealing (Figure 4b).

4 General discussion

The current experiments provided evidence for the importance of subgoals in judgments about saving for short-term purchases of durable and quasi-durable goods. Decisions about forgoing immediate consumption utility in favor of saving for a future purchase are made more frequently than many other decisions regarding saving. There is, however, only a small literature on such decisions compared to the relatively more robust area of retirement savings (e.g. Reference Benzarti and ThalerBenzarti & Thaler, 2007; Reference Wiener and DoescherWiener & Doescher, 2008). The current experiments provide some empirical evidence for theoretically motivated ways to encourage savings behavior through subgoal setting.

Helping individuals improve short-term savings is an issue of significant practical importance. Consumers can increase their overall utility by avoiding making durable goods purchases such as washing machines, cars, and furniture on credit, thereby allowing money that would be spent on interest payments to instead be used for increased consumption. One way to avoid use of credit is to save up money in advance. Simple reference point manipulations, unlike savings match and educational programs, have the benefit of being free, easy to apply, and requiring few resources to help implement in a population. By manipulating the reference point in the form of subgoal setting, the slope of the prospect theory curve can be used to help individuals achieve their own savings goals and increase overall consumption utility. Previous theoretical work (Reference Koszegi and RabinKoszegi, 2009) has applied reference points to savings behavior, but previous studies have not examined a reference point account of the role of subgoals in saving behavior.

The current experiments involved subgoals that were large enough to be a significant portion of the total goal, but small enough that the addition of $20 was a large contribution towards the weekly goal. Experiment 2 showed that the act of saving just enough to meet the subgoal was judged to be particularly appealing and likely to lead to the desired saving result. The boundaries of this phenomenon for helping individuals were not explored in the current experiments but would be of both theoretical and practical importance. An interesting direction for future research would be to determine the characteristics of subgoals that are small enough to allow the frequent benefit of meeting them but large enough so as not to seem insignificant. Subgoals that are too small, relative to the overall goal, could have the opposite effect, as in the “pennies-a-day” phenomenon where a large expenditure seems small if divided into many portions (Reference GourvilleGourville, 1998).

The current experiments examined judgments of willingness to save money, not actual savings behavior. Hypothetical judgments of normative behavior such as saving likely overstate decision makers’ actual propensity to engage in the behavior. For example, Reference Choi, Laibson, Madrian, Metrick, McCaffrey and SlemrodChoi, Laibson, Madrian, and Metrick (2006) report that, among employees attending a financial education seminar, 28% of those already participating in a 401(k) plan said that they planned to increase their contribution rate, but only 8% actually did so. All of those not yet participating in a 401(k) plan said that they planned to enroll, but only 14% actually did so in the following 6 months. Thus, the judgments made by subjects in the current studies may not reflect their actual proclivity to save money in real situations. Importantly, however, in the present paper, the focus is not on the level of savings but rather on how the level of savings is affected by subgoal manipulations. Thus, the result of importance here is that reported likelihood to save money is higher when there is a subgoal and when the immediate consumption to be foregone will allow one to meet the subgoal exactly. Although actual savings behavior may indeed be lower than the judgments given by our subjects, the pattern of findings (more saving with subgoals) is likely to replicate with real behavior. The Reference Ariely and WertenbrochAriely and Werbenbrocht (2002) study described earlier suggests that decision makers have some accuracy in predicting how subgoals will affect their behavior.

Decision makers’ judgments about what they would do reveal their lay theories about their own behavior. The subjects in our studies predicted that they would be more likely to save money if they had a subgoal. Our studies suggest that subgoals increase judgments of proclivity to save money because the subgoals act as reference points and the perception of amount saved below or above the goal follows the Prospect Theory value function. Thus, people’s judgments about their own willingness to save are guided by a Prospect Theory value function. In other words, people use Prospect Theory as an implicit theory guiding predictions about their own behavior.

Recent research has demonstrated that savings behavior is contextually driven (Reference Mulainathan, Shafir, Michael and BlankMulainathan & Shafir, 2009) and can be augmented by fairly simple manipulations such as how money is placed in envelopes (Reference Soman and CheemaSoman & Cheema, 2008; 2011; Reference Soman and ZhaoSoman & Zhao, 2011) or altering the retirement plan default (Reference Choi, Laibson, Madrian and MetrickChoi, Laibson, Madrian & Metrick, 2003). The current results suggest that setting subgoals may also augment savings behavior. Indeed, many goal-directed behaviors besides saving money for a future purchase entail cumulative progress towards an eventual goal. Examples include weight loss, finishing a dissertation, or reducing our national carbon footprint. The current studies suggest that the reference point principle of Prospect Theory can be harnessed to facilitate goal progress in many domains by setting smaller repeated subgoals.

Appendix

All questions, including filler questions, seen by subjects in Experiment 1. Subjects got one of either version A or B for each question. Question order was completely randomized.

-

1A You have been saving for a $300 beach house rental for a Florida vacation. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the beach house rental?

-

1B You have been saving for a $300 Florida vacation. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the vacation?

-

2A You have been saving for a $100 textbook for next semester. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the textbook?

-

2B You have been saving for $100 for school expenses for next semester. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the school expenses?

-

3A You have been saving for $80 for a roadtrip. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the roadtrip?

-

3C You have been saving for $80 of gas for a roadtrip. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the gas?

-

4A You have been saving for $150 in camping gear. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the camping gear?

-

4B You have been saving for a $150 camping tent. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the tent?

-

5A You have been saving for a 19 inch, $300 flat screen TV. The flat screen is black with an oval-shaped base. The TV has 1440 by 900 pixel resolution and comes with a power cord, wall mounting unit, owner’s manual, and remote control. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the TV?

-

5B You have been saving for a 19 inch, $300 flat screen TV. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the TV?

-

6A You have been saving for a $130 desk. The desk is a light wood color. It has two drawers on the left side and a small drawer in the center. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the desk?

-

6B You have been saving for a $130 desk. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the desk?

-

7A You have been saving for a two piece, $120 luggage set. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the luggage?

-

7B You have been saving for a two piece, $120 luggage set. The luggage is black with thick handles, silver zippers, and black wheels. Each piece includes two front pouches and a black luggage tag. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the luggage?

-

8A You have been saving for an $80 sleeping bag. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the sleeping bag?

-

8B You have been saving for an $80 sleeping bag. The sleeping bag is green with a full length zipper. It has an interior cotton liner and a drawstring top. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the sleeping bag?

-

9A You have been saving for the $150 bike shown in the picture below. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the bike?

-

9B You have been saving for a $150 bike similar to the one shown in the picture below. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the bike?

-

10A You have been saving for the $190 stereo system shown in the picture below. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the stereo?

-

10B You have been saving for a $190 stereo system similar to the one shown in the picture below. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the stereo?

-

11A You have been saving for a $90 futon similar to the one shown in the picture below. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the futon?

-

11B You have been saving for the $90 futon shown in the picture below. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the futon?

-

A12 You have been saving for a $70 tennis racket similar to the one shown in the picture below. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the tennis racket?

-

12B You have been saving for the $70 tennis racket shown in the picture below. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the tennis racket?

-

13A You have been saving for a $180 iPod. You have already saved $40 towards the iPod this week. Your weekly savings goal is $60, so this extra $20 would allow you to meet your goal. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the iPod?

-

13B You have been saving for a $180 iPod. You have already saved $40 towards the iPod this week. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the iPod?

-

14A You have been saving for a $250 Wii. You have already saved $30 towards the Wii this week. Your weekly savings goal is $50, so this extra $20 would allow you to meet your goal. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the Wii?

-

14B You have been saving for a $250 Wii. You have already saved $30 towards the Wii this week. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the Wii?

-

15A You have been saving for a $500 cruise for spring break. You have already saved $30 towards the cruise this week. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the cruise?

-

15B You have been saving for a $500 cruise for spring break. You have already saved $30 towards the cruise this week. Your weekly savings goal is $50, so this extra $20 would allow you to meet your goal. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the cruise?

-

16A You have been saving for a $100 pair of shoes. You have already saved $15 towards the shoes this week. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the shoes?

-

16B You have been saving for a $100 pair of shoes. You have already saved $15 towards the shoes this week. Your weekly savings goal is $35, so this extra $20 would allow you to meet your goal. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the shoes?

-

17A You have been saving to buy $100 tickets to a music festival you have been looking forward to. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the tickets?

-

17B You have been saving to buy $100 tickets to a music festival that you have promised to go to with your brother. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the tickets?

-

18A You have been saving to buy an $80 microwave for yourself. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the microwave?

-

18B You have been saving to buy an $80 microwave as a wedding present for your cousin. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the microwave?

-

19A You have been saving to buy $90 worth of party supplies for your roommate’s birthday party. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the party supplies?

-

19B You have been saving to buy $90 worth of party supplies for your birthday party. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the party supplies?

-

20A You have been saving to buy a $60 DVD player as a birthday present for your sister. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the DVD player?

-

20B You have been saving to buy a $60 DVD player for yourself. How likely is it that you will forgo the dinner with your friends, and instead put the money towards the DVD player?