Part Two - Contributions from the Social Policy Association Conference 2017

Published online by Cambridge University Press: 22 April 2022

Summary

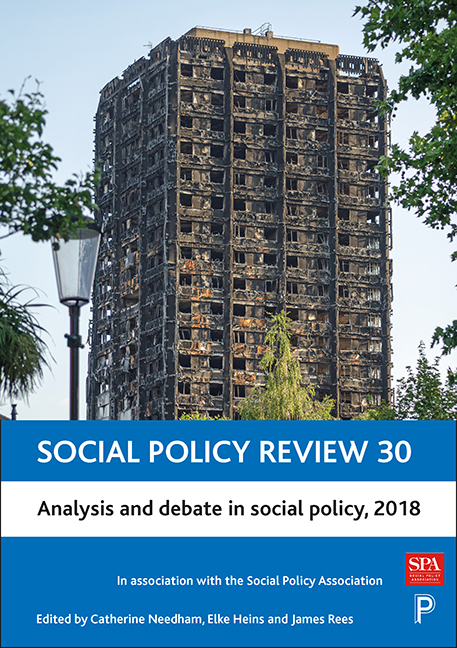

This section of Social Policy Review 30 assembles some of the highlights of the annual conference of the Social Policy Association held in Durham in July 2017. Although perhaps not as momentous as the previous year, 2017 was undoubtedly an eventful political period, both in the UK and across the globe, as the timely contributions in this section remind us. To name but a few select events, we witnessed a snap UK General Election with surprising results that significantly weakened the Prime Minister and had important repercussions for her (social) policy agenda. It was also the first year in office of an explicitly populist US President, and themes of far-right populism dominated elections and debates in many European countries. Social inequality, the conference's leading theme, continued to be a dominant political issue. At a local level, the extent of inequality became perhaps most painfully visible through the Grenfell Tower fire, as already discussed in Chapter One by Stuart Hodkinson. Yet, further intriguing insights into the global scale of tax evasion and avoidance with important implications for inequality were also revealed through the leak of the Paradise Papers. The use of offshore tax havens by a global elite has massive implications for our welfare systems through lost taxes and for the extent of income inequality. Both taxes and benefits form the backbone of the welfare state, but the British media and public are notoriously obsessed with stories about the benefits side of the welfare system, with a particular focus on ‘benefit cheats’. In contrast, the revelations of the Panama Papers in 2016, followed by the Paradise Papers in 2017, moved the spotlight, at least for a while, onto issues of tax avoidance and evasion.

While the leak of these papers in mainstream newspapers reveals secrets of the world's elite's hidden wealth, there is another ‘hidden world’ of the tax system that demands our attention, as Adrian Sinfield argues in Chapter Five. The tax reliefs and related subsidies of fiscal welfare in the UK contribute significantly but virtually invisibly to maintaining and reinforcing inequality. In his chapter Sinfield examines how tax reliefs support those benefiting from occupational and personal pensions, the largest area of social spending through the tax and National Insurance systems.

- Type

- Chapter

- Information

- Social Policy Review 30Analysis and Debate in Social Policy, 2018, pp. 87 - 90Publisher: Bristol University PressPrint publication year: 2018