I. Introduction

International trade is the lifeblood of the global economy, and 90 per cent of internationally traded goods are transported by sea. Hurdles to seaborne trade have ripple effects across society. For example, shortages in essential goods higher shipping costs, and a consequent increase in the cost of goods, contribute to high inflation rates.Footnote 1 In the aftermath of the COVID–19 pandemic, the international trade community has witnessed a proliferation of digital platforms, most of them blockchain-based, aiming to facilitate communications and transactions among the multitude of actors involved in international trade. These platforms permit stakeholders to share and access reliable information that can be updated in real-time.Footnote 2 International trade platforms also facilitate the instantaneous processing of electronic trade documents by recording transactions on a blockchain.Footnote 3 They can increase operational efficiencies, save time, reduce costs, fraud and waste, and provide a competitive edge to system participants. Academic research estimates that up to 40 per cent reduction in delivery times and savings of 25 per cent of transportation costs could be achieved through information sharing.Footnote 4 According to the International Chamber of Commerce (ICC), digitalising trade documents could increase trade volume by 43 per cent on 2019 values by 2026, cut costs and save time associated with cross-border paperwork to business by 81 per cent and free up to GBP 224 billion in efficiency gains in the UK alone.Footnote 5 The benefits of digital transformation of international trade processes have received political endorsement from the G7 digital and technology ministers’ meeting.Footnote 6 Despite the palpable economic benefits, stakeholders will only participate in digitalisation efforts if they can ensure they reap some of the resulting benefits.

One of the biggest challenges faced by those seeking to achieve digitalisation in this area is to encourage a critical mass of stakeholders to adopt digitised processes.Footnote 7 Digitisation requires legislative intervention to accommodate electronic trade documents and to address issues resulting from the automation of transactions potentially achieved by smart contract technology. Positive law reform initiatives in various jurisdictions are dealing with these issues.Footnote 8 In addition to essential legislative intervention, existing research has identified that increased cooperation or co-opetitionFootnote 9 between shipping lines and between shipping lines and other participants in the supply chain is required to enable platform-based digitalisation.Footnote 10 Therefore, it is important to examine whether the mechanisms governing the operation of international trade platforms foster collaboration among industry participants.

This article makes four principal contributions. First, it responds to literature declaring the normative “meaninglessness” of non-currency applications of blockchain technology by providing insights from the container shipping industry, where commercial innovators have engineered practical blockchain use cases to digitalise transport documents of title. Second, it argues that contractual mechanisms govern the transnational use of such platforms at the application layer in commercial practice. Third, it identifies the limitations of contractual governance of blockchain trade networks due to the high levels of uncertainty caused by contractual incompleteness and the risk of opportunistic behaviour by platform providers. Finally, it proposes that structuring platform rulebooks as relational contracts by design would provide an effective principle-based governance mechanism for these platforms, and facilitate digital platform integration in international trade. While both the technology and the legal landscape are still evolving, the findings of this paper contribute to the wider discussion about how private law initiatives in the form of commercial agreements can, in effect, fill legal gaps that create transaction costs.

The following section sets out the governance mechanisms of global trade platforms, many of which are blockchain-based. Most existing scholarly legal writing broaching blockchain governance focuses on the legal implications of the technical means of governance through which the underlying protocol is maintained (coding, mining, information input). Footnote 11 The Courts are also considering technical means of governance, questioning whether decentralised governance of bitcoin “really is a myth”.Footnote 12 This section does not engage in this debate. Instead, it argues that traditional governance concepts remain effective even in systems that use blockchain. Blockchain’s decentralised data storage can do away with intermediation because parties can exchange data and transact peer-to-peer. However, contractual mechanisms establish the terms based on which platforms provide their services. To support this statement, this paper draws evidence from case studies examining specific trade platforms’ terms and conditions in the container shipping industry. The case studies reveal that blockchain platforms in international trade revolve around a common modular architecture consisting of a platform provider and various types of platform members. Platform members consist of industry stakeholders, such as ocean carriers, freight forwarders, multimodal service providers, shippers, consignees, financers, insurers and port and customs authorities. The relationship between the platform provider and the platform members and the relationship between members among themselves are governed primarily by a contractual mechanism, namely the platform rulebooks.

The third section approaches the contractual workarounds developed in the industry, known as rulebooks, as meta-regulatory instruments arguing that they display relational features. To reach this conclusion, this section explores how rulebooks govern the relationships of the parties involved in blockchain-based platforms designed for use in international trade and transport, and it engages in a theoretical and doctrinal analysis of the notion of relational contracts under English law, which is often the governing law of these platforms.Footnote 13 It concludes that even if construed as relational contracts, platform rulebooks remain sub-optimal in finding the right balance between the certainty and the flexibility necessary to govern complex commercial networks.Footnote 14

The fourth section engages in a theoretical analysis drawing upon the principles of law and economics and contract design theory to formulate suggestions on how parties could draft rulebooks to address the complexity inherent in platform rulebooks as network contracts. It proposes that platform rulebooks could be structured as relational network contracts by their drafters to induce stakeholder engagement and adoption, and to facilitate contractual interpretation by courts. In the current state, where the international trade community is already working towards a uniform rulebook that would enable parties to exchange trade documentation electronically, Footnote 15 this proposal could provide a theoretical framework upon which uniformity and standardisation efforts could be founded.

II. Governing International Trade Platforms through Multipartite Rulebooks

A. Industry Case Studies

The digitalisation of trade documents is the foundational use case upon which paperless trade can rely.Footnote 16 This is because trade documents contain crucial information for making financing and pricing decisions, and triggering events, in the trade finance and insurance sphere.Footnote 17 Derivative technological use cases, such as the automation of trade and supply chain finance instruments, assume that the required trade documents are available in a digitalised form.Footnote 18 Therefore, this article draws mainly from the domain of electronic trade documents (ETDs), where the industry’s level of adoption is more advanced. Footnote 19

Among the various documents used in international trade, the bill of lading is one of the most important.Footnote 20 It serves as (1) evidence of the contract of carriage between the shipper and the shipping line; (2) a receipt for cargo shipped on a particular vessel; and (3) a document of title.Footnote 21 As a representation of the goods, the bill of lading confers on its lawful holder certain legal rights, such as constructive possession of the goods, and its value approximates that of the goods it describes.Footnote 22 Therefore, transfer of the bill of lading by (endorsement and) deliveryFootnote 23 raises a rebuttable presumption of an intention to pass symbolic possession of the goods to the transferee.Footnote 24 If the bill of lading is transferred to a person with the intention of pledging the goods, the transferee obtains constructive possession of the goods and therefore, a pledge of the goods is created.Footnote 25

Blockchain has been envisioned as a possible way to digitise ETDs, bills of lading included, which are still largely issued in paper form.Footnote 26 This is because blockchain systems can provide stronger evidence of entitlement and attributes than signed paper documents, thus ensuring de facto originality.Footnote 27 Tokenisation using blockchain can create digital functional equivalents to paper bills capable of being held solely by one person at a time.Footnote 28 These functional equivalents take the form of tokens which are non-fungible (NFTs), meaning they are not interchangeable.Footnote 29 Transfer of the blockchain bill of lading is achieved through entries in the shared ledger following validation mechanisms, and the anti-double-spending feature of blockchain can ensure that only one person would be able to demonstrate that they are the rightful holder at any point.Footnote 30

Depending on design choices, participants can have equal or differing degrees of participation in the governance of a given blockchain. In the blockchain context, governance refers to the process by which rules and procedures are relied on to maintain the protocol. Footnote 31 Whilst blockchain-based networks are governed alike by informal community-driven mechanisms,Footnote 32 by technical means through which the underlying protocol is maintained (coding, mining, information input),Footnote 33 as well as by formal contractual mechanisms,Footnote 34 this paper demonstrates that blockchain-based platforms in international trade are governed primarily by contractual mechanisms. Blockchain-based platforms in international trade are not fully decentralised in the sense that access to data and governance rights are not controlled by all nodes equally. Even though the mechanism for the storage of data may be decentralised, the operation of the platforms is centralised. Only identified participants can join the system, and known entities own and maintain the platform.Footnote 35 Access is provided by a network administrator, the platform provider. The platform provider has overall control over the underlying technical infrastructure: the provider has the power to set the rules of the ledger and control access to it and, as such, confer privileges on certain members.Footnote 36 In that sense, the technical means of governance are held de facto by the platform providers, who are responsible for the platform’s operating system. Footnote 37

To illustrate the varieties of governance mechanisms in global trade platforms, case studies from industry initiatives in container shipping are presented below. The data for the case studies was taken from available versions of platform rulebooks, grey literature, discussions with industry stakeholders, and contracts on the website of the US Federal Maritime Commission.

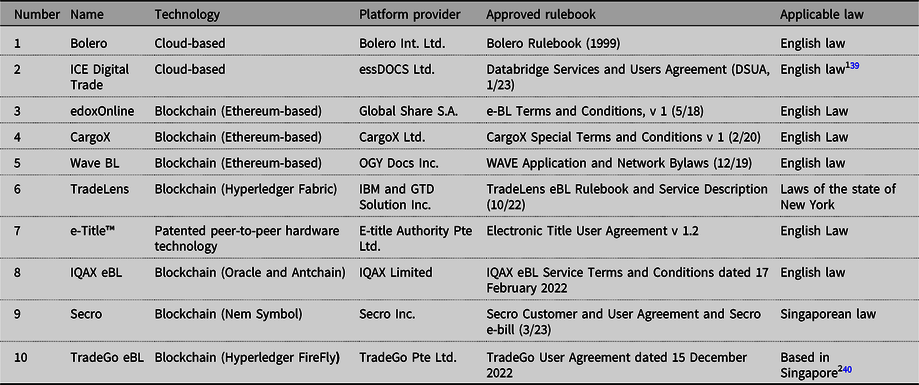

Since 20 February 2010, liabilities arising in respect of the carriage of cargo under electronic bills of lading (eBL) paperless trading systems are covered by mutual insurance associations in the maritime sector, which comprise the international group of protection and indemnity insurance clubs (IGP&I), provided that the system has first been approved. Since then, the IGP&I has approved ten paperless trading systems, seven of which are blockchain-based.Footnote 38 Table 1 presents the basic characteristics of these systems.

Table 1. Systems approved by the international group of P&I clubs

Source: author’s creation.

B. Why Do Contracts Matter? The Dual Role of Platform Rulebooks

Platform providers follow a software or blockchain-as-a-service business model.Footnote 41 To join, potential participants agree to the system rules set by the platform rulebook containing inter alia the terms and conditions of their participation. For example, to join TradeLens, prospective members need to agree to the TradeLens Network Member Agreement.Footnote 42 Similarly, trade platforms based on the Ethereum blockchain, such as Wave BL, edoxOnline or CargoX, are offered by service providers who can restrict participation to identified participants.Footnote 43 The rulebooks perform a regulatory role. They are intended, first, to provide a contractual framework replicating the absence of a suitable legal infrastructure for digital functional equivalents to paper trade documents across jurisdictions and, second, to provide the terms of use or “master agreements” that regulate, on the one hand, the relationship between the platform provider and the platform members, and, on the other, the relationship between the platform members among themselves.Footnote 44

Regarding their first intended purpose, platform rulebooks provide a workable solution to the problem that electronic functional equivalents of paper documents of title to goods are not yet accepted as legal equivalents across jurisdictions.Footnote 45 They establish a contractual nexus between (1) the platform provider and each member; and (2) between members among themselves. All signatories to a rulebook are, thus, always in privity of contract with one another. Parties to the rulebook agree to treat digital records within the system as the functional and legal equivalent of paper documents and undertake not to challenge the validity of any transaction made on the ground that it was made in electronic form instead of in paper form.Footnote 46

In spite of the above, platform rulebooks do not entirely replicate the effects of some ETDs, the so-called documentary intangibles, such as bills of exchange, promissory notes or bills of lading, which embody an obligation in them to such an extent that the intangible right is “thoroughly fused with the document”.Footnote 47 Platform rulebooks are enforceable only towards counterparties (inter partes), while documentary intangibles enable the transferability of property rights which are enforceable erga omnes. Moreover, intangible things, at least in English law, are not amenable to physical possession.Footnote 48 Therefore, ETDs cannot function in the same way as their paper counterparts, where the right to claim the performance of the obligation recorded in the document pertains to the person in possession of the document.Footnote 49 Despite these limitations, shipping lines, the leading actors in the containership supply chain, have designed digital platforms that make use of contractual workarounds incorporated into their respective rulebooks.

Furthermore, various jurisdictions have undertaken legislative initiatives at the national level to recognise electronic equivalents of documentary intangibles in alignment with the Model Law on Electronic Transferable Records, which was commissioned by United Nations Commission on International Trade Law (UNCITRAL) in 2017.Footnote 50 Legislative initiatives, such as the Electronic Trade Documents Act 2023 in the UK, aim to remove the need for commonly agreed rules describing the rights and obligations of parties to a transaction involving ETDs, by recognising ETDs as legal equivalents to paper trade documents in statutory law.Footnote 51 While enabling legislation makes it theoretically possible to use ETDs without the need to become a member of a platform to receive, possess, transfer or dispose of a document,Footnote 52 users still need to employ a “reliable system” to meet the legislative requirements for participating in transactions involving legally recognised ETDsFootnote 53 and accept the commercial terms of use of the supplier of such system.Footnote 54

The subject matter of this paper relates to the second function of the platform rulebooks. The rulebooks provide the terms of use that govern who can join the system and how it operates. These multipartite contracts contain “each user agrees …” statements documenting participants’ obligations and rights.Footnote 55 For example, the TradeLens blockchain-based bill of lading is provided as “a pay-per-use or a subscription offering”.Footnote 56 The rights and obligations of the platform providers and members are contractually allocated.Footnote 57 Therefore, all members agree contractually to participate in a given international trade platform and commit to adhering to the governance mechanism set out in the platform rulebook. The article argues that, in their current form, these governance mechanisms constitute a major hurdle to digital transformation.

Before analysing the regulatory role of rulebooks, the paper first addresses some normative reservations expressed in academic literature regarding the usefulness of the underlying blockchain technology in commercial arrangements governed by such contractual mechanisms.

C. Why Not a Centralised Registry Then?

Blockchain is a distributed tamper-proof ledger shared and updated by a cluster of computers where no single computer has control. Footnote 58 Blockchain characteristics, such as transparency, disintermediation, immutability and privacy, have been discussed and analysed in both legal scholarshipFootnote 59 and supply chain management literature.Footnote 60 Blockchain’s benefits come with significant technical trade-offs, meaning that centralised registries and databases often perform better than blockchain in certain respects.Footnote 61 Critics of blockchain have suggested that having a platform provider, who controls access to the system and manages its operation, renders the blockchain ledger not so different from centralised databases, which rely on the trustworthiness of the gatekeeper of the ledger.Footnote 62 This is based on the belief that “trustlessness”, in the blockchain context, refers to the authoritative character of the blockchain ledger, namely that no party can unilaterally change the records of transactions or entitlements.Footnote 63 The presence of a gatekeeper might recentralise the blockchain in that technical equivalents of governance rights are de facto held by the gatekeeper-platform provider. Footnote 64 As the identity of participants is usually known and participants are also bound to adhere to the rulebook, blockchain does not need to provide the same level of trust in the code as in systems providing a data protocol for keeping the chronological records of transactions between previously unknown counterparties wherein anyone can operate a full-node.Footnote 65 Some even argue that there is no need to trust the code if it is possible to trust those who operate the full nodes.Footnote 66 The question becomes why participants do not incorporate alternatives to the blockchain, such as a government-run registry or a special purpose vehicle company and task it with running a ledger in a centralised database.Footnote 67 This would arguably be more efficient compared to using blockchains with resource-intensive consensus mechanisms.Footnote 68

Notwithstanding the above, this paper agrees with the view that trust is not a binary concept.Footnote 69 Entrusting a counterparty does not eliminate the need for a trusted technology, in the same way it does not eliminate the need for trustworthy legal institutions. For example, the existence of courts to enforce contractual agreements between parties that trust each other sufficiently to transact with one another reinforces trust in the agreements themselves. Blockchain is useful in low-trust environments where participants lack a trusted central intermediary.Footnote 70 Competing participants may trust each other enough to form a consortium for a permissioned blockchain but may not trust each other to the extent of forming a joint subsidiary to maintain a private registry.Footnote 71 Similarly, trade actors may entrust a technology provider to control an interface with the blockchain but may not trust that same provider to the extent of maintaining a centralised registry itself located in a specific jurisdiction. As blockchain implementation in international trade enters the “plateau of productivity”, Footnote 72 it is suggested herein that it is the role of the industry and not legal theory to design specific technical solutions that balance the relative importance and appropriate trade-offs of system features for each particular use case. In the context of container shipping and international trade, this is evidenced by the fact that eBL systems in the form of records held in a centralised database or registry, managed and controlled entirely by a third-party provider have been available since the 1990s,Footnote 73 without being widely adopted by the industry.Footnote 74 The reasons appear to have been: first, the industry’s distrust regarding the centralised registry system;Footnote 75 second, the related security and cyber risk concerns stemming from the centralised system;Footnote 76 and third, the lack of legal recognition of electronic documents of title, which required parties to replicate their legal functions contractually.Footnote 77 On the contrary, blockchain-based eBL systems have been greeted very positively by the international trade community. For example, five out of six world’s leading containership operators based on carrying capacity controlling approximately 60 per cent of the world liner fleet participated in TradeLens as foundation carriers,Footnote 78 while Wave BL’s clientele includes four of the top ten leading containership operators based on capacity (MSC, Hapag Lloyd, ONE and ZIM).Footnote 79 Actual usage of such platforms is on the rise, points to an increasing economic significance of such platforms and attests that blockchain has sparked a renewed drive for the digitalisation of international trade processes.Footnote 80

D. Common Modular Architecture of Platform Rulebooks

It is evidenced from the above that there are real-world applications that make practical use of blockchain technology to digitalise transport documents of title in commercial practice. Enthusiasts envisaged blockchain-based bills of lading as functional equivalents of “bearer” instruments.Footnote 81 All middlemen would be removed, and the parties would be able to exchange documents and transact on a universal blockchain platform on a peer-to-peer basis with formidable benefits in terms of costs and operational efficiencies.Footnote 82 However, blockchain’s transformational potential and the promise of disintermediation which would enable digital bearer instruments relies on the assumption that there would be only one blockchain on which parties would interact directly. Even though blockchain has eliminated the need for some intermediaries, such as a central registry to store commercial data and track ownership in the case of the eBL, it has enabled the development of new intermediaries, such as platform operators providing an interface to its members to interact with an underlying blockchain.Footnote 83

The industry case studies reveal that both blockchain-based and cloud-based platforms in the container shipping industry revolve around a common modular architecture consisting of the platform provider and the various types of platform members. Ethereum-based platforms edoxOnline, CargoX and Wave BL follow a corporate model where the platform takes the form of intellectual property, which is owned and developed by corporations, namely GlobalShare SA, OGY Docs Inc. and CargoX Ltd. respectively.Footnote 84 The corporations offer licenses to the various platform members to use the digital platform-as-a-service.Footnote 85 Similarly, Bolero offers its services through a service contract in which the Bolero Association or Bolero International Ltd. is the platform-as-a-service provider.Footnote 86 Moreover, ICE Digital Trade (formerly essDOCS) provides its eBL through a user agreement in which essDOCS Ltd. is the platform providerFootnote 87 and Secro is provided by Secro Inc., a venture capital-backed US company.Footnote 88 At the same time, TradeLens constitutes a combination of a corporate-contractual model. TradeLens is jointly owned by IBM and A.P. Moller-Maersk A/S, through its subsidiary GTD Solution Inc.Footnote 89 The legal nature of the joint venture between IBM and GTD Solution Inc. which comprises the platform provider is not entirely clear, however its relationship with the various types of platform members is prescribed through several agreements which collectively comprise the platform rulebook. These include (1) the Foundation Carrier Agreement;Footnote 90 (2) the Data Sharing Specification (DSS);Footnote 91 (3) the TradeLens Network Member Agreement, and (4) the TradeLens eBL Rulebook.Footnote 92 Taken together these documents constitute the contractual frameworks governing the use of each international trade platform in container shipping (hereafter “platform rulebooks”).

Platform rulebooks present some common characteristics. First, they provide a contractual workaround to enable trade documents in electronic form to be used as their paper counterparts. They use choice of law clauses to achieve both transferability of possessory rights, assignment of rights and liabilities and of the right to sue, usually through contractual devices, such as novation and attornment.Footnote 93 Most platforms choose English law as applicable substantive law providing legal effect to the provisions of their rulebooks.Footnote 94 For example, CargoX’s rulebook states that “the Originating User and each and every Subsequent User hereby irrevocably appoints CargoX as its agent for the sole and limited purpose of effecting the novations referred to in 7.2”. Footnote 95 CargoX rulebook also postulates that all users commit not to deny that the CargoX eBL has the same status and attributes as a paper BL.Footnote 96 Legislative reform initiatives, like the ETD Act 2023, that enable the transfer of an ETD to have the same effect as a transfer of a paper bill of lading, reduce the significance of rulebooks as a body of residual rules establishing privity among stakeholders to replicate the functions of paper trade documents contractually.Footnote 97

Second, rulebooks aim to have a long-term duration by creating ecosystems where commercial transactions will occur.Footnote 98 Ecosystems create value by attracting many distinct yet interdependent organisations which coordinate, transact, and innovate without being hierarchically controlled.Footnote 99 All parties first agree to the provisions of the rulebook and then proceed to various bilateral or multilateral trade transactions, including sales, transportation, insurance, or financial transactions, using the provisions of the rulebook as a basis. In that sense, rulebooks indicate a commitment of the parties to collaborate based upon a specific framework.Footnote 100

Third, the details of the relationship of the parties are usually not documented exhaustively in the platform rulebook, while the platform providers typically reserve the right to amend it.Footnote 101 Fourth, platform providers typically exclude or limit their liability for losses on their platforms.Footnote 102 Fifth, parties repose some degree of trust and confidence in one another in that platform members undertake to maintain and update certain technical interfaces, such as APIs, in accordance with technical specifications to be provided by the platform provider in the future.Footnote 103 Sixth, parties acknowledge that their relationship will evolve over time.Footnote 104 For example, the TradeLens Foundation Carrier Agreement is an express commitment of the parties to co-operate with one another and collaborate with the platform provider for the provision of data and the future development of the TradeLens platform.Footnote 105 Finally, to the author’s knowledge none of the examined rulebooks expressly excludes a duty of good faith from being implied into their contractual relationship. As we will see further below, these characteristics largely correspond to the characteristics of the “relational contract” as a legal concept under English law.

III. Platform Rulebooks as Relational Network Contracts

Up until now, this paper has demonstrated that international trade platforms, even if they make use of blockchain, are governed primarily by multipartite contracts in the form of platform rulebooks. However, the conventional model of a contract, which takes a definitive and complete form when the elements of formation (namely offer, acceptance, consideration and intention to create legal relations) are present, is conceptually inapposite to platform rulebooks governing global trade platforms. Rather these rulebooks are intended primarily to (1) provide a contractual framework that fills in the gaps in the absence of a suitable legal framework for ETDs and (2) provide a governance mechanism to regulate the relationship between the platform provider and the platform members and among the members themselves. Focusing on the second of these purposes, which remains important even if ETDs have, by statute, functional equivalence to paper trade documents,Footnote 106 this section postulates that rulebooks embrace the characteristics of two types of contracts: network contracts and relational contracts.

A. Platform Rulebooks as Network Contracts

Network contracts consist of “a pattern of interrelated contracts” between independent firms,Footnote 107 designed to “confer on the parties many of the benefits of co-ordination achieved through vertical integration in a single firm, without in fact creating a single integrated business entity such as a corporation or a partnership”.Footnote 108 Academic scholars use the term “network contracts” to denote an array of contracts, thereby reducing the usefulness of the term in legal practice. The term includes contracts connected with other contracts by way of hub and spoke organisation or chains or clustersFootnote 109 as well as collaborative contracts for innovation.Footnote 110 Platform rulebooks present the characteristics of network contracts as they constitute multilateral agreements between independent companies, where parties exchange some of their economic independence for the coordination of their activities to achieve the network aim, that is digitalisation.

Considering the self-interested nature of the various parties involved, parties to platform rulebooks cannot necessarily expect cooperative behaviour from other actors.Footnote 111 Therefore, governing global trade platforms through contracts raises, at least in theory, three challenges to the digitalisation effort: contractual incompleteness, the risk of hold-up and insufficient protection of relationship-specific investments.

First, blockchain’s advantages can only be realised with network effects, and so while the potential gains swell with the size of the network, so does the transactional complexity. Contractual incompleteness insinuates that contracts cannot provide clauses for all contingencies that may affect an agreement’s future course in order to address them.Footnote 112 Even if lawyers were able to perform this task, it would be inefficient to negotiate the outcome of all possible contingencies from a transaction costs perspective.Footnote 113 Contrary to transactional digital platforms, such as Amazon or eBay, the terms and conditions of which can generally identify the risks of non-performance and allocate them to the parties at the time of the agreement,Footnote 114 the innovative nature of blockchain-based platforms in international trade increases the number of future contingencies that may affect the relationship of the parties. Platform providers are constantly looking to innovate and expand their services and client base to support trade finance tools, insurance products or custom clearance processes with a view to achieving end-to-end digitalisation.Footnote 115 It is inherently impossible to allocate risks contractually at the time of the agreement in a constantly evolving project.Footnote 116 In platform rulebooks, the multiplicity of actors involved in international trade and the interdependency of the actions of the contractual parties inherent in network contracts entail even greater uncertainties about the future of the relationship at the point platform members enter into the agreement rulebook. A simplified example, in our case, would constitute a situation where one platform member successfully challenges the validity of some terms of a rulebook in the context of a dispute about a specific transaction. In that scenario, the actions of this platform member would affect the relationships between other members who are not parties to that particular transaction if they had relied on the same terms.Footnote 117 Owing to the high levels of uncertainty about the future of the relationship, contractual allocation of risks at the time of the agreement becomes practically impossible. This constitutes one of the reasons that platform providers usually retain the right to amend the terms of the rulebooks. Footnote 118

Second, platform rulebooks are vulnerable to opportunistic behaviour on behalf of the platform provider. The hold-up problem, coined by Victor Goldberg in 1976, is the possibility that one party of a contract will obtain increased bargaining power to extract profits at the expense of the other,Footnote 119 for example by unilaterally raising prices, terminating the agreement at will or introducing any other opportunistic contract term.Footnote 120 This is a typical business strategy followed by consumer-facing digital platforms, such as Amazon, Uber or Airbnb, that are built with an ecosystem logic and a “winner takes all approach”.Footnote 121 These platforms first subsidise participation in their platform to benefit from network effects and once they achieve sufficient growth, they use their increasing bargaining position to renegotiate or unilaterally vary the terms of use of their platform to extract value from platform members.Footnote 122

In that sense, any modification of a contract is naturally subject to the risk of opportunistic behaviour.Footnote 123 In the context of platform rulebooks governing global trade platforms, a platform provider may introduce updated terms to promote the interests of specific actors, such as those with a stake in the platform or even leverage its bargaining power for price gouging. For example, TradeLens is owned jointly by GTD Solution Inc. and IBM, but GTD Solution Inc. is a subsidiary of Maersk, which participates as a foundation carrier in TradeLens. Therefore, there is a perceived risk that Maersk could leverage its dual position as both a platform member (foundation carrier) and effectively a platform provider (through GTD Solution Inc., its subsidiary) to obtain a competitive advantage.Footnote 124 This is supported by the fact that most platform providers have retained the right to make amendments to platform rulebooks, either unilaterally or with the approval of or consultation with certain platform members.Footnote 125 For instance, CargoX’s rulebook states that “CargoX may revise these [standard terms and conditions] at any time and will post any amendment(s) on their website. … As from the date and time of publication of the amendment(s) on the website they shall be deemed an integral part of these [standard terms and conditions] and shall govern all transactions thereafter commenced”.Footnote 126 Similarly, the data sharing model of TradeLens is subject to periodical change and participants “are required to continue to meet their data provisioning obligations in compliance with the latest version of the Data Sharing Specification”.Footnote 127 Intermediaries that extract information rent, such as multimodal transport service providers that function as single carriers for shippers seeking a door-to-door service, are particularly vulnerable to modifications in data sharing agreements and the terms of the rulebook that govern the use of data.Footnote 128 If parties are aware of the hold-up problem before they strike a bargain to enter into the agreement, then the parties might be reluctant to bargain in the first place. It is, therefore, no surprise that less than 1.2 per cent of all bills of lading are digital today. Footnote 129

Given that these platforms are governed primarily by contractual mechanisms, the suggestion that “blockchain’s superior security measures” can safeguard commercially sensitive information and solve the co-opetition paradox is slightly overrated.Footnote 130 The available data indicate a misalignment between the theoretical conceptualisation of blockchain-based ETDs as the functional equivalent of bearer instruments and its practical actualisation via platforms operated by commercial providers. Blockchain promised to address the industry’s scepticism regarding the centralised subscription-based registry model, which prevented electronic systems identifying the holder of the digitalised document on their own internal registry from being widely adopted. Whilst blockchain’s decentralised storage of data can create a functional analogy of bearer instruments, the common modular architecture of blockchain-based platforms has only partially alleviated privacy concerns and trust issues, putting commercially sensitive information at the de facto control of platform providers. This is because contractual agreements dictate platform members’ data provisioning requirements and data access model. The contractual right of platform providers to collect and analyse data provided by platform usersFootnote 131 is unlikely to affect the reliability of the system for the purposes of the ETD Act 2023. Even though the ETD Act 2023 requires a “reliable system” to be used for an electronic document to qualify as an ETD, the rules of the system may be considered only in connection with the system’s ability to adhere to the purposes of subsection 2(2), namely to replicate reliably the features of paper trade documents in electronic form by satisfying certain conditions or “gateway criteria”.Footnote 132 Therefore, only the operational rules integral to the design of the system related to meeting specific gateway criteria may be considered when assessing a system’s reliability.Footnote 133

Notably, the Unfair Contract Terms Act 1977 (UCTA) would provide limited protection against hold-up problems, as, according to section 27 of the UCTA, where English law is applicable only by choice of the parties, such as in the case of platform rulebooks, the core provisions of the Act do not apply to the contract. Similarly, EU legislation of online intermediation services, such as the platform-to-business (P2B) regulation, does not apply to platforms that do not involve a contractual relationship with consumers.Footnote 134

Therefore, at least in theory, the hold-up problem seems to be an adoption barrier in digitalising international trade processes. Prospective participants would not want to over rely on a particular platform out of fear that they may give other parties increased bargaining power, for example, by sharing their data or by transferring their whole customer base and contracting process entirely to a specific platform. To address such concerns, TradeLens attempted to establish a sophisticated contractual governance mechanism seeking to foresee and specify possible future actions of the platform provider that require either approval or consultation with the Foundation Council before being implemented.Footnote 135 Despite its efforts TradeLens failed to establish the necessary trust to enable full industry collaboration toward digitalisation.Footnote 136 TradeLens’s discontinuance indicates that the use of blockchain does not by itself adequately address the co-opetition paradox.

Finally, given the hold-up problem, the incentives of a party to undertake any investments related to a contract depend on its ability to control the use of productive resources at the time of the re-negotiation.Footnote 137 In this setting, the control of productive resources becomes the essential source of bargaining power, and different ownership structures will determine the outcome of the renegotiation.Footnote 138 In the scope of this paper, platform ownership confers de facto control over the technical means to set the rules of the ledger and control access to it. Ownership of the platform can, thus, develop as a source of bargaining power on behalf of the platform provider. A provider can potentially renegotiate the agreement and benefit from more favourable terms once it has achieved network effects and its bargaining position has been strengthened. Prospective members cannot be certain that the provider will not introduce changes to the terms of the agreement to lock members in and extract value once its bargaining power has increased.Footnote 139 In turn, this possibility would determine the investment decisions of prospective members as long as these investments are relationship-specific.Footnote 140 Shipping lines, for example, face several relationship-specific investments when partnering with a technological platform, making it expensive to unwind the relationship and start a new one with another platform. For example, they face IT integration costs, marketing and onboarding expenses, costs for training their personnel on how to use a specific platform, and, most importantly, costs associated with promoting a platform to their network and customer base. To some degree, these costs lock parties in the relationship because they increase switching costs.Footnote 141 Assuming there is sufficient competition in the market, a platform member still cannot easily switch to another platform if its network and customer base are not members of that same platform. Even if technical interoperability among platforms is achieved, platform members would still face difficulties in switching platforms as long as they would still need to be in privity of contract with their network and customer base. Therefore, after platform members have made these investments and have joined a platform, the provider would be able to opportunistically renegotiate the terms of use of the platform. This would mean that, in theory, prospective members of blockchain platforms in international trade would be disincentivised to invest in adopting new technologies if ownership and control of these new technologies would provide a technology provider with increasing bargaining power to extract profits at their expense in future renegotiations.

To that end, international trade platforms in container shipping differ from other similar digitalisation initiatives, such as the London Metal Exchange (LME) enterprise to provide immobilised or dematerialised warehouse receipts known as “warrants”. Footnote 142 Such business-to-business platforms do not face the same commercial pressures present in international trade platforms. For example, the LME’s commercial position is de facto neutral as it does not directly compete with the users of the rulebook for a market share, nor is it driven by the same commercial interests present in international trade platforms. The latter are often backed by liner carriers who have a clear incentive to digitalise the supply chain to streamline operations but compete with each other and other participants, such as logistics service providers, to achieve their vertical integration strategies and offer an end-to-end service.Footnote 143 This raises the co-opetition paradox, which poses questions that are different from similar platform models, where the stakeholders’ interests are much more aligned.

Against this backdrop, there is a need for a legal solution where platform members can establish a mechanism to protect themselves from uncertainty, opportunistic behaviour, and the risk of hold-up. Without such protection, prospective participants are likely to be cautious of embarking upon digitalisation projects. Then again, parties cannot specify the entire contract ex ante to reduce uncertainty, as both the platform provider and members require a degree of discretion as to how they will pursue their goals, and platforms are likely to evolve through technological progress. Therefore, rulebooks need to strike a balance between competing needs for certainty and flexibility. This balance can be achieved contractually in a legally binding way if we count the relational characteristics of the exchange relationship of the parties involved.

B. Platform Rulebooks as Relational Contracts

This section seeks to answer whether platform rulebooks constitute relational contracts and can be construed as such by the courts. A distinction needs to be made between (1) the relational analysis of contracts as theorised in academic literature; (2) relational contracts as a legal concept under English law; and (3) the proposition to design a relational rulebook by including guiding principles in the express terms of the agreement.

To understand the relational analysis of contracts, one should begin with the classical understanding of contract law which views the contract as a discrete bilateral transaction. Classical contract law is associated with formalism and a textual approach to contract interpretation focusing on the express terms of the written contract, the paper deal. Footnote 144 In contrast, the relational analysis commences with the observation that the binding nature of contractual obligations can be attributed to both legal and non-legal institutions. Footnote 145 Relational contracts, fathered by Macneil,Footnote 146 establish a “quasi-integrated system of relations” with intensified conflicting forces concurrently competing to achieve divergent interests and co-operating in order to solve the problem of adapting to future business contingencies.Footnote 147 According to Macneil, a contract is a synonym of exchange relations, i.e. relations among actors who have exchanged, are exchanging or expect to be exchanging in the future.Footnote 148 In that sense, the notion of “a contract” does not refer to specific transactions or agreements but to the relation in which exchanges occur.Footnote 149

Despite the insights of relational analysis, there remains significant debate on whether contract law should attribute legal validity to the entirety of parties’ relationships and understandings, regardless of whether they are explicitly enshrined in the written contract.Footnote 150 While relational contract theorists support the legal recognition of both formal and informal norms that shape the parties’ business relationship, neo-formalist scholars argue against attributing legal validity to existent but informal aspects of the exchange relationship. Footnote 151 There are institutional limitations of the courts in applying a contextual approach, which derive from the capacity of judges to access information about the context of a specific contract.Footnote 152 Contract law minimalism, advanced by Morgan, favours a textual approach to interpretation and advances that “contract law should consist of clear-cut predictable rules in order to facilitate dispute resolution”. Footnote 153 This is supported by the observation that the relational approach does not yield determinate legal principles for allocating unassigned risks in terms of positive contract law. Footnote 154

To that end, the problem identified by some scholars is attempting to formulate general principles applicable to contract law as a whole while considering concrete relationships. Footnote 155 Indeed, it is not feasible to determine the superiority of either the formalist or contextualist approach to interpretation in the abstract as it depends on the specific merits of the transaction at hand.Footnote 156 Few generalisations can be made and the approach to resolving contract disputes must be tailored to each case’s specific circumstances. Footnote 157

The binary divide between the real and the paper deal does not apply plainly in platform rulebooks. The issue here is not the inadequacy of contract law to capture the intentions of the parties but the ability of contractual rulebooks to provide a governance mechanism able to address contractual incompleteness while addressing the risk of hold-up and protecting relationship-specific investments.

English law provides a good reference point for examining the application of relational contracts as a legal concept to blockchain platforms in container shipping, as seven out of the ten approved systems presented in Table 1 above have elected English law as applicable substantive law.Footnote 158 Traditionally, English courts have been reluctant to embrace a relational approach by imposing a general obligation of good faith in the performance of contractual obligations. The reasons for this reluctance appear to be (1) the preference of English law toward piecemeal solutions rather than overarching principles; (2) the proclivity of English law towards an ethos of individualism; and (3) the vagueness of the concept.Footnote 159 In Interfoto Picture Library Ltd. v Stiletto Visual Programmes Ltd., Bingham L.J. observed that English law does not recognise an overriding principle of good faith but that it “has developed piecemeal solutions to demonstrated problems of unfairness”.Footnote 160

Overall, the judicial treatment of the notion of relational contracts demonstrates a “fuzziness” of the notion as a legal concept under English law. There is no legal definition of a relational contract. Relational contracts are identified through one or more indicia that distinguish them from transactional contracts.Footnote 161 Therefore, relational contracts do not refer to the relational characteristics surrounding every contract but to the complex characteristics of some specific contracts.Footnote 162 Some of these indicia on which a court can rely to identify the relational nature of a contract include (1) a commitment of the parties to collaborate;Footnote 163 (2) indefinite duration;Footnote 164 (3) an intention of the parties’ roles to be performed with integrity and fidelity to their bargain;Footnote 165 (4) the fact that the details of the performance obligations are not documented exhaustively;Footnote 166 (5) the exclusivity of the relationship; (6) the absence of an express term preventing a duty of good faith being implied;Footnote 167 (7) the fact that the parties repose some degree of trust and confidence in one another;Footnote 168 (8) the fact that there might be a substantial financial commitment by one party; and (9) the fact that the mutual expectations are likely to evolve during the performance of the contract.Footnote 169 As discussed above, platform rulebooks display most of the characteristics common law ascribes to relational contracts. However, as the specifics of each rulebook vary, juxtaposing each rulebook against these characteristics while interpreting its terms would be necessary to ascertain if it displays relational features.

The characterisation of a contract as a relational contract implicitly requires treating it as involving an obligation of good faith.Footnote 170 Whilst it remains unclear whether good faith should be considered an implied term in law or in fact, recent decisions seem to indicate that good faith is implied as a matter of law.Footnote 171 Relational contracts form a category of contract in which the legitimate expectations of the parties which the law should protect “are embodied in the normative standard of good faith”.Footnote 172 The recognition of a duty of good faith in the performance of contractual obligations then acts as a framework within which more specific duties and terms can be implied on a case-by-case basis.Footnote 173 For example, in Bates v Post Office, the conclusion that contracts between the Post Office and its sub-postmasters, who run the local office branches, are relational led to the imposition of a duty of good faith as an implied term of the contracts.Footnote 174 Clauses that gave the Post Office the power to vary some of the terms of the contracts unilaterally were considered “unusual” and had the potential “to create a very detrimental and severe effect upon a sub-postmaster”.Footnote 175 As a result, the Post Office needed to show that it had given sufficient consideration to due process and fairness in exercising its discretion to suspend or terminate the sub-post masters’ contracts.Footnote 176

The interim conclusion is that if platform rulebooks governing international trade platforms are construed by the courts as relational in nature, the courts would seek to imply terms that will sustain the business relationship and prevent parties from frustrating the logic of long-term payoffs. For example, when a party has discretion in the performance of a contract, it must exercise its discretion for reasons within the justifiable expectations of the parties and not use its discretion to “recapture opportunities forgone on entering the agreement”.Footnote 177 Construing platform rulebooks as relational contracts can mitigate, thus, to some degree, the risk of opportunism and exploitation on behalf of the provider because it binds contracting parties to abstain from conduct which would be regarded as commercially unacceptable by reasonable and honest people.Footnote 178

Nonetheless, the neo-formalist insights remain relevant to the proposition that platform rulebooks can be interpreted as relational contracts to address opportunism. First, parties would have to rely on a court’s assessment as to whether a rulebook is relational or not in legal terms. Admittedly, English courts are reluctant to follow a relational approach, as evidenced by the recent decisions taking a restrictive approach to the implication of termsFootnote 179 and the interpretation of clauses in commercial contracts.Footnote 180 This provides little guidance to the organisations involved in the platform in understanding their contractual obligations during the contractual performance. Advocates of a minimalist contract law suggest that a more certain way to signal a preference for contextual interpretation would be to include an explicit good faith or similar clause in the agreement. Footnote 181 Second, even if rulebooks are construed as relational contracts, the content of the duty of good faith remains uncertain. Courts would face difficulties in ascertaining the true intent of the parties at the commencement of the agreement, which creates uncertainty as to the implications of the implied duty of good faith in each circumstance. Mitchell concludes that “if relational theory wants to have an impact in the court, its supporters must address the question of how it can yield a set of legal or regulatory tools that judges can use”. Footnote 182 Therefore, third, prospective participants of an international trade platform would require more formalised mechanisms to protect their relationship-specific investments rather than relying merely on interpretation yielding, at best, a vague and implied obligation of good faith.

Against this background, the following section argues that to promote legal certainty, platform rulebooks should be designed as relational network contracts, that is, ones that explicitly contain certain elements, including an explicit commitment of the parties to collaborate, an express duty of good faith and other similar open-ended guiding principles.

IV. Crafting a “Relational Rulebook” by Design to Overcome the Adoption Challenges

A relational rulebook “leaves it to the market” to design its own governance mechanisms without the assistance of juridically implied terms.Footnote 183 Parties can articulate mutual goals and establish governance structures that align their expectations and interests by imposing an express obligation of good faith in their relationship and using express guiding principles to determine the content of good faith through legally enforceable behavioural standards. That way, prospective members would be certain that platform providers must perform their obligations in good faith and in accordance with the established guiding principles and behavioural standards.

Party autonomy in English law entails that if parties expressly agree to incorporate good faith into their contract, such a clause would be generally recognised and enforced by the courts.Footnote 184 The function of the guiding principles would be to tie into the duty of good faith and determine it. Contract interpretation, thus, becomes “a matter of design, not doctrine”.Footnote 185 Parties can establish contractually interpretive principles to freely determine what could faith means to them and their relationship.Footnote 186 For example, parties can include an obligation of loyalty to the aims of the digital trade network, commercial reasonableness, neutrality, and an aim of joint or network maximisation as “proxies” or guiding principles within the text of the contract.Footnote 187

Nevertheless, the compatibility of such open-ended terms with contract law has been the subject of controversy.Footnote 188 There are economic and normative arguments against the use of guiding principles in contracts, and the legal enforceability of guiding principles is far from certain.Footnote 189 Morgan criticises attempts to regulate opportunistic behaviour through contracts as falling under the “lawyer’s perennial fallacy of legal centricism”. Footnote 190 This derives from the belief that extra-legal sanctions, such as reputation harm, could provide a sufficient deterrent against opportunism. Footnote 191 Formalising behavioural standards in the express terms of a contract can undermine collaboration in a relationship as trust would be “crowded out” by the presence of legal sanctions. Footnote 192 Moreover, guiding principles may prove ineffective in practice as they have a cost and the price “will have to be adjusted to restore the balance” and passed back to the protected group. Footnote 193 Morgan concludes that the courts’ ability to integrate custom is limited, which validates formalism as the default approach of contract law. Footnote 194

This is not at odds with the proposed solution of designing a relational rulebook. Indeed, Morgan admits that courts must be prepared to deviate from the default approach when this is expressly indicated by the parties: Footnote 195 if parties expressly stipulate for relational standards to govern their relationship, then the courts are required to give full effect to this choice.Footnote 196 Though relational elements of governance and formal contracts are sometimes seen as mutually exclusive, formal contracts and extra-legal sanctions may also function as complements. Footnote 197 Poppo and Zenger find empirical evidence that customised contracts can specify processes and controls to reduce opportunistic behaviour in the early stages of exchange and that informal norms can work alongside customised contracts by ensuring ongoing exchange and mutually agreeable outcomes. Footnote 198 Mitchell has critiqued the “crowding trust out” argument on the basis that it underestimates the law’s potential to mould contractors’ conduct. Footnote 199 In the context of international trade platforms, a better view is that contract principles can help parties to cultivate trust at the earlier stages of a relationship, even if trust is non-existent at that time.

A more important critique is identifying whether guiding principles and behavioural standards in platform rulebooks can produce legally enforceable obligations. There is inherent uncertainty with open-ended principles, and attempting to enforce vague obligations of trust and collaboration will be difficult, expensive and even counterproductive. Footnote 200 Determining enforceable obligations involves an interpretive process that considers the custom and practice surrounding the relationship. English law requires an “invariable, certain, and notorious usage” to apply custom into a contract, and there is uncertainty about whether trade custom is consistent enough to be considered as having invariability. Footnote 201 The duty to negotiate in good faith is also uncertain as it is repugnant to the adversarial position of the parties during negotiations. Footnote 202 Mitchell argues that contract law should devise a suitable approach that considers the context and determines when direct enforcement of the standard is appropriate and when it should only be used as an interpretative criterion. Footnote 203

Express contractual duties of good faith have been considered in several cases.Footnote 204 In Petromec Inc. v Petroleo Brasileiro, it was stated obiter that an express term to negotiate in good faith would be enforceable based on the fact that it would be possible to objectively ascertain the meaning of good faith in that particular case. Footnote 205 In CPC Group Ltd. v Qatari Diar, Mr. Justice Vos interpreted an express duty of good faith to mean that parties must “adhere to the spirit of the contract” and “be faithful to the agreed common purpose” in accordance with the justified expectations of the parties. Footnote 206 In the case of relational rulebooks by design, most circumstances indicate that express duties of good faith or other express open-ended terms guiding the collaboration of the parties would be enforceable as long as the relational rulebook provides elements that can objectively concretise these duties in each particular case.Footnote 207 Courts would be able to make use of the contextualised agreements and governance mechanisms established in the relational rulebook to determine whether the particular conduct of a party is contrary to a specific established duty under the circumstances of the case. This contracting technique can, thus, prove to be a useful tool to participants of digital trade networks in designing rulebooks that promote fairness, participatory governance, trust, access assurance and commonality of interests.

The final issue pertains to the nature of the obligations that can be attributed to guiding principles and behavioural standards. Most problems arise because the purpose of guiding principles is to establish procedures for managing risks and uncertainties rather than defining specific and definite outcomes or risk allocations. Footnote 208 This presents challenges in interpretation as it necessitates the evaluation by the courts of the exact criteria of conduct that must be fulfilled to identify a breach of the principle. Footnote 209

Written guiding principles can be perceived as obligations to undertake a specific process rather than to achieve a certain result. Footnote 210 Behavioural standards expressing only a “vision” about the relationship are unlikely to carry weight against the hard terms of the contract.Footnote 211 A general duty to negotiate in good faith may be considered void due to uncertainty surrounding its legal implications. Footnote 212 However, if the use of a principle is connected towards a particular result, circumstance, or objective stated in the contract, it is more likely to be enforceable. Footnote 213 This is why the basic principles and behavioural standards suggested for inclusion in the relational rulebook above need to be tied to specific types of risk, such as the power of a platform provider to discriminate in favour of members who might have an equity stake in the platform,Footnote 214 the risk of hold-up, unfair contract termination and allocation of risks and liabilities. Some thoughts on how guiding principles can shape such a governance mechanism are provided below.

To curb the discretionary power of a platform provider to discriminate, the inclusion of a “neutrality principle” in the express terms of the rulebook linked to role-dependent contract drafting would limit the providers’ ability to treat members of the same type differently, thus ensuring a level playing field between shipping lines and between other members of the same type. The ability of providers to dictate terms to shippers, freight forwarders, multimodal service providers and other stakeholders who are prospective members of the platform “on a take it or leave it basis” for the use of the platform can be addressed via contractual incorporation of the UCTA 1977.Footnote 215 The risk of hold-up, i.e. the discretionary power of the platform provider to opportunistically modify the terms of the rulebook at future renegotiations, can be mitigated through contractual principles such as good faith, proportionality and network maximisation, intended to ensure that negotiations in good faith will precede a future amendment of the rulebook and that amendments do not harm the interests of any one type of participant disproportionately. The power of the provider to opportunistically terminate the contract and “expel” a participant can be addressed through the incorporation of behavioural standards designed to restrict the providers’ ability to pursue their self-interest in contract termination. Finally, in the case of the allocation of risks or liabilities, a contractual principle of “reasonableness” could be introduced, intending to allocate each risk to the party which is best placed to avoid or mitigate such risk at the least cost. Even though vaguely drafted, these succinct guiding principles would be interpreted by courts to determine whether the conduct of the parties is justified should a dispute arise. That is the advantage of the relational rulebook against opportunistic behaviour, according to empirical studies: that parties would not want to risk expensive litigation for breaching the guiding principles.Footnote 216

Open-ended obligations would also provide a legal basis on which an adjudicator could resolve disputes in accordance with these principles and behavioural standards. The principles will not be interpreted based on the subjective intentions or beliefs of the parties but ascertained by attributing to them the values that reasonable people in their situation would have had.Footnote 217 This would permit courts to imply enforceable obligations not expressly included in the contract. Therefore, relational rulebooks by design can help parties to remedy the incompleteness of platform rulebooks by outlining indeterminate performance obligations, which are legally enforceable.Footnote 218

By drafting a relational rulebook, parties can thus strike a balance between the front-end costs of the contracting process, which are associated with the drafting process, and back-end costs, namely those associated with interpreting the terms of the contract.Footnote 219 It has long been suggested that the contract represents a trade-off between those two.Footnote 220 When the level of uncertainty is low, transactional contracting allows contract designers to anticipate future contingencies and aim for complete planning.Footnote 221 However, using open-ended terms, such as commercial reasonableness, neutrality or good faith, provides a contractual solution to mitigate the excessive front-end transaction costs in the contracting process in cases of high uncertainty. Platform rulebooks are network contracts that involve high levels of uncertainty, and the involved parties require efficient protection from the hold-up problem as well as contract simplicity that facilitates adoption. With relational rulebooks by design, parties do not have to spend years on “an exercise of foreseeability”Footnote 222 whilst negotiating the agreement, while they can ensure that their true intent is imprinted into the written agreement. Therefore, relational rulebooks by design can achieve the optimal balance between front-end and back-end costs in the context of platform rulebooks governing global trade platforms.

While designing platform rulebooks as relational network contracts can guide adjudicators on the parties’ intention over how they perceive their mutual duties of good faith, it can also help the parties during the performance of the contract. Footnote 223 Implementing the relational rulebook can effectively contribute towards the establishment of a trustworthy relationship crucial to digitalisation by crystallising conduct expectations and promoting cooperation. The relational rulebook can assist the relevant departments within the organisations participating in global trade platforms to understand their contractual obligations better while using and implementing the provisions of the rulebook. Business actors, who are the users of the rulebook, would feel confident in their daily operations to rely on a viable and understandable rulebook rather than a legalistic document “written by lawyers, for lawyers, in a way only lawyers can understand”.Footnote 224

Furthermore, relational rulebooks can contribute to harmonisation and legal interoperability among platforms. On the one hand, the skeletal character of rulebooks can promote interoperability as it would be easier for prospective members to board many platforms without having to face excessive front-end legal transaction costs for due diligence and negotiation of overly prescriptive long rulebooks, such as those of Bolero or TradeLens.Footnote 225 On the other hand, relational rulebooks could provide private regulators, such as ICC’s Digital Standard Initiative, with practical and theoretical insights which can serve as a base for standardisation efforts to create a uniform rulebook.

V. Conclusion

This article argues that traditional governance concepts remain effective in international trade platforms, even if they make use of blockchain, suggesting that contractual mechanisms govern the transnational use of such platforms at the application layer in commercial practice. Accordingly, this study examines the various multipartite rulebooks governing such platforms in the container shipping industry to explore how these contracts perform their regulatory role. The findings suggest that these rulebooks are sometimes drafted with a transactional mindset where platform providers aim to increase their bargaining power in the long term and limit their liability for losses on their platforms. As such, platform rulebooks are sometimes inefficient in addressing the needs of the parties in complex business networks and, thus, decelerate the digital transformation of international trade. TradeLens’s recent breakdown is attributed to the lack of “full industry collaboration”,Footnote 226 and it seems to affirm the hypothesis that in their current form, platform rulebooks sometimes fail to address the co-opetition paradox, leading to market failures.

This article also identifies that the majority of these rulebooks are governed by English law, and it argues that they embody most of the characteristics of relational contracts within this legal context. Construing platform rulebooks as relational contracts has important implications because it would impose an implied duty on the parties to perform their obligations in good faith, which would arguably ameliorate to some degree the risk of opportunistic behaviour inherent in contracts of this type. However, even if construed as such, platform rulebooks remain suboptimal in finding the right balance between the competing needs of the stakeholders involved for both certainty and flexibility. Therefore, this article proposes that rulebooks should be designed as relational network contracts by their drafters to impose a concretised and expressed obligation of good faith on the parties, which would guide parties’ behaviour during the contractual performance and protect the preliminary investments of prospective participants, thereby encouraging digital platform integration in international trade processes. This article provides a starting point for future studies and attempts that may empirically test the effectiveness of guiding principles in addressing digital trade platforms’ potential to engage in opportunistic behaviour.

Lastly, this article contributes to the debate as to whether any meaningful use cases exist for blockchains and distributed ledgers. It provides insights from the container shipping industry, where commercial innovators have engineered real-world solutions that harness the potential of blockchain to solve the double-spending problem in order to digitalise transport documents of title. The recently enacted ETD Act 2023 in the UK, which recognises trade documents in electronic form as legal equivalents to their paper counterparts, provides an essential foundation and an excellent opportunity for global trade blockchain platforms to redesign their systems and terms of use to encourage adoption and foster digital transformation, leading to substantial efficiency gains.