2 - Critiquing Twenty-First-Century Capitalism

Published online by Cambridge University Press: 01 March 2025

Summary

The second set of precursors to Silicon Valley cinema follow in the footsteps of Wall Street (Oliver Stone, 1987), critiquing American capitalism by depicting groups of financial traders dictating the rise and decline of American firms and thus by extension the entire economy. As such, like the technology thrillers, they highlight fears of shadowy cabals manipulating our world for their own benefit. Each film engages with the fallout from the economic collapse of 2007–2008. Their venal and corrupt capitalists see no ethical problem in using illegally obtained information to manipulate stock values and boost their personal finances. As important, their critique of the influence of toxic masculinity and the traders’ devotion only to their own wealth accumulation develops a deeper philosophical connection with Silicon Valley cinema, one surrounding Ayn Rand's valorising of the self-interest of the self-appointed great men of our times.

Based on its anti-hero's memoir, The Wolf of Wall Street (Martin Scorsese, 2013) recounts Jordan Belfort's rise to Wall Street notoriety courtesy of his preternatural sales skills and his willingness to flout both convention and the law when selling stocks. Obsessed with money and the attendant opportunities for sex- and drug-fuelled bad behaviour, Belfort finds his company under investigation by the FBI and the American Securities and Exchange Commission, with his conviction and jailing following soon afterwards. This downfall presages a shift into a different grift: motivational speaking, where he dispenses the supposed secret to financial success to conference rooms full of suckers desperate to make a fast buck in sales. Margin Call (J. C. Chandor, 2011) reveals how analysts at a fictional investment bank discover in 2008 that the company is on the verge of bankruptcy thanks to it underestimating the risks attached to mortgage- backed securities. The firm's heads, operating according to capitalist exigencies, decide to sell as many of these assets as they can before the price drops so low that it will endanger the firm. This throws the rest of the securities market to the wolves, with the film ending on the verge of another Wall Street Crash. The mysteries of these mortgage-backed securities are unravelled in the documentary Inside Job (Charles Ferguson, 2010), which details the close relationship between bankers, regulators and academics in the decades before the 2007–2008 financial crash, indicting all three for greed, laziness and corruption.

- Type

- Chapter

- Information

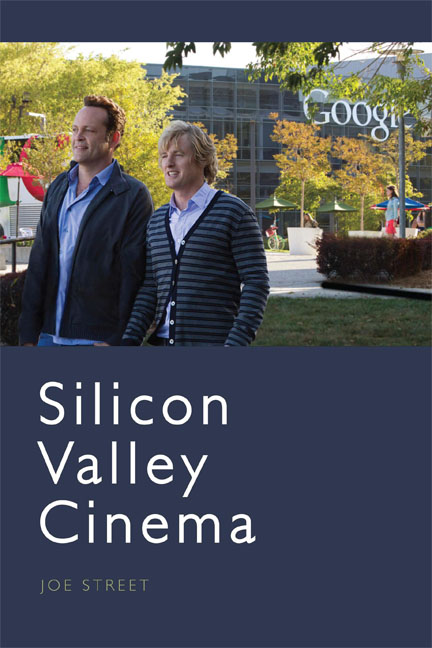

- Silicon Valley Cinema , pp. 33 - 41Publisher: Edinburgh University PressPrint publication year: 2023