Introduction

Money is omnipresent. All actors in modern societies use money for a variety of purposes, in both market and non-market communities, in both everyday life and extraordinary events. Classical economic theory suggested that money is primarily used as a medium of exchange, a unit of account, and a store of value [Menger Reference Menger, Johannes, Lexis, Elster and Loening1900; Mises (1912) Reference Mises1924; Hume Reference Hume, Fleming, Kincaid and Donaldson1752; Smith (1776) Reference Smith, Campbell and Skinner1976]. Instead, ever since the classical work of Georg Simmel [(1990) Reference Simmel and London2004], sociologists have suggested that money is used for both economic and a variety of non-economic purposes. Money was identified as a means of freedom [ibid.] and dependence [Deutschmann Reference Deutschmann2011; Ganßmann Reference Ganßmann2012], to control behaviour by other actors or to represent organizational power [Schimank Reference Schimank2015] and to display social prestige [Lamont Reference Lamont1992], affection and care [Zelizer Reference Zelizer1994]. Drawing on François Simiand [Reference Simiand1934], Viviana Zelizer [Reference Zelizer1994, Reference Zelizer2011] in particular investigated various symbolic-cultural usages of money (multiple monies) [Carruthers and Arovich Reference Carruthers and Arovich2010: 51-81]. For whatever economic or non-economic purpose money is used, it remains a central economic and ubiquitous social institution in modern societies.

The usage of money depends on a variety of monetary institutions. Modern (fiat) money is issued by central and private banks and its validity is guaranteed by state authorities [e.g., Wray Reference Wray2012]. The value of money is influenced by national and supra-national institutions (for example, the European Union) by means of monetary policy [e.g., Braun Reference Braun2016; Ingham Reference Ingham2004]. It is these monetary institutions that build the basis of the monetary order of modern societies. That said, what do ordinary people know about these institutions that are central to the monetary order? Do the monetary order and the everyday usages of money depend on knowledge of these institutions? The sociological literature has widely neglected these questions because it is theoretically assumed that it is not knowledge but trust that makes the sound functioning of the monetary order possible and that trust is the basis of the everyday usage of money [Simmel Reference Simmel and London2004; Luhmann (1968) Reference Luhmann1979; Giddens Reference Giddens1990; for a critique of the trust hypothesis, see Kraemer Reference Kraemer2019]. However, neither ordinary people’s trust in, nor their knowledge of, monetary institutions has been empirically studied. Both omissions reflect a crucial gap in the existing sociological literature.

To address this gap, the study presents empirical evidence on people’s knowledge about monetary institutions. We studied what people know about the creation of money, the backing of money, and the institutions that influence the value of money. We use raw data from an original empirical study of 2,000 individuals in Austria conducted in 2017 to show that knowledge of monetary institutions is by and large not prevalent in the Austrian population, a finding that holds true across different socio-economic groups. We also show that “myths” about the creation of money (e.g., that money is primarily issued by central banks), the backing of money (e.g., that money is backed by gold), and the institutions that influence the value of money (e.g., central banks) are widespread.

The paper is structured as follows. First, we review literature on the sociology of money with particular regard to money knowledge and monetary institutions. Second, we review empirical contributions in the field of financial literacy. Third, we define money and provide an outline of central institutions to understand the monetary order. Fourth, we explain our methods and data. Fifth, we present central descriptive, bivariate and multivariate empirical findings of people’s knowledge of money and monetary institutions with regard to socio-demographic and socio-economic factors (gender, age, education, employment status, household income). Finally, we discuss our empirical findings against the backdrop of existing studies in the field of the sociology of money.

A short review of the sociology of money

Work in the area of the sociology of money begins and usually draws on Georg Simmel’s classic work, Philosophy of Money [(1900) 2004]. It was Simmel who found that money is not only an economic category but a social institution. His considerations of money as a means that contributed to accelerating the “release” of people from feudal ties or heritages since the 19th century and to allowing for more personal freedom are both well-known and widely recognized. Also well-known, and in a similar vein, are Simmel’s reflections on money as a “quantifier” of both economic and social relations: in his view, money obscures the more “qualitative” relations between persons [cf. critically Zelizer Reference Zelizer1994, Reference Zelizer2011; Dodd Reference Dodd2014; Bandelj, Wherry and Zelizer Reference Bandelj, Wherry and Zelizer2017].

For Simmel, modern money is “pure token money” [(1900) 2004: 176] that is not (or is no longer) backed by tangible assets such as precious metals (gold). Because of its relational nature, the value of money is highly volatile. Simmel identifies four key prerequisites underlying the everyday usage of money. First, there must be a central authority that defines its scope of validity and guarantees its functionality as legal tender. This is a thought that Simmel’s contemporaries similarly found and from which they developed the so-called “state theory of money” [Knapp Reference Knapp1905]. However, Simmel, second, goes further in arguing that it is not the sheer existence of the state or a state-appointed entity that leads actors to recognize money as a valid legal tender and a valued object. Instead, for him, it is “public confidence in the issuing government” [Simmel (1900) Reference Simmel and London2004: 190, own emphasis] that is most important for people accepting money. However, the “confidence” in the “socio-political organization and order” [ibid., 193], which Simmel does not specify in detail, is a necessary but not sufficient condition to ensuring economic actors’ willingness to engage in the exchange of goods for money. The third aspect that Simmel considers indispensable is that economic actors also have “confidence in the economic community” [ibid., 193] that uses money. For him, it is actors’ “two-sided faith” [ibid., 192] in the durability of the political and economic order that results in money being used and accepted for exchanging goods and to receive payments. Fourth, Simmel considers trust in the relative stability of the value of money over time as a central prerequisite of its usage and acceptance. He does so because he assumes that people would not use money if they could not rely on others to accept it in future market exchanges and against whatever may be considered as equally valued resources. Here again, Simmel sees this expectation based on “confidence”, more precisely, the confidence that money “can be spent again at the same value” [ibid., 191]. On this point, he interestingly refers to the importance of knowledge when he states that this “confidence” depends on a “weak form of inductive knowledge” [ibid., 191, own emphasis]. To him, this “inductive knowledge” stems from prior, time-tested experience based on countless economic transactions that money can be used reliably.

Until today, for much of the recent literature, Simmel is a central reference point in the sociology of money. Above all, he has steered research into the multiple usages of money. Ever since Simmel’s perception of money as both a means of freedom and dependence, sociologists have identified a variety of other usages of money, including money as a means of exercising power within firms and other organizations [Deutschmann Reference Deutschmann2011; Ganßmann Reference Ganßmann2012], the use of money to represent organizational power and to control the behaviour of other actors [Schimank Reference Schimank2015], and the use of money to display social reputation and prestige [Lamont Reference Lamont1992], affection and care, or to witness the social ties of a community [Zelizer Reference Zelizer1994, Reference Zelizer2011]. His thoughts on the relationship between people’s “confidence” in the state or the “economic order” and the usage of money have only gained sparse attention. To our knowledge, his thoughts on “inductive knowledge” have never been further theoretically elaborated or empirically examined [see Kraemer Reference Kraemer, Kraemer and Nessel2015 for a critical review]. This may be because the sociological literature since Simmel has not been interested in the knowledge of ordinary people in the institutions that are central to money creation, money’s backing, or the influence of money’s value.

The central argument that the monetary order of modern societies relies on trust was prominently advanced by Niklas Luhmann [(1968) Reference Luhmann1979: 55]. Luhmann perceived of money as a central institution in modern societies and argued in the line of Talcott Parsons’ [1967: 307ff.] view that money is a “general medium of communication” in the economic sphere. Compared to more personal relations and means of exchange in pre-modern societies, Luhmann argued that complex modern economic systems rely on money, which is understood as a medium of “generalised trust”.Footnote 2 More recently, some authors have taken up similar ideas but without the system-functional notion prevalent in the work of Luhmann or Parsons. Thus, for example, Geoffrey Ingham [Reference Ingham2004: 12] concludes that much sociological literature assumes that money “is accepted by convention, is underpinned by trust”. Ingham, although critical of such reasoning, has used the notion of trust in the context of analysing credit relations which he sees as the “nature of money”. He argues that trust is particularly important among what he sees as the four main actors within the monetary order, namely, the state, rentiers, banks, and the borrowers of credit: “Monetary relations involve two simultaneous relations: between the contracting agents and between these and the issuer of money. This triangular relation involves impersonal trust which enables transactions between strangers. In modern monetary systems there are several interconnected ‘triangles’ of impersonal trust which link a hierarchy of intermediaries—credit card issuers, banks, central banks, states.” [Ingham Reference Ingham and Pixley2013: 128, own emphasis]. Notwithstanding the empirical evidence, many authors seem implicitly to assume that knowledge about the financial and monetary order is not available to the average citizen. They therefore build on the concept of trust to explain why money is ubiquitously used and accepted (see below).

A few authors seem less inclined to refer only to the notion of trust in providing an explanation of why money is steadily used in everyday economic exchange. Ganßmann [Reference Ganßmann2012: 132, own emphasis], for example, does so by stating: “Economic action is a myth that serves to suppress the knowledge that all we are relying on in our economic activities are rather shakily founded beliefs in the stability of monetary institutions.” It is this thought that is of interest for our further argument, as it suggests that it is not only trust in or knowledge of monetary institutions that may build a basis for the everyday usage of money. Instead, Ganßmann points to the role of people’s “beliefs” or “illusions” regarding the functioning of monetary institutions and the monetary order as a whole. Indeed, as we will empirically show, such beliefs, or money myths as we will refer to them, are widespread in the population and contrast with reflexive knowledge about the “true” functioning of the monetary order. Such money myths include ordinary people’s (false) ideas of money being backed by tangible assets, of bank customers’ savings deposits being passed on to third parties as loans, of the state’s “printing press” or central banks as the only source of money and not private banks creating fiat money, to name but a few.

More recently, some authors, following fundamental considerations by Hyman P. Minsky [Reference Minsky, Kindleberger and Laffargue1982], have shown that collectively shared expectations, hopes or fears can have a much greater impact on the stability of the monetary system than central bank monetary policy measures [Holmes Reference Holmes2014; Braun Reference Braun2015; Beckert Reference Beckert2016: 113-116]. For example, central banks or governments try to influence the investment decisions of economic actors. Here, central banks increasingly use rhetorical strategies to stimulate a climate of positive expectation. Notable too, in this regard, is the work of George A. Akerlof and Robert Shiller [2009] who emphasize the role of “stories” in knowledge and understanding. They hold the view that stories have “real” effects for markets; in fact, stories play a “functional” role for the economy in this sense. Furthermore, central bank representatives are becoming increasingly aware of the crucial role of communication channels in reaching the wider public. As the chief economist of the Bank of England notes, the goal is not only to reach experts (economists, market participants and media) but a wider public, explicitly including households and firms [Haldane Reference Haldane2017]. Arguing from an anthropological perspective, Douglas Holmes [Reference Holmes2014] describes such performative expectation management as an “economy of words”. Particularly in extraordinary financial crises, institutional actors of the monetary order try to disperse uncertainty and “calm the markets” [see Draghi’s “Whatever it takes”]. However, enlightening as this research might be, it remains unclear to what extent the “economy of words” of central banks is not only addressed to the professional public of financial experts, investors and corporations, but also reaches the ordinary population.

Also coming from an anthropological tradition, Annelise Riles [Reference Riles2018] argues that, in recent years, starting with the financial crisis of 2008, the role of central banks has been changing. In response to this change, an ever-wider public is questioning and challenging the legitimacy of central banks. The cultural, social and political embeddedness of the institution of the central bank is becoming more and more evident, she argues. As a result, conflicts are emerging between different “publics” over the legitimacy of central bank practices, which are in the end a “culture clash” [ibid.: 35ff.] between an expert culture of central bankers and the people forming these different publics. The ultimate reason for this clash of cultures, as Riles suggests, is an increasingly widespread realization and concern that the practices of central banks have a direct and real effect on citizen’s lives. Therefore, the public claims a “practical knowledge” [see Weber’s elaboration in the conclusion of this paper] of how certain central bank policies will have an effect on their lives. Regardless of the perspective—the central bank’s desire to more carefully communicate to the public, the public’s claim to be informed of what the central bank does, or the economic profession’s gaining of a deeper insight into economic phenomena—the question remains: what kinds of myths, misconceptions and knowledge are distributed among the public, and how widely are they held?

A significant contribution, which links the notion of trust in the monetary system to the concept of myth, was recently outlined by Benjamin Braun [Reference Braun2016]. Braun argues that there exists a “prevalent folk theory of money” consisting of three “myths”: that “all money is created equal, that banks are intermediaries, and that money is exogenous”. He conceptualizes the concept of monetary myth as “empirically inaccurate” and contrary to the theoretical arguments or “reality checks” of the “workings of the monetary system” [all citations see ibid.: 1073 and 1075]. The purpose of Braun’s differentiation between a so-called “folk theory of money” and the scholastic view or theory of the suggested real “workings of the monetary system” is twofold. First, he uses this distinction to suggest an explanation of why central banks such as the European Central Bank (ECB), the Bundesbank and, above all, the Bank of England have changed and enriched their communication strategies by addressing not only the “markets”, that is experts, but also “the people”. Second, he uses this distinction to argue that, in normal times, the folk theory of money may have no or only a minor effect on trust in a central bank´s legitimacy, whereas it has a strong effect in times of “financial upheaval and unprecedented monetary expansion” [ibid.: 1067].

Braun builds his arguments about monetary myth “on academic writings, anecdotal evidence, and common sense to systematize the ideas about money that circulate among the general public and that, when put together, amount to a folk theory of money”. In summary, he concludes that “money is complicated, and it is hardly surprising that the folk theory of money outlined above is wrong in every major aspect” [ibid., own emphasis]. Finally, it is worth mentioning that Braun seeks to make plausible his argument that central banks now “speak to the people” through communications published in bulletins or social media [ibid.: 1081-1083]. In both cases, central banks such as the Bank of England and others acknowledge that they have only limited power over (private banks’) money supply, and that it is private banks that produce the bulk of modern fiat money. Indeed, such tacit and overt public acknowledgement of the limited power of central banks is a novum in central banks communication to the public, as Braun rightly observes. Yet, it is worth asking how many people would have read the Bank of England’s bulletins or seen its YouTube videos. That said, it is again questionable if the Bank of England’s communication efforts have indeed resulted in a widespread dissemination among the broad population and changed or influenced some “myth” of money or the understanding of the monetary order.Footnote 3 We think this is not the case. Instead, we believe that such communication efforts seeking to “speak to the people” have only minor, if any, effects on monetary knowledge and trust in central banks. Such a perspective overestimates the power of monetary institutions to influence ordinary people’s beliefs in money and the power of performative action to build trust.

Up to this point, we have argued that, since Simmel, the sociology of money has made progress in identifying the multiple usages of money. The (few) authors who have addressed the question of why people ubiquitously use and accept money in everyday life mainly draw on the concept of trust, not knowledge. Interestingly, the concept of trust has not been further distinguished: ever since Parsons and Luhmann, the sociology of money primarily refers to the abstract notion of “system” or “impersonal” trust that replaced forms of “individual trust” in pre-modern societies [e.g., Ingham Reference Ingham and Pixley2013]. However, authors referring to the concept of trust have not further specified in which monetary institutions or in “what” people trust when using money; or to use their metaphor, in which or whatever “system” people trust. We believe that this omission results from the fact that the monetary order and the institutions influencing the creation and value of money have only recently received closer attention, especially after the financial crisis of 2008/2009.

During and after the financial crisis of 2008/2009, it became apparent that trust in money and in monetary institutions is one essential prerequisite for the sound functioning of the monetary order. Although most work concentrates on macro arguments concerning the relationships between European institutions and European member states [e.g., Streeck Reference Streeck2014, 2016] or the programmes of the European Central Bank aimed at tackling the financial crisis [e.g., Braun Reference Braun2016, Reference Braun2018], that crisis steered analysis to better understand the foundations and the institutions of the monetary order, especially the production side of money, which had been neglected in the sociology of money since Simmel’s classic work.

In recent years, some sociologists have begun to work on this research desideratum [Ingham Reference Ingham2004; Huber Reference Huber2017; Sahr Reference Sahr2017; Paul Reference Paul2017], taking their inspiration from heterodox economists [Wray Reference Wray1998, Reference Wray2012; Smithin Reference Smithin2000; Pettifor Reference Pettifor2017] and anthropologists [Graeber Reference Graeber2011]. The global banking and financial market crisis of 2008 [FCIC 2011] was certainly a significant catalyst in putting the production side of money in the sociological perspective. Thus, it is now acknowledged that it is mostly private banks, not central banks, that “produce” the bulk of (fiat) money (see chapter 3). Although the sociological literature has broadened our understanding of the monetary order and produced scientific knowledge about it, the literature has failed to provide empirical evidence of what ordinary people know about the institutions that produce money and influence money’s value. Furthermore, it has neglected the question of whether ordinary people know that modern fiat money is not backed by tangible assets and is based on “faith”, as Simmel suggested.

In conclusion, the sociology of money has advanced an understanding of money as more than an economic institution. Since Simmel’s classic work, one strand of research has shown that money is used for a variety of economic and non-economic purposes. However, it has not studied in more detail the social or institutional foundations of this ubiquitous use, or the variety of purposes for which money is used. Those authors that addressed these questions drew on the conception of trust and, only occasionally, on the concept of “belief”. A second stream of research has concentrated on the institutions relevant to the production of money and its value. They show that money is primarily produced by private banks, and that the value of money is influenced by central banks such as the European Central Bank. Both streams of research appear poorly integrated, and both lack empirical scrutiny when exploring ordinary people’s trust in or knowledge of the institutions identified as relevant for the production and value of money. This is a crucial omission because, as Simmel suggested, trust is only important in situations of ignorance. As Simmel [(1908) Reference Simmel2009: 315] puts it in a famous quote, “Trust, as the hypothesis for future behaviour, which is certain enough thereby to ground practical action, is, as hypothesis, a middle position between knowledge and ignorance of others. Someone who knows all need not trust, someone who knows nothing cannot reasonably trust at all.” Authors who refer to the notion of trust underlying the usage of money and the monetary order have either not thought about the relationships between trust and knowledge or, as we suggest, assume without empirical evidence that ordinary people do not know “enough” about the functioning of the monetary order and the institutions relevant to it. If the above-cited argument by Simmel is taken seriously, only the latter explanation may justify why it should be trust and not knowledge that is suggested to be the central basis of the everyday usage of money and the sound functioning of the monetary order. However, the neglect of knowledge as a possible mechanism that may explain the everyday usage of money for whatever purpose and for the relative stabilityFootnote 4 of the monetary order of modern societies is not justified, unless it is built on empirical evidence. Consequently, only if there is empirical evidence to show that ordinary people do indeed not know anything about the production of money, the institutions that influence its value, or that money is not backed by tangible assets but only based on “faith”, may the concept of trust theoretically be seen as a possible explanation of the ubiquitous use of money and the relative stability of the monetary order. Again, and as Simmel has argued so insightfully, trust seems only important in situations of ignorance. Furthermore, if we acknowledge Ganßmann’s views, we do not even know what people believe when thinking about the monetary order and the institutions relevant to it. Given this reasoning, we believe that, before analysing ordinary people’s trust in monetary institutions, it is indispensable to first assess what ordinary people do indeed know or not know about or believe regarding the institutions that produce money, and that influence, and potentially “back”, money’s value. The notion that knowledge may be a central social mechanism underlying the sound functioning of the monetary order and the widespread use and acceptance of money in everyday life is also suggested by research in financial literacy. In the next chapter, we review this strand of research to further justify why an analysis of the knowledge prevalent in the population, and not (only) its possible “trust”, may be important in better understanding the monetary order.

Research on financial literacy: Mathematical and financial knowledge

In the previous chapter, we reviewed literature on the sociology of money with particular regard to knowledge of money and monetary institutions. We argued that the sociology of money emphasizes the central role of “trust”. It has made progress in analysing the usage of money and the institutions that produce money, but has neglected an empirically oriented analysis of ordinary people’s knowledge of the monetary order. In the following, we review a strand of research that has empirically assessed people’s knowledge about financial issues: financial literacy. Studies in financial literacy investigate the competencies of a population regarding what is called “financial knowledge” (OECD/INFE 2016]; recently, this issue has also been addressed in the PISA study Assessment and Analytical Framework. Mathematics, Reading, Science, Problem Solving and Financial Literacy [OECD 2013: 139ff.]. In this research tradition, financial knowledge is conceived of as a mathematical understanding of a set of operations suggested to be relevant to financial decisions including simple mathematical procedures such as division or, more complexly, calculating inflation rates and their effects on savings or investments [Atkinson and Messy Reference Atkinson and Messy2012; Lusardi and Mitchell Reference Lusardi, Mitchell, Mitchell and Lusardi2011b]. More recently, the mathematical knowledge of people’s financial capabilities in areas such as the “time-value of money”, “interest paid on a loan”, “interest plus principal”, “compound interest”, “risk and return of an investment”, “definition of inflation”, and (financial) “diversification” have been considered [Cupak et al. Reference Cupak, Fessler, Silgoner and Ulbrich2018; similarly Ergün Reference Ergün2017; Fonseca et al. Reference Fonseca, Mullen, Zamarro and Zissimopoulos2012].

Recent studies show that the level of financial knowledge, as conceived of in the framework of financial literacy, is low among the population in many countries around the world [Cupak et al. Reference Cupak, Fessler, Silgoner and Ulbrich2018; OECD 2017]. A closer examination of the distribution of financial literacy among the population reveals differences between social groups. Socio-demographic variables such as education, gender, and income have regularly proven to be important factors in explaining varying, but low, degrees of financial knowledge. [Atkinson and Messy Reference Atkinson and Messy2012; Fonseca et al. Reference Fonseca, Mullen, Zamarro and Zissimopoulos2012; Lusardi and Mitchell Reference Lusardi and Mitchell2011a; Reference Lusardi, Mitchell, Mitchell and Lusardi2011b; Reference Lusardi and Mitchell Olivia2014: 19]. Furthermore, some studies have identified ethnicity [Fonseca et al. Reference Fonseca, Mullen, Zamarro and Zissimopoulos2012: 95; Lusardi and Mitchell Reference Lusardi and Mitchell2011a: 11], age [Atkinson and Messy Reference Atkinson and Messy2012: 46-48] or geographic differences, e.g. between rural or urban populations [Lusardi and Mitchell Reference Lusardi and Mitchell2011a: 11], as important in explaining varying degrees of financial literacy.

These findings were then related to the effects that they may exert on individuals and on national economies. Regarding personal effects, certain studies have found that financial literacy does influence financial behaviour, such as pension savings [Lusardi and Mitchel Reference Lusardi and Mitchell2011a, Reference Lusardi, Mitchell, Mitchell and Lusardi2011b]. The relationship between the effects of financial literary on national economies has not been empirically confirmed because studies with such aspirations would clearly face many severe restrictions. However, the OECD [2009: 3] assumes that “the consequences of uninformed credit decisions can be disastrous, especially if the credit in question concerns a mortgage loan” and that financial literacy has “deepened the financial crises” of 2008/2009 [ibid., 9].

To sum up the preceding results of studies on financial literacy, three major findings can be highlighted. First, the level of financial knowledge as conceived of in the framework of financial literacy is low among the population in all countries surveyed. Second, financial literacy is influenced by socio-demographic variables and varies with age, education, ethnicity, gender, and income. Third, different degrees of financial literacy may exert effects on financial behaviour. Notably, however, this strand of research is not interested in the knowledge prevalent among the population regarding the workings of financial institutions. More precisely, it is not the population’s knowledge of the financial system at large that is examined, but elementary financial mathematical knowledge about financial operations. Furthermore, the knowledge of the population regarding money and monetary institutions is not addressed at all. From a sociological view interested in money, these shortcomings are to be contested and reveal a lack of theory behind the research in financial literacy. However, they also point to the role of knowledge in potentially influencing ordinary people’s behaviour. It is exactly this suggestion––which is not explored in the sociological literature on money––that we have used to empirically assess people’s knowledge of the creation of money, of money’s backing, and of the institutions involved in influencing the value of money that we, in line with others [see summary in Ingham Reference Ingham2004], see as central to a better understanding of the functioning of the monetary order.

What is money?

So far, we have argued that ordinary people’s knowledge of the monetary order has not received theoretical attention in the sociology of money; nor has it been empirically studied. By reviewing the financial literacy literature, we showed that knowledge, and not (only) trust, as suggested in sociological literature, may be a mechanism that accounts for the sound functioning of the monetary order and the everyday usage and acceptance of money. Before we empirically address neglected questions in both streams of research, we want to specify what we understand as money in this study and what we see as the central monetary institutions relevant for the monetary order.

Our definition of money is in accordance with intermediate money concepts as defined by monetary institutions such as the European Central Bank [ECB 2012: 110]. We understand money as coins and notes issued by central banks and deposits with an agreed maturity of up to two years. More precisely, we define money according to what is commonly known as the M2 money aggregate: “M2 (intermediate money) comprises M1Footnote 5 and, in addition, deposits with original maturities of up to two years and deposits redeemable at notice of up to three months.” [ECB 2012: 110]. We exclude the monetary aggregate M3, which includes “shares/units, repurchase agreements, and bonds” [ibid.], from our understanding of money. This is because we are interested in forms of money that are frequently used by ordinary people in everyday money practices. Shares, and especially repurchase agreements and bonds, certainly do not fall into this category of everyday usage.

Coins and notes of any given currency in circulation are issued by central banks (“narrow money”, M0). In contrast, all parts of M2 are the result of commercial activities by private banks (“intermediate money”, M2). We agree with both scientific [e.g., Wray Reference Wray2012: 83-88] and institutional [e.g., Deutsche Bundesbank 2017: 17f.; McLeay, Amar and Ryland Reference McLeay, Amar and Ryland2014: 2f.] views that most money is “created” by private banks. Private banks create money by making loans that in turn appear as deposits in a bank’s balance sheet. Every time a loan is made and a subsequent deposit is assigned in the balance sheet of a private bank and, consequently, in the aggregate of M2, new money is created. On this point there is widespread agreement [Deutsche Bundesbank 2017: 17f.; McLeay, Amar and Ryland Reference McLeay, Amar and Ryland2014: 2f.; Wray Reference Wray2015: 83-88]. For the purpose of our argument, it is notable that most money is created by private banks making loans, leading to deposits in their balance sheets.

Regarding the two most widespread currencies, namely the U.S. dollar and the euro, the current ratio between a currency in circulation issued by central banks (M0) and money created by private banks (M2) underpins this well-accepted argument. In the Eurozone, the ratio between M0 and M2 is approximately 1 to 9 (currency in circulation: 1,115.6 billion euro, overnight deposits: 6,714.3 billion euro, deposits with an agreed maturity of up to two years: 1,180.2 billion euro, deposits redeemable of notice of up to three months: 2,265.4 billion euro).Footnote 6 In the U.S., the ratio between M0 and M2 is similarly approximately 1 to 9 (currency in circulation: 1,540.3 billion dollars, M2: 13,986.9 billion dollars).Footnote 7 In the U.K., the ratio between currency in circulation (notes and coins in pound sterling) and deposits seems to be even higher. Data on the ratio between M0 and M2 cannot be easily retrieved for the U. K., as the Bank of England has stopped accounting for data on M2. Nevertheless, some notes on this point were made by McLeay and colleagues [McLeay, Amar and Ryland Reference McLeay, Amar and Ryland2014: 2]: “97% of the amount currently in circulation” is made up of “deposits” (as of December 2013). Interestingly, the ratio between notes and coins and deposits seems to change historically in favour of the latter. Although historical data are few and, to our knowledge, there exists only one study on this issue, data provided by Michael North suggests a similar view. North [1994: 168, table 9] analysed the prevalence of notes and coins in comparison to deposits in England, France, and Germany between 1850 and 1913.Footnote 8 He showed that, in 1850, the ratio between coins and notes and deposits was approximately 63 to 37 billion pound sterling in England, approximately 10 to 90 billion francs in France, and approximately 66 to 34 billion marks in Germany (the latter data are available for as early as 1875). By 1900, the year in which Simmel’s Philosophy of Money was first published, the ratio was 16 to 84, 67 to 33, and 42 to 58, and by 1913 the ratio was approximately 12 to 88, 56 to 44, and 32 to 68 in the three countries. These data suggest that private deposits have steadily replaced coins and notes issued by state institutions. It further suggests that money in the form of privately issued deposits by private institutions is not a new phenomenon but is part of an historic development.

Regarding the “production” of money, we see central banks issuing notes and coins and private banks issuing fiat money, with the latter producing the bulk of money (approximately 90%). Regarding the institutions influencing the value of money, we agree with Ingham [Reference Ingham2004] that, by setting interest rates or monetary policy (e.g., buying government bonds), the ECB is the main institution influencing the value of money. Of course, other factors might influence the value of money, but due to its mandate, the ECB is the most relevant actor in this domain.

Finally, our study addresses the question of what people know or believe about the backing of money. According to Simmel’s [(1900) 2004] classic work, money is only backed by faith. However, since Simmel, the international order has changed dramatically. It was during the time of the gold standard that money was backed by tangible assets, i.e., gold, for some time. However, with the end of the gold standard and the above-cited mechanisms of private banks issuing money by means of credit, money became pure fiat money. That is, money is no longer backed by tangible assets such as gold but, as Simmel has suggested, by “faith”.

In summary, we conceive of money as being produced to a minor degree by central banks and to a major degree by private banks. We conceive of the value of money being (mainly) influenced by the ECB. Finally, we conceive of money not being backed by tangible assets such as gold, but only by “faith”. Before we present empirical results of what people know or believe about these monetary institutions, we present our data and methods.

Method and data

Our study uses original data from a nation-wide survey conducted in Austria in autumn 2017.Footnote 9 The sample of 2,000 men and women over the age of 15 is representative of the Austrian population. The sample selection followed a stratified multistage clustered random sampling procedure based on postal addresses. Computer-Assisted Personal Interviews (CAPI) were conducted at the respondents’ households. An original questionnaire was developed in several workshops over a period of several weeks. The pre-test and the survey itself were conducted by the internationally renowned Institute for Empirical Social Studies (IFES) located in Vienna. The 82 interviewers who were involved in the nationwide survey were trained by the research institute one week before the start of the survey. Throughout the period of the survey a phone hotline was available for both interviewers and interviewees. The research institute monitored the work of interviewers (15%), and random control calls were made of all conducted interviews.

The sample was based on a (nearly) complete list of all households in Austria (postal addresses). Consequently, the non-coverage bias is very small. The multiple stratified and clustered sample was randomly drawn from this pool of households. The stratification was based on NUTS-3-regions in Austria documented by communal size (only in Vienna were the actual political city districts taken into account), resulting in 193 strata that took into account seven different communal sizes. Based on that, the number of required sample-points for a sample of 2,000 households was calculated, according to the assumption that a list of 12 addresses required a minimum of six interviews. The correspondences between strata and sample-points were calculated using the latest available demographical data from the official Austrian statistical agency. In each stratum, one or more (depending on the number of inhabitants) sample-points were used. Clusters within the strata were randomly picked and sample-points built, while the size of the population was taken into account to avoid distorting the probability of being chosen.

The target households were informed by letter of the interviewer visits. The initial sample size was 4,628, with 2,018 interviews conducted, or a response rate of 46.4%. Approximately 33.9% declined to participate and 19.7% could not be reached despite multiple attempts.

Appendix 1 shows the distribution of the entire sample with regard to gender, education, employment status, household income and social strata. The table shows the sample distribution in a descriptive manner. Interesting variables for this descriptive overview were taken into account or calculated. Gender was measured by a binary variable, and age is given in years. For a better overview, age categories are shown in Appendix 1. Education was operationalized by a 12-level ordinal scale [see OeNB 2016] relative to the highest level of education obtained and reflecting Austria’s specific institutional structures (again, Appendix 1 shows only five combined categories). Employment status [see also Erikson and Goldthorpe Reference Erikson and Goldthorpe1992; see OeNB 2016] and household income (operationalized as a 20-level scale ranging from “under 450” to “3,900 and more” using 300 euro spans within each level) as presented in the Appendices, also consist of stacked categories. The social-strata-index Footnote 10 variable has a five-level ordinal scale, and the count consists of three variables: educational level, household income and employment status. It therefore highly correlates with the other variables. Each category of these three variables represents a numerical equivalent, and the index consists of the sum of all three variables. The five categories here (A to E) are quantiles of the strata-index.

Results

Research on financial literacy, as mentioned above, focuses on a very specific kind of knowledge, namely, financial knowledge. This article is interested in a different kind of knowledge than research on financial literacy, i.e., people’s knowledge of what money is, how money is created, whether money is backed, and which institutions are trying to guarantee monetary stability. Additionally, on the issue of money creation, we considered the backing of money and the institutional competence of the value stability of money as the principal dimensions of our definition of money knowledge. Herein, we follow Ingham [Reference Ingham2004], who sees the questions of what money is, how it is created and how its value is sustained as the three main pillars of The Nature of Money.

In our sample, we asked the following three questions (the correct response categories are shown in brackets; in our terminology they represent knowledge about money creation, backing and the institutional responsibility for money stability):

What do you think—how is money created (money = cash and deposits)? [“The central bank prints it”, “Private banks issue credit”]

What do you think—how are bank deposits and cash backed? [“Money is not backed at all”]

What do you think—who is responsible for the value stability of the Euro? [“The European Central Bank”].

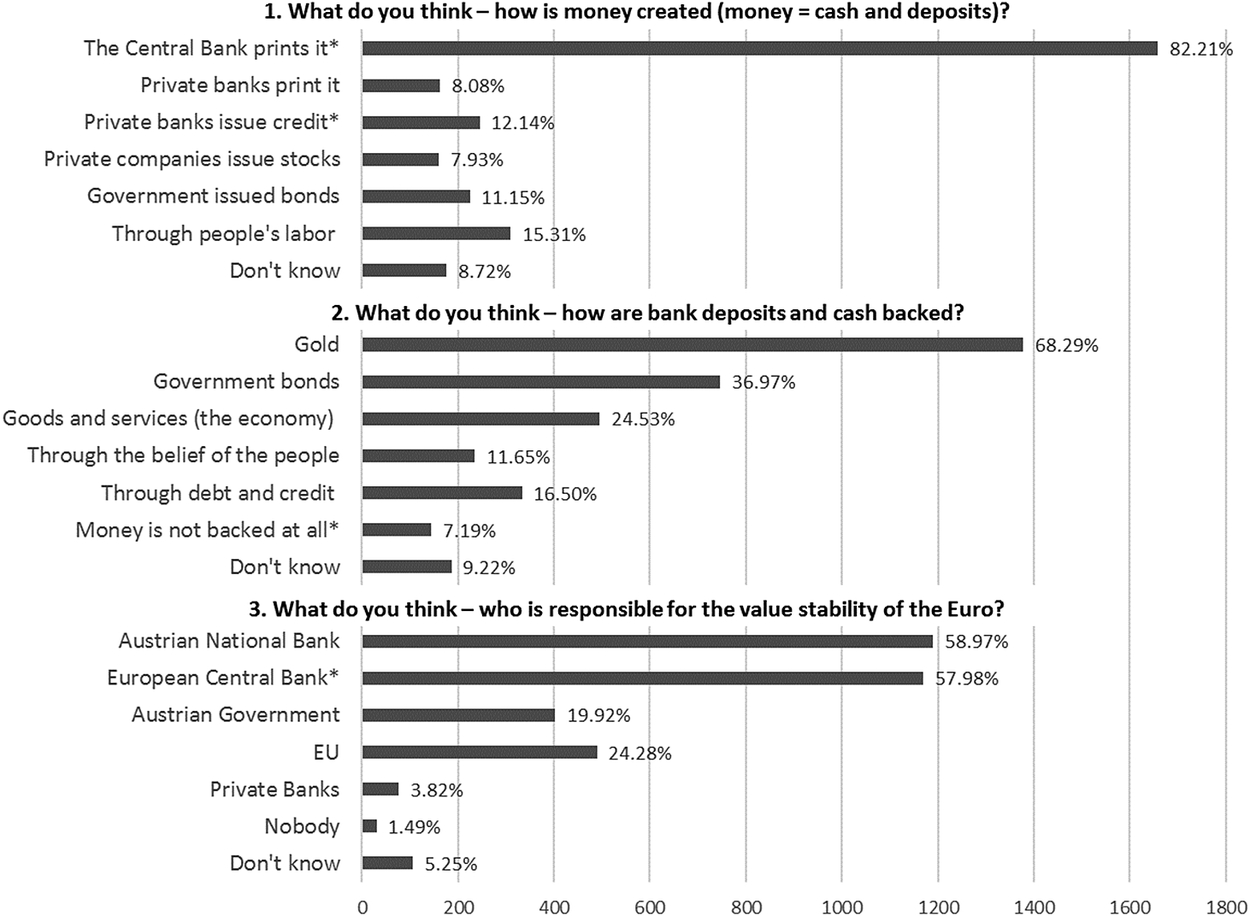

Figure 1 shows the response categories for each of these questions, while the correct response categories, i.e., those representing knowledge about the money system, are marked with an asterisk (*). The response items of the three questions operationalize money knowledge or money myths. They are based on a literature review of documents from central banks that we regard as knowledge, and on beliefs mentioned in the sociological literature. Additionally, we developed other response categories in multiple question-development workshops. Figure 1 shows the complete set of response categories.

Figure I Response frequencies of money knowledge (three questions)

Question 1 has two “correct” answers (items 1 and 3), as elaborated in the recently published central banks documents referred to above. Central banks do indeed print cash money (82.2% of respondents knew this). However, the overwhelmingly greater part of money is created in the process of issuing credit by private banks (only 12.1% of respondents knew this). As private banks do not have the legal authority to print money, item 2 is a pure myth, even though 8% of respondents believe this to be true. Additionally, approximately 8% believe that money is created when private companies issue stock. In regard to this point, some economists, in particular heterodox economists, might argue that there is little difference between assets and money because they are easily interchangeable. Nevertheless, money is not created when stocks are issued, and hence only existing money can be used to buy stocks. Therefore, it is a myth that issuing stocks leads to the creation of new money. Approximately 11% of respondents believe that governments have the ability to create money. Again, to some extent this might be true in the U.S. or other countries. In the Euro-zone, as the consequences of the financial crisis of 2008 show, this is not the case. Approximately 15% of respondents believe that human labour is the source of money. This notion can be found in a slogan of an Austrian bank, which translates roughly as follows: “Let your money work for you”. On this point, approximately 9% ticked the category “don’t know”.

Question 2 relates to the question of how money is backed. We consider the response category “money is not backed at all” to be true. We define money as consisting of cash and deposits (M2); therefore, if we ask how money is backed, it includes only cash and deposits (chapter 3). This issue requires clarification. Some economists might argue that credit is always issued by a bank for something (a house, a car, or another item). As such, the goods and services of the economy relate to money in this sense (this is reflected in response category 3). Approximately 25% of respondents adhere to this notion. The vast majority (68.3%), however, believe that we still have some sort of gold standard meaning that money is backed by gold. This is clearly a myth. Even a closer look at a central bank’s balance sheets shows that only a tiny fraction of money, as we define it, relates to gold in central bank storage. Approximately 37% believe that government bonds, another item in the balance sheets of central banks, are securities for money. Here, the question of assets is once again crucial. However, we defined money very clearly in the question the respondents were asked so answer; therefore, this aggregate of money is not backed by government bonds. Of course, the ECB also holds bonds in its books, but that does not mean that money is “backed” by bonds or, as many believe, that money comes into circulation by public debt. On the contrary, the ECB is principally prohibited from directly financing member states. Simmel also discussed this point when his Philosophy of Money was written. His conclusion was that money is only “backed” by people’s belief that everyone else accepts money (reflected in response category 4). Approximately 12% of respondents believe that this is so. Approximately 17% believe that money is backed by debt and credit. While money is produced by issuing credits by private banks, the crisis of 2008 showed what happens if debt and credit are used to back up other assets. Again, only a very small fraction of people would accept debt certificates for other people’s credit in lieu of cash. On this point, approximately 9.2% of respondents said they did not know.

Question 3 relates to the question of institutional responsibility for the value stability of the euro. The ECB is the “right” answer here. Without doubt, states are able to influence inflation rates. However, the ECB is the only organisation that has a legal mandate from the European parliament to target the inflation rate. It is important here to distinguish between different dimensions and levels: state, private, national, European. Therefore, we asked whether the National Central Bank (response category 1) or the European Central Bank was responsible here (or both, since multiple answers were possible for all three questions). Approximately 59% of respondents believe that the Austrian National Bank is responsible for the value stability of money, while 58% believe it is the ECB. We also included the categories “Austrian Government” (20%) and “EU” (24.3%). Only 3.8% believe that private banks are responsible, and approximately 1.5% believe that nobody is in charge, while 5.25% answered “don’t know”.

Bivariate descriptive results

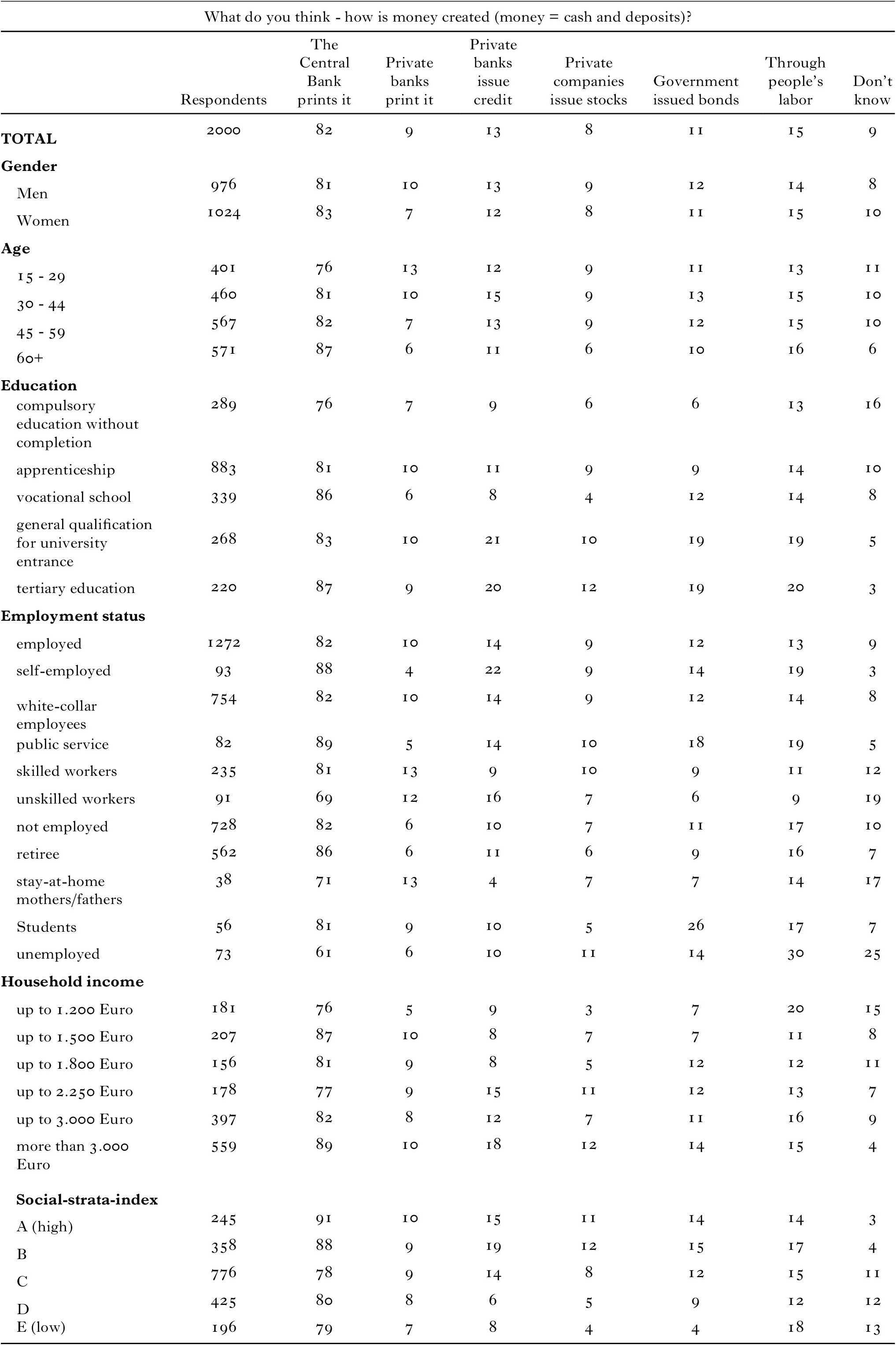

The bivariate descriptive result indicates that, across the studied social groups in regard to gender, age, education, household income and social strata, money knowledge is very low, although there exist relative differences at this low level. In other words, throughout all social groups, Austrian society knows very little about money. Knowledge is particularly low in regard to the question of the creation of money.

How are these three questions distributed across the variables of gender, education, employment status, household income and social strata? The results presented here are from Appendices 2, 3 and 4. All response categories of question 1 show almost no difference with regard to gender. With respect to age, it is interesting to note that the older the citizen, the more often he or she responded that money is created by the printing press of the central bank. However, age also has an influence on the view that private banks print money. Younger citizens aged between 15 and 29 believe twice as often as citizens over the age of 60 that private banks print money. The youngest also replied “don’t know” to this question twice as often as the oldest. As in the case of gender, there is no clear overall effect on money knowledge. The effect of education level was relatively modest. The belief that money is generated when governments issue bonds is three times higher in the highly educated group than in those with the lowest education level. It is interesting to note that twice as many highly educated people as people with the lowest education level know that money is created through private banks. Additionally, there is a small difference between the highest and lowest education levels in regard to the knowledge that money is printed by central banks. Furthermore, many more people with low education levels (16%) reply “don’t know”, compared to the highly educated (3%). Employment status shows some variance within the categories. Public sector employees have the highest percentage of answers in regard to knowing that the central bank prints money (89%), while unskilled workers have the lowest (69%). The self-employed knew more often than all others that money is created by private banks (22%). The variance between the other categories is rather small. Additionally, students believe more often than others that money is created by government bonds (26%), and the unemployed believe more often than others that labour is the source of money (30%). The unemployed also answer “don’t know” most often compared to the other categories. When it comes to household income the picture is similar to that of education levels. The wealthy know more often that money is printed by central banks and they know twice as often as those on the lowest income levels that private banks create money. Those within the lowest income levels also reply “don’t know” more often. When we look at social strata (a combination of household income, education level and job position), people from the highest strata know most often that central banks print money. However, the second highest strata knows more often than the others that money is created by private banks. People from the lowest strata reply “don’t know” most often, but incorrect knowledge (myths) are the lowest in the lowest strata.

The question of how money is backed is again almost equally distributed between men and women. The correct category (“money is not backed at all”) does not differ in regard to gender. There is also almost no difference in this area with regard to age. Nor is there a great difference with respect to the other categories. It is interesting to note that older people are more likely to believe that money is backed by gold. Younger people are more likely to say that they don’t know. Education level has no effect on knowledge about how money is backed. The higher the education level, the greater the belief in the myth that money is backed by debt and credit. In addition, a higher education level goes hand-in-hand with the belief that money is backed by gold. Employment status reveals that those who work have a strong conviction concerning certain categories (money is backed by gold) and very weak convictions about others (money is backed by economic performance or money is backed by debt and credit). At the same time, those who work were the most likely to provide the correct answer: that money is not backed at all (17%). The unemployed most often replied “don’t know”. Household income and social strata yield quite similar results. The higher the income, the greater the belief in different money myths about how money is backed. The same holds true for social strata although, in both cases, the influence is usually not very great. However, only in the correct category is the effect reversed: both lower income and lower strata respondents more often reply that money is not backed at all (13%).

With respect to the question of which institution is responsible for the value stability of the euro, gender again has almost no effect. Nor does age result in substantial differences. In regard to education, higher levels show greater knowledge (meaning that the ECB is responsible for the value stability of the euro). The other categories do not show huge differences between education levels. Overall, the picture is also very similar in regard to employment status, household income and social strata. The variation within the correct categories is not very high, although the level is quite high (50-80% of respondents in different social groups know the correct answer).

The descriptive results summarized in Figure 1 highlight the fact that the general population has very little knowledge, in particular concerning the creation of money, while most believe in the myth that money is backed by gold. Many people know about the institutional responsibility for the value stability of the euro (56%). Additionally, our descriptive bivariate results (see Appendices) indicate that there are differences between social groups in regard to certain money myths. When looking at knowledge, there is almost no difference with respect to gender although the other variables show differing results. Some variables (as expounded above) show a directed effect (e.g., education on the knowledge that the ECB is responsible for the value stability of the euro), while they have no influence on others (education has no effect on the correct answer to Question 2, that money is not backed at all). Again, it is important to note that the differences described here concerning money knowledge occur at a very low level. The specific descriptive results for each question asked were then compiled in a money-knowledgeindex (described below). Additionally, it is important to note that, in the multivariate analysis, we concentrated on gender, age, income and education level since the social strata index is a variable consisting of the education, income and employment status variables.

Money-knowledge index

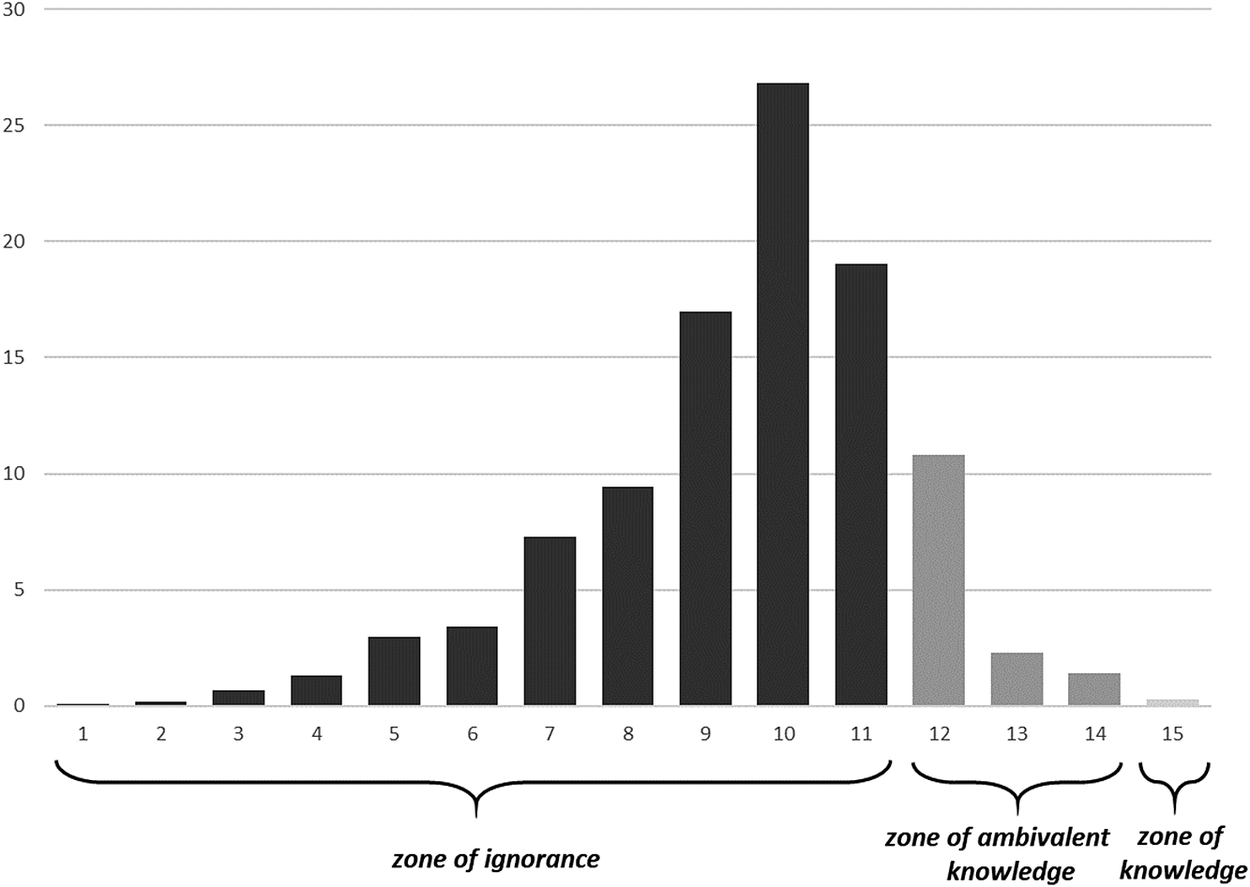

Money knowledge was operationalized by three questions, each of which consisted of seven categories (multiple categories could be ticked). An index was constructed to cover overall knowledge across all three questions. The index counts the correct number of answers. In Question 1, there are two correct categories, and both had to be correct for the answer to count as correct). In Questions 2 and 3, only one category was correct. In each case, the number of incorrect categories ticked was subtracted from the total. The original index ranged from 3 to -11. The theoretical range of the index was from 3 (only correct answers and no incorrect answers ticked) to -14 (no correct answers and all incorrect answers ticked). The value zero could result from always ticking “don’t know” or from having an equal number of correct and incorrect questions. This theoretical index was reached at the positive maximum (.03% had only correct answers and no incorrect ones), while there were no empirical cases of the negative maximum. The index was then transformed to contain only a positive range. The transformed index ranges from 1 to 15 (mean = 9.5, SD = 2). It is important to note that the index value 12 indicates an equal number of correct and incorrect answers (12 = 0 in the original index). Index value 11 indicates one more incorrect than correct answers. Index value 10 indicates that there were two more incorrect than correct answers, and so on. The index mean value of 9.5 indicates the most frequent category in which people provided more incorrect than correct answers. Low scores indicate either that myths replace knowledge or that respondents were overly confident in their knowledge and therefore ticked incorrect answers they believed to be correct. Since the formulation of the questions asked for opinions (“what do you think…”), we interpret low index scores as a high belief in money myths. Only 0.3% had a score of 15 and 0.1% had a score of 1. From studies conducted in the fields of financial literacy, we can hypothesize that education and income have a positive effect on money knowledge, that men know more about money than women, and that age and money knowledge are inversely U-shaped.

As shown in Figure 2, three zones on the money-knowledge/money-myths continuum can be identified: a “zone of knowledge” (0.3%), a “zone of ambivalent knowledge” (14.5%) and a “zone of ignorance” (88.2%). This shows that the overwhelming majority of respondents are in the zone of ignorance, which can also be interpreted as belief(s) in money myth(s). It is important to note that the range below an index score of 12 can be seen as either the “zone of ignorance” or the “zone of myths”. However, no qualitative interpretation can be provided about the kinds of myths in which people in this range believe.

Figure 2 Response frequencies of money knowledge (three questions)

Multivariate analysis

Table 1 summarizes the regression model using the calculated money-knowledge index as the dependent variable, and income, age, gender and education as independent variables. Model 0 provides the bivariate correlation between the dependent and independent variables, and Model 1 provides the multivariate regressions using the different sociodemographic variables as independent variables. The model suggests that age, income and education have a small but significant influence on money knowledge. Older respondents know slightly more than others about the money system, and those with higher income and higher education know less. Gender has no significant impact on money knowledge.

Table 1 OLS Regression Money Knowledge

*** P < 0.01; ** P < 0.05; * P < 0.1;

Numbers give standardized beta coefficients.

The multivariate analysis sheds more light on the results from the descriptive analysis. It is clear that some of the descriptive results are valid for the entire population (p < 0.1). At the same time, the very small effects of all included variables as predictors of money knowledge are also coherent with the descriptive results in the sense that money knowledge cannot be adequately predicted by any of these variables.

Discussion: Knowledge, myths and misconceptions

People use money in everyday life in ubiquitous and multiple ways. They use it in markets and beyond, in both organizations and communities. They use it in very different social relationships (buyer-seller, creditor-borrower, employer-employee, state-citizen, parent-child, member-association, donor-public charity, etc.) and for a variety of economic and non-economic purposes, without being able to name them abstractly or to be reflexively aware of their effects. As Zelizer [Reference Zelizer2011] noted, people also know that money has quite different meanings in different social contexts depending on the situation in which it is used.

In sociological research on money, however, it has remained unclear what ordinary people know and what they do not know about money and the institutional foundations of the monetary system. Against the background of such a serious research desideratum, we examined empirically what people actually know about the monetary order. In this study, we found that people know hardly anything about money and the institutional foundations of the monetary order. Although people use money ubiquitously in everyday life, they mostly know little to nothing about how money is created, whether it is backed by tangible assets, or whether it represents nothing but a dematerialized “pure token” [Simmel (1900) 2004: 176]. Additionally, people have very vague notions about institutional responsibility for the value stability of the euro. People’s knowledge about money, money creation, money backing and the underlying institutions of the monetary order is at best rudimentary. This significant, blatant ignorance is remarkable, especially given that people in everyday life are naturally willing to barter goods in demand for a pure token, donate money for charitable or non-profit purposes, share and give away money within families, or do anything else to avoid monetary penalties.

Ever since Simmel, the sociology of money has assumed that people believe in money myths. Like people’s money knowledge, money myths have not been empirically investigated. At best, the sociology of money has speculated which myths are involved. With our empirical study, we show that people know little to nothing about the institutional foundations of the monetary order while claiming to know something about money. The interviewees indeed believe in money myths. That is, money myths are widely used by the population in a variety of forms; for example, the assumptions that money is backed by physical assets such as gold or other precious metals, that customers’ savings deposits are passed on by the banks as loans to borrowers, or that only central banks create money by printing and issuing banknotes, not private banks by lending, which the central banks authorize them to do. The vast majority of people do not know that deposits are created by a “keystroke” [Wray Reference Wray2015: 66] when a bank customer demands a loan or overdraws the account. Obviously, most respondents believe that deposits or debit cards are the same as cash. However, respondents have illusory notions about the fact that money is backed by rare materials or value stocks. Thus, we state a double empirical finding, i.e., people know little or nothing about an institution as central as money, but at the same time they indicate that they do know something. In other words: People believe in money myths.

Another finding of the survey is sociologically significant. Similar to the belief in money myths, the lack of knowledge about money and the institutional foundations of the monetary order are more or less socially indifferently distributed throughout the population—regardless of age, gender, education, profession and income. As we have shown, all socio-demographic and socio-economic variables play a negligible role in the social distribution of monetary knowledge and myths. This finding is remarkable, since patterns of perception and interpretation are usually influenced by these sociological variables. Within the very small “zone of knowing” there are at most a few socio-structural abnormalities. For example, respondents who are self-employed or have a higher education know that money is created by private banks more often than all the others. Both of these groups are more likely to know that the ECB––and not the national central bank––is responsible for the monetary stability of the euro. However, it should be noted here that the vast majority of the self-employed with an above-average education who were surveyed believe in money myths.

So far, we have classified all “incorrect” response categories on the dimensions of money creation, money backing and monetary institutions as “money myths”, which we have located in the “zone of ignorance”. However, such a classification is not unproblematic in a sociological sense. Therefore, we differentiate in the following between money-related myths and misconceptions or fallacies. We call only such “incorrect“ response categories money myths, insofar as their claim of validity is collectively shared by a majority of the interviewees. In order to be able to speak of money myths, a second characteristic must be added. Money myths are different from other misconceptions or fallacies in that they are efficacious in the social world. Myths can facilitate or stimulate collective actions. Contrary to misconceptions or fallacies, money myths can unfold—in the sense of the classical Thomas theorem—collective effects on the structural level of a monetary order. They justify specific practices in the everyday use of money. For example, money is used in the expectation that the myth will not be disappointed. In other words, money myths influence and perpetuate specific social usages of money. The believers in money myths use money in accordance with their beliefs and not otherwise because they believe in the accuracy of the money myths. On the other hand, we define “incorrect” response categories as misconceptions or fallacies if they are only shared by a small minority of respondents and do not have a broad impact in the social world. Against the background of our empirical findings, we classify the “incorrect” response categories “all money is printed” and “money is backed by gold” as money myths. On the other hand, we interpret all those “incorrect” response categories (1.2, 1.4, 1.5, 1.6, 3.1.) as misconceptions, which are only considered correct by a minority of the sample.

In the results chapter of this article, we first focused on question 1 (money creation), in respect of which response categories are “right” or “wrong”, based on recent official statements by the ECB and the Bank of England. Accordingly, we have classified the answer categories “the central banks print money” and “private banks issue credit” as “correct” and all other response categories as “incorrect”. In question 2 (money backing), we have argued that “money is not backed at all” is “correct”. In question 3 (money institutions), we have assigned “correct” and “wrong” response categories in the sense of the legal mandate of the ECB. Against the background of the sociological literature (see chapter 1), however, it makes sense to interpret the assignments of the response categories (“correct”/“incorrect”) in a broader sense. From a sociological perspective, one could argue that money myths (“all money is printed” and “money is backed by gold”) are social facts in the sense of Émile Durkheim [(1895) 1982], which create an action-oriented interpretive framework (“trust”) and influence the everyday use of money. More precisely, money myths are not mere fictional imaginations, but narratives that socially embed the usages of money. Against the background of this theoretical consideration, we interpret our empirical findings as follows: Ordinary people readily accept deposit money as long as the expectation is not disappointed that these money forms can always be exchanged for cash or precious metals at any time. Following this theoretical consideration, it makes sense to interpret collectively-shared money myths, which we have previously identified in the “zone of ignorance”, as narrative frameworks that culturally embed the monetary order and thus contribute to its social stability. In this sociological sense, money myths can be classified as “correct” response categories.

This finding somewhat challenges the assumption by scholars of the recent communication efforts of national banks about the “real” functioning of the monetary order. In contrast to Braun [Reference Braun2016] and Holmes [2014], for example, our findings suggest the limitation of communications by central banks, e.g. in that the bulk of modern money is created by private banks issuing credit and not by central banks issuing notes and coins. Instead, the prevalence of money myths seems deeply rooted in ordinary people’s perceptions of money. It is therefore questionable whether the central banks’ speaking to the people (Braun) and an “economy of words” (Holmes) can change monetary knowledge. Note, however, that central banks only recently began to change their communication about the monetary order in order to enhance “real” knowledge about it. Future research could hence more closely evaluate whether money myths can be altered by the communication efforts of central banks and other actors (e.g. “positive money initiatives”) in the long run and to which social groups they appeal most. As our results draw on the Austrian case where the national bank has not launched communication campaigns and full money initiatives are not existent, it would be interesting to replicate the survey used in this study in other countries (see below), particularly in the UK, which provides an outstanding example of changing communication by a central bank.

Finally, we may add that money myths never seem to be stable over time. They can erode, and they have to prove themselves in recurring financial market crises [Rogoff and Reinhart Reference Rogoff and Reinhart2009]. Even in normal times they can be put to the proof. This may for example be the case if the everyday usability of cash as a payment instrument is restricted (see the different upper limits for cash payments in the eurozone since 2010) or the account holders cannot “escape” from negative interest rates and thus undermine the store of value function of money. Money myths can certainly be put to the proof in extraordinary events (bankruptcy, galloping inflation, prohibition on the private purchase of gold, limitation of legal access to cash––see the Debt Crisis in Greece of 2015). At the peak of financial market crises, money myths may even turn out to be an illusion. From a sociological perspective, it would certainly be hasty to interpret money myths as simple ignorance or as “false consciousness”. As long as money myths are not disenchanted, they can be latently efficacious in everyday life. However, money myths are questioned in a fundamental way, for example, when credit money can no longer be “withdrawn” from the cash account—within the limits of the available budget or the granted credit line.

Our empirical findings also show that we cannot confirm the assumption of the sociological literature of money since Simmel (see chapter 1) that people believe or trust that money is “backed” “through the beliefs of the people” (item 4 of question 2, 11.65%) or the future purchasing power (“goods and services”, item 3 of question 2, 24.53%). It would thus seem that our empirical findings on money knowledge can by no means be interpreted so clearly in the sense of a simple dichotomy of the response categories along the distinction between “correct” and “incorrect”. An empirically unclear issue that requires further investigation is the extent to which the myth-based ignorance of the “objective” architecture of the monetary order is indeed a prerequisite for ordinary people to use money in everyday life largely without friction, as one might theoretically assume against the background of the sociological money literature.

Another issue that remains to be investigated relates to the empirical findings in Austria on money knowledge and money myths as compared to other countries of the European Union or the eurozone. First of all, it should be noted that empirical studies on knowledge or ignorance in the population regarding money and the institutional foundations of the monetary order are not available in other countries. We suspect that similarities and variations can be found in other European societies. It would not be implausible to assume that in many countries comparable results can be expected in all three dimensions (money creation, money backing, monetary institutions). At the same time, however, it can be assumed that significant deviations would be found in some countries. The diffusion of money myths among the population may depend on country-specific institutional confidence. If institutional confidence is high, it could also be assumed that money myths are widespread. Further dependent variables would be the perceived performance of the national economy or the economic dynamics of “northern” EU-countries, the internal and external “power prestige” [Weber (1921-1922) 1978: 910] of national political elites, as well as the level of state loyalty among the population. We could expect that, in national societies with precarious economies, drastic economic and financial crises in the recent past and a strong skepticism towards the state order (e.g. Greece), the belief that money is backed by gold or that national political elites have sufficient capacities to successfully ward off a supranational crisis of the European monetary order is less widespread.

The empirical findings on money knowledge and money myths have important implications for research on financial literacy. Contributions in the field of financial literacy suggest that financial knowledge is unequally socially distributed, and that age, gender, education and income play an important role in the appropriation of mathematical and financial knowledge. However, as we have shown, the findings of financial literacy research do not correspond with the money knowledge of the population. Rather, it can be concluded that even persons with above-average financial knowledge do not necessarily know how money is created. Nor do they know the difference between private credit money (deposits) and central bank money (cash), whether money is covered by assets, and which institutions are responsible for the value stability of the euro. Rather, it can be assumed that many people with solid or above-average financial knowledge also believe in money myths. Against this background, a key aspect of financial literacy research is that the knowledge dimension is limited to mathematical and financial knowledge, but the dimensions of monetary knowledge and myths are ignored.

What follows from the empirical findings on money knowledge and money myths for the recent sociology of money? Zelizer [Reference Zelizer1994, Reference Zelizer2011] has examined the everyday usage of money. In contrast to the classical economic exchange theory of money [see Ingham Reference Ingham2004] and Simmel’s sociological “quantity theory” of money, Zelizer analyses the “qualitatively” multiple, social and cultural embeddedness of money usage in everyday life [see Dodd Reference Dodd2014: 269-311; on the distinction between a “quantitative” and “qualitative” sociology of money and a critical review, see Kraemer and Nessel Reference Kraemer, Nessel, Klaus and Nessel2015: 13-21]. Our findings on money knowledge and money myths refer to a research dimension that was largely ignored by Zelizer. The use of money is not only involved in social and cultural contexts and social meanings. When people use money (for example, when sharing, lending, giving, saving, and connecting money with multiple meanings), they always do so in the expectation that they know what money is. For multiple social and cultural purposes, money can also be used—in normal times—in an unproblematic and unquestioned manner, because people are guided by their as-if-money knowledge and money myths. Against this background, it would be fruitful to more precisely discuss Zelizer’s thesis of the “social meaning of money” in the context of the presented findings on widespread money ignorance and myths.

Our findings can also be valuable for a political economy of money. Undoubtedly, Ingham is a prominent author investigating the institutional foundations of the modern monetary order, the power imbalances between key groups of actors (creditors, debtors, the state), and the dominant conflicts of interest over monetary stability from a decidedly sociological perspective. Against the background of the survey, an important question emerges with respect to ignorance and money myths within the population for the power asymmetries and conflicts of interest outlined by Ingham. It will also be necessary to clarify the influence of asymmetrically distributed money knowledge—for example, between experts and non-experts—on the modern monetary system. It is always relevant to the question of how myths about money—beyond all sociodemographic and socioeconomic variables—affect power asymmetries and conflicts of interest within the monetary system. In this context, it will also be necessary to clarify the extent to which the empirical findings on money knowledge and money myths can be used in the recent sociological debate on the privilege of private banks to create bank deposits through loans [Huber Reference Huber2017; Sahr Reference Sahr2017]. For example, it might be discussed whether the fiat money regime works (in normal times) without friction because ordinary people do not know how money is created.

Finally, we want to discuss the question of how the empirical findings on money knowledge and money myths—or misconceptions and fallacies—can be interpreted in light of Simmel’s [(1908) 2009: 315] classic thesis on “trust” as a “middle position between knowledge and ignorance”. Our findings show that the vast majority of the respondents in the sample (88.2%, see chapter 5.2) are to be found in the “zone of ignorance”. These respondents believe that the total money supply is printed and covered by value assets, that the nation state guarantees bank deposits in the event of a banking or financial crisis, and that the National Central Bank is responsible for the value stability of the euro. In contrast, the “zone of knowledge” (.3%, see chapter 5.2) of those respondents who do not believe in money myths is very small in our sample. They know that money is not only printed by central banks but also created through lending by private banks. These respondents are aware that money is not backed by gold, government bonds or commodities, or loans or debts. Instead, they state that money is not backed at all. They assume that the legal guarantee of bank deposits in the event of a banking crisis is not a redeemable promise. In addition, they know that it is the ECB and not the National Central Bank that is responsible for monetary stability. They may also distrust the “economy of words” [Holmes Reference Holmes2014; Beckert Reference Beckert2016: 113-116] of central banks.