It would be a dangerous undertaking for persons trained only to the law to constitute themselves final judges of the worth of pictorial illustrations, outside of the narrowest and most obvious limits.

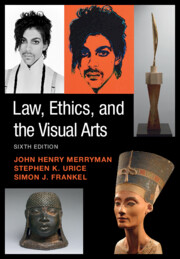

i. introduction to law, ethics, and the visual arts, sixth edition

This book covers a wide range of legal and ethical issues concerning visual art. For example: Do the realities of a visual artist’s profession call for special legal treatment? To what extent can artists control the reproduction or distribution of their own creative works? Should the legal owner of a work of art be free to alter or destroy it, without incurring liability? Why do we care if a renowned, beautiful, and powerful painting is discovered to be a forgery? How do art auctions operate? How do taxes affect artists, art dealers, and collectors? Who owns relics of the past – the current possessors of antiquities, the modern countries in which they were created or in which they were discovered, or, in the words of the 1954 Hague Convention, “all mankind”? Can military necessity ever justify destruction of a great architectural monument? Should the Elgin Marbles, now in London’s British Museum, be returned to Greece – or Benin Bronzes in numerous Western museums, to Nigeria? May a financially unstable museum sell works from its collection to pay operating expenses or fix the roof? Can we rely on state attorneys general to control conflicts of interest, insider advantage, and self-dealing on the part of museum trustees and staff? Does and should the First Amendment protect ugly, obscene, or politically offensive works of art? These are but a few of the questions addressed in the following chapters.

This book describes how law and ethics apply to the people and institutions in the art world – an international, interdependent complex of artists, collectors, museum professionals, dealers, and auctioneers, with a large supporting cast of art historians, archaeologists, critics, experts, bronze founders, fine printers, suppliers of artists’ materials, city planning commissions, corporate sponsors, governmental sources of funding, the Internal Revenue Service, insurers, art nappers, thieves, counterfeiters, and many others.

It is easy to suppose that art is incompatible with law and ethics. In art, we value the creative act: the gesture that transcends boundaries, defies conventions, and breaks rules, leading to new perceptions, insights, and understandings. In contrast, law and ethics work within a system of boundaries, conventions, and rules, maintained by an established order, albeit one that is ever-evolving. How can they coexist? Is there an inexorable equation: the more law and ethics, the less art (and vice versa)?

Clearly not. Law establishes the conditions of social peace and stability that liberate artists to make art and protects artists against repression or censorship on political, religious, or moral grounds. Law provides artists with enforceable rights in their works and in their relationships with dealers. Law protects works of art against theft and destruction and against adulteration and misrepresentation through fakes and forgeries. Law makes possible the assembly and display of art collections and exhibitions, and the formation and operation of museums. It supports and regulates the art market, providing an orderly process for the distribution (and redistribution) of works of art. Law and ethics define and protect the competing interests of parties in transactions among artists, dealers, auction houses, collectors, and museums. They ensure the freedom of historians, experts, and critics to study art and to express their opinions. Without a legal system and codes of ethics, there could be nothing comparable to the sophistication, diversity, and prosperity that art and some artists and arts institutions currently enjoy.

That said, we will notice throughout this book that the law is often a blunt instrument to draw lines and resolve disputes involving works of visual art. In most judicial proceedings, only one party – the plaintiff or the defendant – will prevail: there can be no Solomonic judgment with a work of art. Repeatedly, we will see outcomes demanded by law or precedent that leave us feeling queasy. Indeed, many (if not most) art and cultural property disputes would be served better by alternative dispute resolutions such as mediation or by creative settlements. To paraphrase an early scholar in this field, Marie Malaro, the law makes us only bearable, not honorable. Avoiding legal liability falls short of achieving the ethical behavior characteristic of civil societies. So, throughout this book, we will ask not only whether a court’s decision was a proper application of the law to the facts, but also whether the result accords with what is ethically acceptable. Put another way, was the prevailing party merely bearable or, instead, honorable? We hope readers will come to understand why so many actors in the art world rely on codes of ethics to guide their decision-making.

As the book’s title states, our focus is on the visual arts. The cases, articles, and other materials that follow reflect the concerns of painters, sculptors, photographers, printmakers, art dealers, collectors, auction houses, museums, and other art world participants. This heterogeneous collection of issues comprises an area of practice, rather than a single body of coherent doctrine. Therefore, the subject matter of the book’s various materials is unusually diverse – from censorship to income taxes, copyright to fiduciary duty, contracts to international treaties – and draws on the substance of many legal disciplines including property, contracts, torts, international law, and civil and criminal procedure, among others. Given the potential breadth of what we might include, we have limited ourselves to legal and ethical issues particular to the visual arts. Accordingly, we do not dwell on issues that apply as much to the art world as they do for other areas of life, such as employment or real estate law. The result is a wide-ranging set of materials covering a diverse set of areas – a feast for polymaths, one might say.

We have prepared this new edition to reflect the expansion of legislation, cases, scholarship, and interest in art law with three primary audiences in mind. First and foremost, this book is a classroom text, as all prior editions have been, meant to introduce students in law schools and other college and university courses to the wide range of unique issues located at the intersection of the visual arts, law, and ethics. Second, although not a treatise, it serves as a resource for legal practitioners that includes most of the key statutes (or references to them) and the critical legal authorities on most art law issues. Third, we hope anyone interested in art and the law will find this book to be an accessible, interesting, and (perhaps even) fun way to learn how law and ethics affect the contemporary world of the visual arts.

The book’s legal and ethical issues are enhanced by the context of the art world, with its cast of intriguing characters, colorful charlatans, and genuine geniuses. Decades ago, Ed Hayes, sometime lawyer for the estate of Andy Warhol, told the New Yorker, “The worst thugs I ever ran into were in the art business.” Warren St. John, Ed Hayes’s Huzzahs, The New Yorker, May 8, 1995, at 33. The stories throughout the book are engaging, memorable, and occasionally shocking. The materials that follow provide one of the most enjoyable ways to look at a variety of legal issues, liberally laced with culture, history, and entertaining anecdotes. As the pioneering art and museum law scholar Stephen E. Weil commented 30 years ago, “Things that would be deadly dull become vivid when talking about art. Take the statute of limitations for example. You can keep an audience spellbound when it is discussed in conjunction with art. The tension between art and the law produces that effect. It’s wonderfully heady.” Barbara Lyne, Art Law Blooms, Nat’l L.J., June 18, 1990, at 1. In other words, this book is really intended for anyone who is curious about art, ethics, and law – and enjoys good stories.

While the issues are wide-ranging, certain themes recur. For example, how do (and should) the law and judges decide what is “art” and who is an “artist”? Does the distinct character of art justify or require different treatment under the law from that accorded other tangible personal property? How does and should the fact that art is a form of expression affect the way it is regulated, protected, and funded? What special fiduciary or other duties should be imposed on those who buy, sell, or exhibit works of art? What is and should be the role of judges (or juries) in deciding disputes involving aesthetic determinations, such as whether a particular work is obscene or authentic? We see repeated tensions between art as property and art as expression, and between art as property and art as cultural property that may be better characterized as stewarded rather than owned. We turn later in this chapter to two such recurring themes: As a matter of law, what is art and who is an artist?

The book’s chapters provide a tour of different art world actors and issues. Chapter 2 addresses artists and the art market, covering the distinctive issues faced by visual artists – for example, where they live and work, the toxic nature of some of their materials, the sale of their works into the primary market (i.e., an artwork’s first sale), and the relationships between artists and dealers. Although the Uniform Commercial Code (UCC) governs transactions involving works of art, treating them no differently than other “goods,” many states have enacted laws that deviate from the UCC to provide greater protection for artists in their crucial relationship with dealers.

Chapter 3 turns to intellectual property law and asks what rights artists have in the works they create. We start with copyright law, which generally protects original and creative works from being copied or used by others without permission. We take a lengthy tour to consider, among other issues, the requirements for copyright protection, how one artist’s work may infringe another’s copyrighted work, and how the fair use doctrine applies to visual art. We also consider the right of publicity – the right of individuals to control the commercial use of their names and likeness. For example, when may an artist paint a famous musician or athlete without permission? We next look at resale royalties, the notion that artists should receive some remuneration when works they create are resold, on the theory that the continuing value of the work is attributable in significant part to the artist’s contribution. Finally, we look at moral rights, which protect an artwork from alteration, mutilation, or destruction, without the artist’s permission, and prevent an artist’s name from being used in connection with a work the artist did not create or did create but that subsequently has been altered or mutilated.

Chapter 4 considers transactions in works of art from the perspective of collectors, primarily looking at laws and practices governing sales in the secondary market, whether at public auction or through art galleries and dealers. We consider rules governing auctions and how the law balances the competing interests of collectors (whether as buyers or sellers), auction houses, and art dealers. In Chapter 5, we focus on two critical issues in the acquisition of a work of art: title and authenticity. For example, works of art that were stolen or otherwise disappeared and then rediscovered raise important issues of ownership and good title. A critical issue in these circumstances is how to apply statutes of limitations. For example, a stolen painting reappears decades later; is a lawsuit brought by the original owners (or their heirs) to recover the work too late? Does it – and should it – matter if the current owner purchased the work in good faith, without knowledge it had been stolen? Authenticity has been an issue as long as there has been an art market and is particularly challenging for courts, which sometimes must rule on a work’s authenticity in the face of conflicting testimony from expert witnesses.

In Chapter 6, we consider how art intersects with the inevitability of taxes and death, and the frequent occurrence of divorce. How are tax regimes applied to artists, dealers, and collectors? When are their expenses deductible? What are the tax consequences of their sales of works of art? For purposes of charitable deductions and estate taxes, how do taxpayers determine the fair market value of works of art? And when a couple accumulates a valuable collection of art, how is it divided if they divorce?

In Chapter 7, we shift from these individual-focused concerns to consider the fate of art in times of armed conflict. Art, always fragile, is particularly vulnerable in wartime. What rules has the international community adopted in efforts to protect works of art, monuments, and great architecture when combat breaks out? We then focus on the historically unprecedented scale of confiscation and displacement of works of art under the Third Reich (1933–1945), and describe efforts to restitute such works to their rightful owners (or their heirs) and how the law has both fostered and stalled those efforts. Chapter 8 turns to the treaties, laws, and codes of ethics applicable to the collecting of, and the international trade in, antiquities. We address issues such as how the law and codes of ethics attempt to regulate the market in antiquities and under what circumstances antiquities should be returned to their country of origin.

Chapter 9 focuses on museums, a central institution in the art world, including the legal issues they often encounter and the duties they owe to the public with respect to their collections. Finally, Chapter 10 addresses art and freedom of expression, particularly how courts have applied the First Amendment to artistic expression. We also consider government funding of art in light of its expressive nature and the frequent, controversial issues generated by art in public places.

Some of the issues and materials in the book could appear in multiple chapters, so their placement may, at times, seem arbitrary – and, to an extent, it is. Museums, covered in Chapter 9, face cultural property issues addressed in Chapter 8. Collectors, the focus of Chapter 4, encounter issues of title and authenticity, discussed in Chapter 5. Difficulties in organizing these issues reflect the intertwined, overlapping, and often conflicting interests of the art world’s various players. Thus, any categorization of these complex issues will necessarily be somewhat capricious. In addition, we recognize that most teachers, students, and other readers will not treat the materials in this book as a linear journey, but, instead, as an enticing buffet – to be dipped into, sampled, and enjoyed.

Comments

1. For thoughtful and engaging, if somewhat outdated, reflections on the nature and significance of “art law,” see Stephen E. Weil, Introduction: Some Thoughts on “Art Law,” 85 Dick. L. Rev. 555 (1981), reprinted as Some Thoughts on “Art Law” in Stephen E. Weil, Beauty and the Beasts: On Museums, Art, the Law and the Market 199 (1983).

ii. what is art?

We will encounter numerous instances in which legislators have sought to define “art” (or similar terms, such as “work of fine art”) and judges must determine whether a particular work meets the applicable definition. At law, as in life, there is no one answer to “what is art,” and the line drawing that legislatures and courts engage in is rarely easy to understand.

One context in which this question first arose concerned tariffs – taxes on imported goods. Historically, US tariffs have often favored artistic works over other objects, taxing the former at a lower rate. This policy required the customs service (and courts) to make judgments as to whether an object is a work of art as defined in tariff schedules. We consider several such cases.

Brown, Justice:

It is difficult to fix the proper classification of the importations in question under the act of October 1, 1890, without referring to the prior acts upon the same subject.

By the tariff act of March 3, 1883, 22 Stat. 497, c. 121, there was imposed a duty of 45 per cent upon “porcelain and Bohemian glass, chemical glass ware, painted glass ware, stained glass, and all other manufactures of glass … not specially enumerated,” while “paintings, in oil or water colors,” were subject to a duty of 30 per cent; and “paintings, drawings and etchings specially imported in good faith” for religious institutions were admitted free. Under this and similar prior statutes, which did not differ materially in their language, it was uniformly held by the Treasury Department that the term “paintings” covered all works of art produced by the process of painting, irrespective of the material upon which the paint was laid; and that paintings on glass, which ranked as works of art, were dutiable as paintings, and when imported for religious institutions were entitled to admission free of duty. Like rulings were made with respect to paintings on ivory, silk, leather and copper, having their chief value as works of art. The term was also held to include wall panels painted in oil and designed for household decoration. A like view was taken by this court in Arthur v. Jacoby, 103 U.S. 677, of pictures painted by hand upon porcelain where the porcelain ground “was only used to obtain a good surface on which to paint, and was entirely obscured from view when framed or set in any manner, and formed no material part of the value of said paintings on porcelain, and did not in itself constitute an article of china ware, being manufactured simply as a ground for the painting, and not for any use independent of the paintings.”

In the meantime, however, the manufacture of stained glass began to be a recognized industry in this country. Strong protests were sent to Congress against these rulings of the Department, and demands were made for the imposition of a duty upon stained glass windows as such, to save the nascent industry from being crushed out by foreign competition. Accordingly, in the act of October 1, 1890, we find a notable change in phraseology and the introduction of a new classification. By paragraph 122 a duty of 45 per cent is imposed upon “all stained or painted window glass and stained or painted glass windows, and hand, pocket or table mirrors, not exceeding” a certain size; while by paragraph 465, “paintings, in oil or water colors,” are subject to a duty of only 15 per cent. The former exemption of “paintings, drawings, and etchings specially imported” for religious institutions is continued in paragraph 677, while in paragraph 757 a similar exemption is extended to “works of art, the production of American artists residing temporarily abroad, or other works of art, including pictorial paintings on glass, imported expressly for … any incorporated religious society, … except stained or painted window glass or stained or painted glass windows.”

It is insisted by the defendants that the painted glass windows in question, having been executed by artists of superior merit, specially trained for the work, should be regarded as works of art, and still exempted from duty as “paintings,” and that the provision in paragraph 122, for “stained or painted window glass and stained or painted glass windows,” applies only to such articles as are the work of an artisan, the product of handicraft, and not to memorial windows which attain to the rank of works of art. Those who are familiar with the painted windows of foreign cathedrals and churches will indeed find it difficult to deny them the character of works of art; but they would nevertheless be reluctant to put them in the same category with the works of Raphael, Rembrandt, Murillo, and other great masters of the art of painting. While they are artistic in the sense of being beautiful, and requiring a high degree of artistic merit for their production, they are ordinarily classified in foreign exhibits among the decorative and industrial rather than among the fine arts. And in the catalogues of manufacturers and dealers in stained glass, including the manufacturers of these very importations, no distinction is made between these windows and other stained or painted glass windows, which, by paragraph 757, are specially excepted from the exemption of pictorial paintings on glass.

For most practical purposes works of art may be divided into four classes:

1. The fine arts, properly so called, intended solely for ornamental purposes, and including paintings in oil and water, upon canvas, plaster, or other material, and original statuary of marble, stone or bronze. These are subject to a duty of 15 per cent.

2. Minor objects of art, intended also for ornamental purposes, such as statuettes, vases, plaques, drawings, etchings, and the thousand and one articles which pass under the general name of bric-a-brac, and are susceptible of an indefinite reproduction from the original.

3. Objects of art, which serve primarily an ornamental, and incidentally a useful, purpose, such as painted or stained glass windows, tapestry, paper hangings, etc.

4. Objects primarily designed for a useful purpose, but made ornamental to please the eye and gratify the taste, such as ornamented clocks, the higher grade of carpets, curtains, gas-fixtures, and household and table furniture.

No special favor is extended by Congress to either of these classes except the first, which is alone recognized as belonging to the domain of high art. It seems entirely clear to us that in paragraph 757, Congress intended to distinguish between “pictorial paintings on glass” which subserve a purely ornamental purpose, and stained or painted glass windows which also subserve a useful purpose, and moved doubtless by a desire to encourage the new manufacture, determined to impose a duty of 45 per cent upon the latter, while the former were admitted free.… If the question in this case rested solely upon the language of paragraph 677, doubtless these importations would be exempted as paintings imported for religious purposes; but as, by paragraph 757, pictorial paintings on glass, a more specific designation, are again exempted, and stained glass windows are excepted and taken out of this exemption, we think the intent of Congress must be gathered from the language of the latter paragraph rather than the former. Particularly is this so in view of the fact that, by paragraph 122, a duty is levied upon “stained or painted window glass and stained or painted glass windows” eo nomine.Footnote 1 … [The court concludes] Congress intended to subject them to a duty....

Smith, Judge:

A marble font, two marble boxes and stands, and two marble seats imported at the port of New York were classified by the collector of customs as manufactures of marble, and were accordingly assessed for duty at 45 per cent ad valorem under that part of Paragraph 98 of the tariff act of 1913 which reads as follows:

98. Marble, breccia, onyx, alabaster, and jet, wholly or partly manufactured into monuments, benches, vases, and other articles, or of which these substances or either of them is the component material of chief value, * * * not specially provided for in this section, 45 per centum ad valorem.

The importers protested that the several articles which were so classified and assessed by the collector were dutiable at 15 per cent ad valorem under the provisions of Paragraph 376 of said act, which said Paragraph reads as follows:

376. Works of art, including paintings in oil or water colors, pastels, pen-and-ink drawings, or copies, replicas or reproductions of any of the same, statuary, sculptures, or copies, replicas or reproductions thereof, and etchings and engravings, not specially provided for in this section, 15 per centum ad valorem.

… The [Board of General Appraisers of the U.S. Treasury Department] held that the marble font and marble seats were works of art within the meaning of Paragraph 376 as interpreted by the board in the matter of the protest of Downing & Co. (T. D. 35564). In that case the board decided that if the so-called Greek temple there involved was a work of art at all it was such by reason of the fact that it was a sculpture, and from that we assume that the board must have concluded that the marble font and seats here in controversy were sculptures, and therefore held them to be works of art and dutiable under Paragraph 376 apparently because they were copies of original sculptures not provided for in Paragraph 652.

From the decision of the board the Government appealed and now contends that its appeal should be sustained on the ground that the font and marble seats are not sculptures at all, and that they are not works of art as that term is used in Paragraph 376.

It appears from the photographs in evidence that the font is a plain marble basin, supported by a long, slender, tapering column, which is sustained by a short, round pillar of smaller diameter. The short pillar springs from an annular base which rests on a plain square slab of marble. The surface of the long, tapering column is ornamented by carvings suggestive of leaves. The font was made by Molonari, a sculptor, and was copied by him from an original found in one of the churches of Italy; but whether the original was the work of a sculptor does not appear. The production is the work of a sculptor. It is fashioned from the solid marble. It may be conceded that it is artistic and beautiful. Nevertheless, those conditions, or, better said, those distinguishing features of the article, are not sufficient of themselves to constitute a sculpture. Sculpture as an art is that branch of the free fine arts which chisels or carves out of stone or other solid material or models in clay or other plastic substance for subsequent reproduction by carving or casting, imitations of natural objects, chiefly the human form, and represents such objects in their true proportions of length, breadth, and thickness, or of length and breadth only. It can not be said that the font, considered as an entirety, portrays any natural object. The surface of the tapering column which supports the plain marble basin is carved, it is true, with a representation suggestive of leaves, but that representation is so plainly ornamental and so clearly incidental that it can scarcely be regarded as sculpture and much less as giving that status to the whole article. Indeed, as appears from the photograph in evidence and the testimony in the case, that which makes the font artistic and beautiful is the purity of its lines and its just proportions, and not the carving on the column, which we think must be regarded at best as decorative and not sculptural art.

Finding, as we do, that the font is not sculpture, the next question which arises is, Can it, because of its beauty and artistic character, be classified as a work of art within the meaning of Paragraph 376? We think not. In our opinion, the expression “works of art” as used in Paragraph 376 was not designed by Congress to cover the whole range of the beautiful and artistic, but only those productions of the artist which are something more than ornamental or decorative and which may be properly ranked as examples of the free fine arts, or possibly that class only of the free fine arts imitative of natural objects as the artist sees them, and appealing to the emotions through the eye alone. The potter, the glassmaker, the goldsmith, the weaver, the needlewoman, the lace maker, the woodworker, the jeweler, all produce things which are both artistic and beautiful. It can hardly be seriously contended, however, that it was the legislative purpose to include such things, beautiful and artistic though they may be, in a provision which, as shown by its history and the enumeration therein contained, was intended to favor that particular kind of art of which painting and sculpture are the types.

That everything artistic and beautiful can not be classed as fine art was well established in United States v. Perry.… In that case it was held by the Supreme Court that the windows were not paintings and that, although they were artistic in the sense that they were beautiful, they were representative of the decorative and industrial rather than of the fine arts.

Inasmuch as we find that the font is not sculpture and not a work of the fine arts, we think that it is not dutiable under Paragraph 376 as found by the board.

The marble seats or chairs in controversy are copies of a Grecian original found in the Vatican museum, and, as appears from the record, were made by Molonari, a sculptor. The ends of the arm rests of the seats are carved into the form of lions’ heads, which are sustained by supports terminating in what appear to be carved lions’ paws. These carvings, even if they could be regarded as demanding the exercise of sculptural art, were evidently designed as an embellishment of the seats, and it would be going far to say that of themselves they were sufficient to give the character of sculptures to the entirety of which they are a minor, not a predominating, part. It may be conceded for the purposes of this case that because of the sculptural work upon them, the articles under consideration have an artistic beauty which otherwise they would not possess. Nevertheless, no one gazing upon them can forget that they are seats or chairs and that they are not the expression of the sculptor’s impulse to imitate some object in nature as he conceived it to be, but a conception brought to material form primarily and principally to serve a useful purpose, and not to please. The making of seats and chairs is strictly industrial, not sculptural, art; and when the sculptor’s hand is called upon to make such conveniences artistic and beautiful, his work reaches no higher plane than the purely decorative, unless it be so compelling that the achievement of the artisan is lost in the realized sentiment of the artist. The seats here involved were not designed to serve as mere settings for whatever of sculptural work there may be upon them, but as seats to which such sculptural work clearly bears the relation of adornment and nothing more. They must, therefore, be classed as articles of utility produced by industrial art because of a sense of need or usefulness and not as sculptures or examples of fine art the activities of which are chiefly, if not wholly, called into play by sentiment and for the purpose of appealing to the emotions.

As we are of opinion that the carved marble seats are not sculptures or works of art within the intention of Paragraph 376, we must hold that they are not dutiable as found by the board, and that the assessment of the collector should be sustained.…

Comments

1. Do you concur with the holding in Perry that stained glass windows of scenes from religious history were not “fine arts” for purposes of applicable tariffs? Do the legislative distinctions at issue in Perry make sense more generally?

2. The Olivotti court distinguishes between utilitarian and fine arts in finding that the marble chairs must “be classed as articles of utility produced by industrial art because of a sense of need or usefulness and not as sculptures or examples of fine art.” What does the court mean by defining fine arts as works “called into play by sentiment and for the purpose of appealing to emotions”? Can useful objects ever be considered art?

3. Sculpture is often categorized as reductive, molded, or additive. The first is represented by the definition provided in Olivotti – starting with a block of material, a sculptor reduces it to the form the artist intends. Molded works are, typically, cast in such material as bronze from molds made in a variety of media and techniques. Finally, additive (or assembled) works achieve their final form when an artist adds elements together – for example, David Smith’s or Mark di Suvero’s abstract sculptures. In defining sculpture, what elements should the court consider – the technique by which it was made, whether it is representational or abstract, or its material?

4. Notice the explanation in Olivotti that “[s]culpture as an art is that branch of the free fine arts which [depicts] … imitations of natural objects, chiefly the human form, and represents such objects in their true proportions of length, breadth, and thickness, or of length and breadth only.” (Emphasis added.) That narrow conception of sculpture was tested a decade after Olivotti.

In 1926, several sculptures by Romanian artist Constantin Brancusi were shipped to the United States for exhibition. They included Brancusi’s Bird in Space (Figure 1.1), which had been purchased from the artist by noted American photographer Edward Steichen and now resides in the Seattle Art Museum.

figure 1.1 Constantin Brancusi, Bird in Space (1926).

US Customs did not recognize any of the Brancusi sculptures in the shipment as works of art and denied them duty-free entry as provided in the then-applicable tariff schedule. Instead, Customs assessed the works at 40 percent of declared value as “[a]rticles or wares not specially provided for … if composed wholly or in chief value of iron, steel, lead, copper, brass, nickel, pewter, zinc, aluminum, or other metal, but not plated with platinum, gold, or silver, or colored with gold lacquer, whether partly or wholly manufactured.” Steichen raised the issue with Brancusi, who was, predictably, distressed. Ultimately, various patrons of modern art, including the artist Gertrude Vanderbilt Whitney (who later founded New York’s Whitney Museum of American Art), agreed to support an appeal of the customs decision. The case went to trial in the United States Customs Court in late 1927.

Technically, the question before the court was whether Bird in Space qualified as “original sculpture or statuary” under the 1922 Tariff Act. That statute defined those terms “to include professional productions of sculptors only” and to exclude “any articles of utility, nor such as are made wholly or in part by stenciling or any other mechanical process.” And, of course, the Customs Court considered the issue in light of Olivotti’s interpretation of “sculpture,” with its restriction to “imitations of natural objects, chiefly the human form.” So the focus in the trial was whether Bird in Space – present in the courtroom – was an “original sculpture or statuary” and the “professional production of a sculptor,” as opposed to “an article of utility.” These issues made for interesting exchanges at trial, as these excerpts from the testimony of Edward Steichen reflect:

BY MR. C.J. LANE [Counsel for Brancusi]:

Q. Will you be kind enough to tell the Court the reputation of Constantin Brancusi as an artist?

Constantin Brancusi has been in Paris for the last twenty-five years, and he has been exhibiting in all art exhibitions in Europe as well as in America.

BY JUSTICE WAITE:

Q. You have seen the exhibitions?

I have seen the exhibitions, yes, in Paris, I have seen them in London and the exhibitions here in New York as well. He is looked upon as one of the most famous of the ultimate school of art.

BY MR. C.J. LANE:

Q. Is he represented in any capacity as an artist in America at present?

I believe he has one of his bronzes in the Buffalo Museum of Art, and one in Chicago.… He is also in the Chicago Art Museum.…

Q. Of your own knowledge is he represented in galleries in Europe [or] private collectors of Europe?

He is represented in the National Gallery of Romania, and in one of the Scandinavian galleries, I don’t know whether Norway or Sweden.

Q. He has been a recognized sculptor, has he not?

He has.…

BY JUSTICE WAITE:

Q. What do you call this?

I use the same term the sculptor did, oiseau, a bird.

Q. What makes you call it a bird; does it look like a bird to you?

It does not look like a bird, but I feel that it is a bird; it is characterized by the artist as a bird.

Q. Simply because he called it a bird, does that make it a bird to you?

Yes, your Honor.

Q. If you would see it on the street, you never would think of calling it a bird, would you?

BY JUSTICE WAITE:

Q. Answer my question, will you? If you saw it anywhere, had never heard anyone call it a bird, you would not call it a bird?

No, sir.

BY MR. C.J. LANE:

Q. Is there anything utilitarian about that article that you can see?

None.

Q. Do you know of any single use it may be put to, serve any purpose whatsoever?

None whatever.…

Q. Laying aside the title, tell us whether this is a work of art, has it any underlying aesthetic principle, no matter what its title is?

Yes.

Q. Will you explain, please?

From a technical point of view, in the first place, it has form and appearance; it is an object created by an artist in three dimensions; it has harmonious proportions which give me an aesthetic sense, a sense of great beauty. That object has that quality in it. That is the reason I purchased it. Mr. Brancusi, as I see it, has tried to express something fine. That bird gives me a sensation of a rushing bird. When originally started it was not like it is today. For twenty years he has worked on that thing, changing, dividing it until it has reached this stage where the lines and form express a bird, the lines suggesting it flying up in the sky.…

BY MR. HIGGINBOTHAM [Counsel for United States]:

Q. You say you saw part of the operation in producing Exhibit 1. What particular portion did you see?

The filing and polishing work.

Q. That was done by mechanics?

That was done by Mr. Brancusi himself, I saw him do it.

Q. The filing or rough filing was the first part?

Started off with the rough filing.

Q. When this came out of the casting or foundry it was simply a rough piece of metal.

It was a very rough piece of metal.

Q. You saw it at that time?

I saw it at that time.

Q. He filed it down and polished it up?

Yes.…

Similar themes were covered in the examination of another witness for Brancusi, Jacob Epstein, a prominent English sculptor:

BY C.J. LANE:

Q. Mr. Epstein, are you acquainted with one Constantin Brancusi?

Yes, I have known Constantin Brancusi works for the last fifteen years.…

Q. Is Constantin Brancusi a sculptor?

In my opinion, yes, decidedly so.

Q. Is he so considered in the world of art?

He is considered so in the world of art.…

BY JUSTICE WAITE:

Q. What is his reputation among artists, men who are judged artists, how is he considered, as an artist?

He is considered as [a] very great artist I should say.…

BY MR. HIGGINBOTHAM:

Q. You consider from the training you have had and based on your experience you have had in these different schools and galleries – you consider that [Bird in Space] a work of art?

I certainly do.

Q. When you say you consider that a work of art will you kindly tell us why?

Well, it pleases my sense of beauty, gives me a feeling of pleasure, made by a sculptor, it has to me a great many elements but consists in itself a beautiful object. To me it is a work of art.

Q. So if we had a brass rail, highly polished, curved in a more or less symmetrical and harmonious circle, it would be a work of art?

It might become a work of art.

Q. Whether it is made by a sculptor or made by a mechanic?

A mechanic cannot make beautiful work.

Q. Do you mean to tell us that Exhibit 1 if formed up, that a mechanic, that is a first class mechanic, with a file and polishing tools could not polish that article up?

He can polish it up but he cannot conceive of the object. That is the whole point. He cannot conceive those particular lines which give it its individual beauty. That is the difference between a mechanic and an artist, he cannot conceive as an artist.

BY JUSTICE WAITE:

Q. If he can conceive, then he would cease to be a mechanic and become an artist?

Would become an artist, that is right.…

BY MR. HIGGINBOTHAM:

Q. We will say a certain piece of rock, marble, is taken by a sculptor and simply chipped off at intervals, as long as that chipping off at intervals was done by a sculptor you would consider it a work of art?

The moment a piece of rock, marble, is begun in the hands of the man, if he is an artist, it can become from that moment a work of art.

The Customs Court’s decision after trial follows.

Waite, Justice:

The importation in this case is invoiced as a bronze bird and mentioned in the record as “Bird in flight.” It was entered as a work of art in the form of a sculpture and claimed to be entitled to entry free of duty under paragraph 1704 of the tariff act of 1922. It was assessed by the collector of customs at 40 per cent ad valorem as a manufacture of metal under paragraph 399 of the same law.

The respective paragraphs are as follows:

PAR. 399. Articles or wares not specially provided for … if composed wholly or in chief value of iron, steel, lead, copper, brass, nickel, pewter, zinc, aluminum, or other metal … whether partly or wholly manufactured, 40 per centum ad valorem.

PAR. 1704. Original paintings in oil, mineral, water, or other colors, pastels, original drawings and sketches, in pen, ink, pencil, or water colors, artists’ proof etchings unbound, and engravings and woodcuts unbound, original sculptures or statuary, including not more than two replicas or reproductions of the same; but the terms “sculpture” and “statuary” as used in this paragraph shall be understood to include professional productions of sculptors only, whether in round or in relief, in bronze, marble, stone, terra cotta, ivory, wood, or metal, or whether cut, carved, or otherwise wrought by hand from the solid block or mass of marble, stone, or alabaster, or from metal, or cast in bronze or other metal or substance, or from wax or plaster, made as the professional productions of sculptors only; and the words “painting” and “sculpture” and “statuary” as used in this paragraph shall not be understood to include any articles of utility, nor such as are made wholly or in part by stenciling or any other mechanical process.…

The importation appears to be a production in bronze about 4½ feet high supported by a cylindrical base about 6 inches in diameter and 6 inches high. It is highly polished and burnished brass or bronze, symmetrically constructed with a top between 1 and 2 inches in diameter. It terminates at the top in a point which might be caused by the cutting of the piece diagonally across and upward until it terminates in an edge. It increases in size as it descends with a slight curve to the middle, from which point it decreases and terminates about 10 inches from the pedestal, where it is cylindrical, and from that point it increases in size in a conical shaped base which rests upon the pedestal.

Exhibit 2, a photographic representation of the importation is made a part of this decision, as it is difficult to describe it with sufficient accuracy to convey to the mind of one who has not seen it its actual appearance.…

The piece is characterized, as stated above, as a bird. Without the exercise of rather a vivid imagination it bears no resemblance to a bird except, perchance, with such imagination it may be likened to the shape of the body of a bird. It has neither head nor feet nor feathers portrayed in the piece. As stated above, it is entirely smooth on its exterior, which is a polished and burnished surface.

Considerable testimony was produced on both sides. On the part of the plaintiff the testimony of the sculptor was taken and of one other who claimed to be and probably was a professional artist. Other witnesses were produced who have been familiar with art and art works in their study and in museums and as artists and writers upon art. All of these declared the production to be a piece of sculpture and a work of art, the work of a professional artist and sculptor, Brancusi.

Two witnesses were produced on the part of the Government who have had experience in art and sculpture, who were, in fact, under the accepted definition, sculptors. These pronounced the importation to be neither a work of art nor sculpture.

There is no question in the mind of the court but that the man who produced the importation is a professional sculptor, as is shown by his reputation and works and the manner in which he is considered by those competent to judge upon that subject. We also find it is an original production.

The requirements of the paragraph under which this is claimed to be entitled to free entry provide for original sculptures, the works of a professional sculptor, with the further proviso that the term shall not be understood to include any articles of utility. The term “works of art” which originally appeared as the heading of the predecessor of this paragraph (par. 717 of the act of 1909), was dropped therefrom in the enactment of the 1913 law (par. 652), and the latter was reenacted, practically without change, as paragraph 1704 of the present tariff law. Nevertheless, this court has held that to be entitled to free entry under said paragraph 1704, articles must be works of art.

Having found that this is the work of a professional sculptor, and that it is original, the question then for us to determine is as to whether it conforms to the definition given under the law for works of art. It must be conceded that what have been determined to be works of art under the decisions of recent years, would, under the more remote, decisions of the courts, not only the customs courts but the United States Supreme Court, have been rejected as not falling within that term. We think that under the earlier decisions this importation would have been rejected as a work of art, or, to be more accurate, as a work within the classification of high art. Under the influence of the modern schools of art the opinion previously held has been modified with reference to what is necessary to constitute art within the meaning of the statute, and it has been held by the Court of Customs Appeals that drawings or sketches, designs for wall paper and textiles, are works of art, although they were intended for a utilitarian purpose.

Government counsel in support of the contention that this importation is not sculpture, cites the case of United States v. Olivotti. In defining the term “sculpture” the court there said:

Sculpture as an art is that branch of the free fine arts which chisels or carves out of stone or other solid material or models in clay or other plastic substance for subsequent reproduction by carving or casting, imitations of natural objects, chiefly the human form, and represents such objects in their true proportions of length, breadth, and thickness, or of length and breadth only.

This decision was handed down in 1916. In the meanwhile there has been developing a so-called new school of art, whose exponents attempt to portray abstract ideas rather than to imitate natural objects. Whether or not we are in sympathy with these newer ideas and the schools which represent them, we think the fact of their existence and their influence upon the art world as recognized by the courts must be considered.

The object now under consideration is shown to be for purely ornamental purposes, its use being the same as that of any piece of sculpture of the old masters. It is beautiful and symmetrical in outline, and while some difficulty might be encountered in associating it with a bird, it is nevertheless pleasing to look at and highly ornamental, and as we hold under the evidence that it is the original production of a professional sculptor and is in fact a piece of sculpture and a work of art according to the authorities above referred to, we sustain the protest and find that it is entitled to free entry under paragraph 1704.…

Comments

1. Note how the court focused on two critical issues: Is this work of no utility by someone recognized as an artist? Is it created through an artistic process, intended as art? Note also the role of “expert” testimony concerning whether someone is an artist and about artistic process and value – we will see similar testimony play out in other cases throughout the book.

2. Obviously, the Brancusi case was one piece of a larger story about the emergence of modern, nonrepresentational art, and how the law adapted to a novel expansion of artistic expression. We will see in Chapter 10 how US law has accommodated a diversity of artistic expression in the context of freedom of expression. As you progress through the following chapters, keep in mind the challenge courts face in determining what, in various contexts, qualifies as “art.”

3. Another, larger story lurking in these cases is why US tariff law draws these distinctions at all. What is the policy rationale that privileges “art” over “utilitarian” objects? Presumably, this historic distinction was intended to encourage importation of objects that offered some kind of cultural benefit. How would you characterize that benefit? Is this privilege for works of art, and the lost revenue to the US Treasury, justified? Does it present a risk that government can, to some extent, dictate artistic tastes through tariffs?

4. For more on the Brancusi case, see Laurie Adams, Art on Trial: From Whistler to Rothko 35–58 (1976).

5. A more recent controversy concerning taxation on art involved the works of contemporary video artist Bill Viola and minimalist artist Dan Flavin. In 2006, the art gallery Haunch of Venison sought to import the artists’ video and light works into the United Kingdom from the United States. Viola’s video works consisted of DVDs and projection equipment, while Flavin’s light installation comprised several fluorescent light tubes, similar to the work by Flavin shown in Figure 1.2.

figure 1.2 Dan Flavin, Untitled (for Frederika and Ian) 3 (1987).

Each installation required assembly upon arrival and contained detailed set-up instructions for the gallery. Works of art imported into the United Kingdom typically enjoyed a reduced VAT (value-added tax) rate of 5 percent and exemption from customs duty. However, the British tax and customs authority, HM Revenue and Customs (HMRC), classified the Viola and Flavin artworks as image projectors and lighting fittings, respectively, thereby subjecting each to the (then) standard VAT rate of 17.5 percent plus customs duty. Despite classifying the works as equipment, HMRC based its tax assessment on the works’ fair market value as works of art. See Henry Lydiate, Flavin’s Fittings, Art Monthly, February 2011, at 37. The gallery appealed HMRC’s decision to a VAT and Duties Tribunal, asserting that the works were properly categorized as original sculptures, or else “collectors’ pieces of historical interest,” and therefore qualified for reduced taxation. See Haunch of Venison Partners Ltd. v. Revenue & Customs [2008] UKVAT(Customs) C00266. HMRC argued that because the works were dissembled and imported in pieces, the works should be classified based on their separate parts. HMRC also claimed that the video works could not be classified as sculptures because the video itself, when projected on a screen, was not three-dimensional. After reviewing the evidence, including testimony from art experts, the Tribunal agreed with the gallery that the pieces were correctly classified as original sculptures. The Tribunal also held that the video works were three-dimensional, since Viola selected all of the parts that he supplied for the video installation to achieve his artistic vision. Further, the Tribunal rejected the argument that the pieces must be viewed objectively as separate components, noting that it was “absurd” to ignore the fact that the pieces together make a work of art. Although HMRC expressed concern that importers would circumvent duty rates by claiming objects as art, the Tribunal stated that this fear was exaggerated, as importers still carried the burden of proving that pieces qualify as art. Two years later, the European Commission reversed the Tribunal’s decision. See Commission Regulation 731/2010 of Aug. 11, 2010, concerning the classification of certain goods in the Combined Nomenclature, 2010 O.J. (L 214) 2, 2–3 (EU). The European Commission reaffirmed HMRC’s original determination, finding that the Viola and Flavin works were not art, but rather were properly classified based on their individual component parts. The Commission determined that the video pieces of the Viola work, either separate or assembled, could not be considered a sculpture. While acknowledging that the artist modified the pieces, the Commission stated that the preliminary function of the goods was not altered. With regard to the Flavin light installation, the Commission found that it was not a sculpture since “it is not the installation that constitutes a ‘work of art’ but the result of the operations (the light effect) carried out by it.” Thus, the works could not be classified as art, and did not qualify for reduced VAT rates or exemption from customs duty. Yet, in a cruel irony, the implication of the decision was that the works would be taxed based on their value as works of art, not based on the (much lower) value of the materials used. Does this result appear fair?

6. A few years earlier, and across the pond, California’s tax agency reached a different result in a similar situation. In 2002, the San Francisco Arts Commission commissioned a work of public installation art entitled Facsimile from acclaimed artists Elizabeth Diller and Ricardo Scofidio. The main component of the artwork was a 15' × 25' LED screen that was to be suspended on the exterior of the Moscone Convention Center in downtown San Francisco. The artists envisioned that the screen would rotate around the building’s facade via a motorized track while showing live footage from the building’s interior interspersed with fictionalized, prerecorded video scenes.

The artists specially designed the LED screen for the work, which the Arts Commission planned to purchase directly from a manufacturer. Accordingly, the San Francisco City Attorney’s Office wrote to the California State Board of Equalization (BOE) to confirm that the purchase would not be subject to sales tax, since a provision in the state’s tax code exempts government agencies from sales tax on art purchased for public display. The City argued that Facsimile qualified as an original work of art, as it had no utilitarian or commercial purpose, but rather, “functions solely as artwork.” Further, citing Brancusi (above) and Bleistein (below), the City Attorney’s Office noted that courts generally defer to the opinions of arts professionals when defining a “work of art” for statutory purposes. The BOE agreed, finding that Facsimile qualified as an original work of art best described as “mixed media.” The BOE recognized the screen added its own aesthetic elements to the piece and was a part of the artists’ vision for the work. Therefore, the screen was a part of the artwork and was exempt from sales tax. The exemption saved the Arts Commission approximately $75,000 to $85,000. However, this triumph was somewhat short-lived, as the artwork experienced many technical and operational difficulties. See Kale Williams, Moscone West’s $1.5 Million Artwork Beset by Glitches, SFGATE.com, Sept. 3, 2014, www.sfgate.com/bayarea/article/Moscone-West-s-1-5-million-artwork-beset-by-5731932.php. Early on, the screen was dropped and damaged, requiring replacement of the LED modules. The wheels for the screen had to be replaced due to a squeaking noise, there were bugs in the work’s software, and the screen never rounded the curved building properly while transmitting video. In 2014, the Arts Commission voted to dismantle the project altogether. See Aaron Betsky, RIP Facsimile: Death of a Public Art Project, Architect, Oct. 23, 2014, www.architectmagazine.com/design/culture/rip-facsimile-death-of-a-public-art-project_o.

7. Consider Christo and Jeanne-Claude’s The Gates, a temporary work installed in New York City’s Central Park in 2005 (Figure 1.3): Under the criteria in the cases above, is this a work of art?

figure 1.3 Christo and Jeanne-Claude, The Gates (2005).

According to one commentator, “Of course, The Gates is art, because what else would it be? Art used to mean paintings and statues. Now it means practically anything human-made that is unclassifiable otherwise.” Peter Schjeldahl, Gated, The New Yorker, Feb. 28, 2005, www.newyorker.com/magazine/2005/02/28/gated.

Closely related to the issue of what is art is the question of who is best positioned to decide. Ideally, perhaps, art historians and critics. But when a dispute is litigated, a judge will decide legal issues, and the same judge or a jury will decide the facts. Are judges or juries suitable parties to decide whether an object is a work of art or of a certain artistic merit? Should their decision be based only on expert testimony? For a long time, judges have expressed reluctance to make decisions about artistic merit, but have often done so nonetheless, as reflected in the following oft-cited Supreme Court decision concerning the poster shown in Figure 1.4 and similar posters.

figure 1.4 The Great Wallace Shows (1898).

Holmes, Justice:

This case.… is an action brought by the plaintiffs in error to recover the penalties prescribed for infringements of copyrights. The alleged infringements consisted in the copying in reduced form of three chromolithographs prepared by employees of the plaintiffs for advertisements of a circus owned by one Wallace. Each of the three contained a portrait of Wallace in the corner and lettering bearing some slight relation to the scheme of decoration, indicating the subject of the design and the fact that the reality was to be seen at the circus. One of the designs was of an ordinary ballet, one of a number of men and women, described as the Stirk family, performing on bicycles, and one of groups of men and women whitened to represent statues. The circuit court directed a verdict for the defendant on the ground that the chromolithographs were not within the protection of the copyright law, and this ruling was sustained by the circuit court of appeals.

There was evidence warranting the inference that the designs belonged to the plaintiffs, they having been produced by persons employed and paid by the plaintiffs in their establishment to make those very things. It fairly might be found also that the copyrights were taken out in the proper names.

Finally, there was evidence that the pictures were copyrighted before publication.…

We shall do no more than mention the suggestion that painting and engraving unless for a mechanical end are not among the useful arts, the progress of which Congress is empowered by the Constitution to promote.Footnote 2 The Constitution does not limit the useful to that which satisfies immediate bodily needs. It is obvious also that the plaintiffs’ case is not affected by the fact, if it be one, that the pictures represent actual groups – visible things. They seem from the testimony to have been composed from hints or description, not from sight of a performance. But even if they had been drawn from the life, that fact would not deprive them of protection. The opposite proposition would mean that a portrait by Velasquez or Whistler was common property because others might try their hand on the same face. Others are free to copy the original. They are not free to copy the copy. The copy is the personal reaction of an individual upon nature. Personality always contains something unique. It expresses its singularity even in handwriting, and a very modest grade of art has in it something irreducible, which is one man’s alone. That something he may copyright unless there is a restriction in the words of the act.

If there is a restriction it is not to be found in the limited pretensions of these particular works. The least pretentious picture has more originality in [it] than directories and the like, which may be copyrighted. The amount of training required for humbler efforts than those before us is well indicated by Ruskin. “If any young person, after being taught what is, in polite circles, called ‘drawing,’ will try to copy the commonest piece of real work, – suppose a lithograph on the title page of a new opera air, or a woodcut in the cheapest illustrated newspaper of the day – they will find themselves entirely beaten.” There is no reason to doubt that these prints in their ensemble and in all their details, in their design and particular combinations of figures, lines and colors, are the original work of the plaintiffs’ designer. If it be necessary, there is express testimony to that effect. It would be pressing the defendant’s right to the verge, if not beyond, to leave the question of originality to the jury upon the evidence in this case.…

These chromolithographs are “pictorial illustrations.” The word “illustrations” does not mean that they must illustrate the text of a book, and that the etchings of Rembrandt or Steinla’s engraving of the Madonna di San Sisto could not be protected to-day if any man were able to produce them. Again, the act however construed, does not mean that ordinary posters are not good enough to be considered within its scope.… Certainly works are not the less connected with the fine arts because their pictorial quality attracts the crowd and therefore gives them a real use – if use means to increase trade and to help to make money. A picture is none the less a picture and none the less a subject of copyright that it is used for an advertisement. And if pictures may be used to advertise soap, or the theatre, or monthly magazines, as they are, they may be used to advertise a circus. Of course, the ballet is as legitimate a subject for illustration as any other. A rule cannot be laid down that would excommunicate the paintings of Degas.…

It would be a dangerous undertaking for persons trained only to the law to constitute themselves final judges of the worth of pictorial illustrations, outside of the narrowest and most obvious limits. At the one extreme some works of genius would be sure to miss appreciation. Their very novelty would make them repulsive until the public had learned the new language in which their author spoke. It may be more than doubted, for instance, whether the etchings of Goya or the paintings of Manet would have been sure of protection when seen for the first time. At the other end, copyright would be denied to pictures which appealed to a public less educated than the judge. Yet if they command the interest of any public, they have a commercial value – it would be bold to say that they have not an aesthetic and educational value – and the taste of any public is not to be treated with contempt.… That these pictures had their worth and their success is sufficiently shown by the desire to reproduce them without regard to the plaintiffs’ rights. We are of opinion that there was evidence that the plaintiffs have rights entitled to the protection of the law.…

Harlan, Justice, dissenting:

Judges Lurton, Day and Severens, of the circuit court of appeals, concurred in affirming the judgment of the district court. Their views were thus expressed in an opinion delivered by Judge Lurton: “What we hold is this: That if a chromo, lithograph, or other print, engraving, or picture has no other use than that of a mere advertisement, and no value aside from this function, it would not be promotive of the useful arts, within the meaning of the constitutional provision, to protect the ‘author’ in the exclusive use thereof, and the copyright statute should not be construed as including such a publication, if any other construction is admissible. If a mere label simply designating or describing an article to which it attached, and which has no value separated from the article, does not come within the constitutional clause upon the subject of copyright, it must follow that a pictorial illustration designed and useful only as an advertisement, and having no intrinsic value other than its function as an advertisement, must be equally without the obvious meaning of the Constitution. It must have some connection with the fine arts to give it intrinsic value, and that it shall have is the meaning which we attach to the act of June 18, 1874, amending the provisions of the copyright law. We are unable to discover anything useful or meritorious in the design copyrighted by the plaintiffs in error other than as an advertisement of acts to be done or exhibited to the public in Wallace’s show. No evidence, aside from the deductions which are to be drawn from the prints themselves, was offered to show that these designs had any original artistic qualities. The jury could not reasonably have found merit or value aside from the purely business object of advertising a show, and the instruction to find for the defendant was not error.…”

I entirely concur in these views, and therefore dissent from the opinion and judgment of this court. The clause of the Constitution giving Congress power to promote the progress of science and useful arts, by securing for limited terms to authors and inventors the exclusive right to their respective works and discoveries, does not, as I think, embrace a mere advertisement of a circus.

Comments

1. The narrow question presented in Bleistein was whether the circus advertisements at issue qualified as “useful arts” referenced in the Constitution’s Copyright Clause and “pictorial illustrations” eligible for copyright protection under then applicable law. Justice Holmes took the view that if a work appeared to be a pictorial illustration, that was the end of the inquiry – it was protected by copyright law. Justice Harlan, dissenting, took a narrow view that copyright should not include “a mere advertisement of a circus.”

2. The larger significance of the Bleistein decision, which echoes throughout this book, was the distinct approaches the two justices took to judging works of art. Justice Holmes cautioned that “[i]t would be a dangerous undertaking for persons trained only to the law to constitute themselves final judges of the worth of pictorial illustrations, outside of the narrowest and most obvious limits,” words that have been taken by many courts as a warning that judges should not be assessing the worth of artistic creations in deciding what legal protections those works should receive. Justice Harlan, in contrast, had no problem judging the works at issue, finding them not sufficiently serious to be worthy of copyright protection. (Although one might ask if Holmes also was judging the works, but differently.) In practice, as we will see, judges often pay homage to Holmes but follow Harlan. And in fact, the law sometimes requires judges to assess the “worth” of works of art. For example, under current federal moral rights legislation (discussed in Chapter 3), “works of visual art” are protected from destruction only if they are of “recognized stature.” This standard requires judges to assess the recognition a work has received and to adjudge it worthy of protection, often based on expert testimony but sometimes, also, on the judge’s perception of the work at issue. In other contexts, we will see judges expressing their own reaction to a work, as they decide whether it should be displayed in a government building or should receive government funding, for example. Consider the respective views of Holmes and Harlan as you review the decisions in the following chapters.

3. For more on whether and how judges should be and are making aesthetic judgments, see Christine Haight Farley, Judging Art, 79 Tul. L. Rev. 805 (2005); Brian Soucek, Aesthetic Judgment in Law, 69 Ala. L. Rev. 381 (2017); Barton Beebe, Bleistein, the Problem of Aesthetic Progress, and the Making of American Copyright Law, 117 Colum. L. Rev. 319, 333, 386–87 (2017); and Robert Kirk Walker & Ben Depoorter, Unavoidable Aesthetic Judgments in Copyright Law: A Community of Practice Standard, 109 Nw. U. L. Rev. 343 (2015).

iii. who is an artist?

As another threshold matter, we consider who – in the eyes of the law – is an artist. Having seen that art is often defined, as a practical matter, as anything created by someone recognized as an artist, it is tempting to say that an artist is someone who creates something recognized as art. That definition is not far off.

The legal definition of artist appears in myriad fields of law: tax; employment; zoning and land use. But more notable is where the definition is not found: federal statutes on the arts and humanities [and] federal statutory protection of artists’ pecuniary and moral rights.… Surprisingly, these laws … assume the definition [of artist]. Courts also rarely address the definition directly; the inquiry into the legal definition of artist is often ancillary to one defining “art” or “artistic activity.”

… [N]either the Copyright Act nor the Visual Artists Rights Act (“VARA”) defines artist. Nor does … [the National Foundation on the Arts and Humanities Act of 1965, or NFAHA, the] enabling legislation [that created the National Endowment for the Arts]. In the case of VARA, one can only infer that an artist is one who makes the types of visual art that are expressly listed as protected. For the NEA, one is left to guess that an artist is one who proposes projects of “artistic excellence” and “artistic merit.” Besides their tautological nature (an artist is someone who makes art), these definitions seem rootless and depend on what the meaning of art is – something also in flux.…

The Internal Revenue Code does not expressly define artist for itemized [income tax] deductions.… Rather, it broadly allows deductions for “all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business.” … As applied to the arts, courts look to the trade or business nature of the artistic activity to determine whether a taxpayer is an artist. To be characterized as an artist, a taxpayer must show that he engaged in the trade (making art) with a good faith effort to realize profit. A fact-intensive inquiry, courts have determined the good faith expectation of profit of a taxpayer claiming to be an artist by looking at how successfully he sold his work, how much revenue he received from the sales, any independent sources of income, and his declared motives.…

The Internal Revenue Code does, however, define artist explicitly for exemptions regarding inventory costs [in Section 263(A)(h)(2)] … as “any individual if the personal efforts of such individual create (or may reasonably be expected to create) a picture, painting, sculpture, statue, etching, drawing, cartoon, graphic design, or original print edition.” 38 IRC § 263(A)(h)(3)(C)(i). As defined, an artist is then exempt from paying “qualified creative expense[s],” … Although the case law is sparse, the U.S. Tax Court has ruled that a producer of greeting cards featuring cartoon characters did not qualify for the artist exception to 26 U.S.C. § 263’s uniform capitalization rules.…

According to the U.S. Census Bureau, an artist is one who is “primarily engaged in … creating artistic and cultural works.” This definition is important because it is used by myriad federal agencies, including the Bureau of Labor Statistics (“BLS”) and the NEA, to report employment conditions for artists. However, each agency uniquely construes the Census Bureau’s … definition, which leads to another level of complexity. For instance, the BLS also defines a fine artist as one who “create[s] original works of art for their aesthetic value, rather than for a functional one.” The Current Population Survey (co-sponsored by the Census Bureau and the BLS) … defines “artist occupations” to include fine artists, entertainers, art directors, comedians, photographers, writers, and authors.

… The legal definition of artist is relevant on the state (and sometimes municipal) level for several different purposes. These purposes range from visual artists’ moral rights to zoning to public art project funding.…

The State of New York protects its visual artists’ moral rights through the Arts and Cultural Affairs Law. Under this statute, an artist is defined as “the creator of a work of fine art, or in the case of multiples, the person who conceived or created the image which is contained in or which constitutes the master from which the individual print was made.” The definition is circular, and New York courts have done little to clarify its scope – though they have interpreted this definition to mean an artist can be a corporation.…

The legal definition of artist is extremely important for housing in New York because only certified artists may inhabit particular mixed-use zoning areas…

In many states, the legal definition of artist for consignment appears bare and tautological (an artist is one who makes fine art). For example, California defines an artist in this context as the “person who creates a work of fine art or, if that person is deceased, that person’s heir, legatee, or personal representative.” Florida defines an artist in its Artist’s Consignment Act in almost identical terms: the “creator of a work of art or, if she or he is deceased, the artist’s heirs or personal representative.” …

Municipal codes and the First Amendment converge to define and regulate many other types of visual artists: “tattoo” artists, “street” artists, and “graffiti” artists. Through health and zoning codes, municipalities often try to regulate where and when these types of artists may practice or sell their work. But artists have challenged these regulations on First Amendment grounds, ranging from restriction of freedom of expression to assembly. A legal definition of these types of visual artists thus arises from a hodgepodge of municipal codes under the states’ police powers and the case law resulting from artists’ First Amendment challenges.…

Comments

1. Note the types of art and artists that are included in these legal definitions. Now take note of the types of art and artists that these definitions either intentionally or unintentionally leave out. Despite the title of Logan’s paper, under these definitions it may not be enough to be a person who makes art to be considered, at law, an artist. Take, for example, the definitions of artist for federal tax and employment law purposes, under which the law assumes that an artist is someone whose art can and does create an income or is intended to do so. Those whose art is not generated to be sold or simply not sold in the formal economy may be outside these legal definitions. In another vein, think about how some of the definitions separate artists who produce fine art from other types of artists (e.g., “tattoo” artists, “street” artists, “makeup” artists, etc.). What assumptions underlie these distinctions? Does this separation implicate issues of class, race, or gender?

2. In Masterpiece Cakeshop, Ltd. et al. v. Colorado Civil Rights Commission et al., 584 U.S. 617 (2018), the Supreme Court considered whether a baker who refused to create a cake for the wedding of a gay couple ran afoul of Colorado’s civil rights laws. In his concurring opinion, Justice Thomas considered whether the baker, Jack Phillips, was engaged in expressive activity protected by the First Amendment:

The conduct that the Colorado Court of Appeals ascribed to Phillips – creating and designing custom wedding cakes – is expressive. Phillips considers himself an artist. The logo for Masterpiece Cakeshop is an artist’s paint palate with a paintbrush and baker’s whisk. Behind the counter Phillips has a picture that depicts him as an artist painting on a canvas. Phillips takes exceptional care with each cake that he creates – sketching the design out on paper, choosing the color scheme, creating the frosting and decorations, baking and sculpting the cake, decorating it, and delivering it to the wedding.… Phillips is an active participant in the wedding celebration. He sits down with each couple for a consultation before he creates their custom wedding cake. He discusses their preferences, their personalities, and the details of their wedding to ensure that each cake reflects the couple who ordered it.… Phillips also sees the inherent symbolism in wedding cakes. To him, a wedding cake inherently communicates that “a wedding has occurred, a marriage has begun, and the couple should be celebrated.” . . . Accordingly, Phillips’ creation of custom wedding cakes is expressive. The use of his artistic talents to create a well-recognized symbol that celebrates the beginning of a marriage clearly communicates a message – certainly more so than nude dancing, Barnes v. Glen Theatre, Inc., 501 U.S. 560, 565–566 (1991), or flying a plain red flag, Stromberg v. California, 283 U.S. 359, 369 (1931).

Justice Thomas clearly believes that the act of creating and designing a wedding cake can be expressive, but does he conclude Phillips is an artist? Do you? What is Phillips expressing? Do you agree that creating a custom wedding cake more clearly communicates a message than flying a plain red flag?

The question of whether someone is an artist has repeatedly come before the courts in the context of federal income taxation. Specifically, courts have considered whether an individual is engaged in the business of being an artist in determining whether expenses incurred in working as an artist are properly deductible against an individual’s other income. We look further at this issue in Chapter 6, addressing how tax laws impact artists, but for now consider the following two decisions on the issue of the income tax deductibility of an artist’s expenses.

Simpson, Judge:

… The only issue for decision is whether petitioner Benjamin E. Adams was engaged in carrying on a trade or business as an artist so that certain expenses incurred during the taxable years are deductible as business expenses under section 162(a) of the Internal Revenue Code of 1954.

Findings of Fact

… Petitioners, Benjamin E. Adams and Amanda C. Adams, are husband and wife residing in Chicago, Illinois.…

Prior to the year 1956, Amanda C. Adams operated a restaurant in Chicago on the ground floor of a two-story building. Petitioners resided on the top floor of this building. During this time, petitioner was engaged as a roofing and home improvement salesman.