The leaders of international monetary regimes benefit from the power that leadership brings them. It is therefore no surprise that, when such regimes face challenges, dominant states attempt to stabilize them. But their efforts often fail. Just why they fail is a persistent question. Theorists have offered a range of possible explanations, though most are exogenous to the international politics and governance of the regimes themselves. They tend to blame the decline of existing leaders (Kindleberger Reference Kindleberger1973), external shocks (war, depression, and so on) (Obstfeld and Taylor Reference Obstfeld and Taylor2004), or national-level political shifts (Simmons Reference Simmons1994).

I draw on historical institutionalism (HI) and macroeconomic regime (MR) research to build a novel theory of endogenous international monetary regime change (Blyth and Matthijs Reference Blyth and Matthijs2017; Fioretos Reference Fioretos2017). I show that distinct leadership strategies and member responses emerging in particular historical structures can explain important mechanisms of stability and change in international monetary orders. More specifically, I isolate two modalities of opportunistic leadership, cooptation and stratification, that drive different patterns of regime development and change. Leaders turn to these strategies when their systems are under stress. Each yields short-run benefits at the cost of long-run disruption and eventual regime failure.

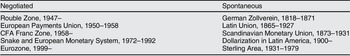

In what follows, I explore the incentives behind the strategic choice between cooptation and stratification. I also describe the consequences of this choice for regime stability and change by focusing on two distinct historical pathways: collapse—rapid and sudden break down; and decline—gradual disintegration over time. Figure 1 illustrates these sharply contrasting historical processes from the year of operational foundation to the point of complete dissolution in the interwar gold-exchange standard (1922–1936), Bretton Woods system (1958–1978), Sterling Area (1931–1979), and Latin Union (1865–1927).

Figure 1 The thing to be explained: International monetary regime collapse and decline

Note: The rate of dissolution measured as the fraction of member states remaining in each year following the regime’s operational onset. T0 = Interwar 1922; Bretton Woods 1958; Sterling Area 1931; Latin Union 1865.

Sources and coding: Refer to online appendix 1.

What explains these distinct historical pathways? I argue that variation in historical structure (institutional constraints on policymaking) influences which strategy a leader selects—cooptation or stratification—and therefore which developmental trajectory follows.

In brief, cooptation and stratification are two different ways in which leading states can externalize balance-of-payment adjustment pressures from themselves while promoting a measure of regime stability. Through cooptation, the leader includes members in collective efforts to share the burden of the costs of economic adjustment arising from international payment imbalances, whilst also dampening calls to pay these costs immediately. National financial authorities (ministries of finance and central banks) are enabled to transcend their domestic political contexts, and given positive incentives to support the leader and the regime, limiting the possibility that member states will exit when pressures arise. Under a stratification strategy, the leader excludes regime members from policymaking. Member authorities are also kept apart from each other to avoid collective bargaining over the allocation of international adjustment costs. The leader manipulates burdens and benefits by setting different policies for different countries and allowing some to leave the regime.

Ideally, leaders would include valued regime members while excluding those that threaten instability (Hirschman Reference Hirschman1970, 93). But such an approach, mixing elements of cooptation and stratification, depends on a delicate balance between a leading state’s public international function to provide good regime governance and its private national motivation to avoid the burdens of economic adjustment. This balance is difficult to achieve given the temptations of preponderant power. By contrast, pure cooptation and stratification strategies seduce leaders with clear short-term gains that increasingly conflict with the long-term requirements of regime coherence.

Whether a leader pursues one or the other of these myopic options depends in large part on what type of regime it leads. My focus is on the political and structural—as opposed to the technical and economic—features of international monetary regimes (Strange Reference Strange1971); I am concerned with how they cohere and how rules are made and implemented in them. I therefore delineate historical structures using the classic distinction between negotiated and spontaneous international orders (Young Reference Young1982).

I show that, in negotiated regimes formed through interstate political bargaining, leaders are more willing and able to use cooptation. In spontaneous regimes, which originate in economic processes of trade and financial integration, incentives tilt toward stratification. We can therefore predict distinct patterns of regime development and change in negotiated and spontaneous orders. Cooptation builds in tensions that lead systems to collapse all at once. Stratification lays the groundwork for protracted decline.

The developmental logics are straightforward. Cooptation is essentially a ruse, whereby the appearance of constructive cooperation dampens ongoing balance-of-payment problems. Awareness of the imbalances is concealed beneath a seemingly stable surface of formal rules and technocratic devices, while relations and institutions evolve to skew payoffs in favor of the leader and against the members. Economic imbalances between nations and political resistance from inside the regime eventually limit the leader’s ability to procure member support, precipitating an abrupt redirection of its power and interest. The result is sudden collapse.

By design, stratification is less likely to trigger political backlash; this is the logic of exclusion and division. But here, again, problems arise. A leader cannot forever shun collective policy solutions and force members into asymmetric adjustment without paying a price. Following this approach ensures that rules and practices are not updated to meet changing economic conditions. Further, relational ties decay as individual members, especially those with raw deals, edge out of the regime. The result is the gradual abandonment of institutions, and slow decline.

With this theoretical framework at hand, I use comparative-historical analysis and look at primary records from several archives to probe an anomaly. International regime theory has long held that “rapid social change … is apt to undermine existing spontaneous orders without creating conditions conducive to the emergence of new orders,” while “negotiated orders and even imposed orders usually stand up better in the face of social change” (Young Reference Young1982, 290). However, in the monetary domain, the opposite is often true. The interwar gold-exchange system and the Bretton Woods system—negotiated orders—collapsed; the Latin Union and the Sterling Area—spontaneous orders—experienced drawn-out decline.

My account reveals the connections between behavioral lapses and hidden forms of macrostructural deterioration—occurring beneath formal rules and practices—that ultimately lead to these diverse outcomes. This systemic perspective takes up the case against the “reductionist gamble” of the prevailing Open Economy Politics (OEP) paradigm (Cohen Reference Cohen2016; Oatley Reference Oatley2011), while avoiding the common pitfall of structural accounts that are, too often, unclear about what states actually do to drive processes of change in the world economy. The identification of cooptation and stratification strategies also complements foundational insights into the sources of power that leading states employ to externalize economic adjustment pressures, and into the adverse consequences that can follow from the persistent exploitation of such power (Andrews Reference Andrews2006; Cohen Reference Cohen2015; Helleiner and Kirshner Reference Helleiner and Kirshner2009).

The Problem: Explaining Pathways of Regime Change

The rules, norms, and practices that constitute international monetary regimes enable cross-border trade and investment by governing the balance-of-payment adjustment process and its associated supports: liquidity and credible commitments. International adjustment remediates trade surpluses and deficits through the reallocation of economic resources. But nobody wants to adjust, because adjustment is costly (Simmons Reference Simmons1994). Should the surplus countries appreciate and/or allow inflation? Or should the deficit countries depreciate and/or stomach deflation? There are also inevitable intellectual disagreements about the causes of disequilibrium, who ought to deal with them, and when remedial action is required.

A hazard arises from the perpetual struggle over economic adjustment: the potential breakdown of cooperation and international regime failure. The question that motivates this study is how exactly this happens. Anyone seeking an understanding of international monetary regime failure must reckon with the fact that failure often assumes one of two distinct forms. One is increasing institutional maladaptation and internal pressures leading to sudden collapse (“punctuated or fast change”); the other is prolonged institutional malaise and gradual decline (“incremental or slow change”) (Rixen, Viola, and Zürn Reference Rixen, Viola and Zürn2016).

This basic contrast in how international monetary systems fail belies established understandings of why they fail. In classical structural theories, the distribution of power between states determines the resilience of a regime. The formation and maintenance of regimes is attributed to the rise of dominant powers, and the failure of regimes to declining hegemonic powers (Kindleberger Reference Kindleberger1973). The contours of monetary history can be connected to cycles of growth, expansion, and decline in hegemonic states. But structure, so defined, offers few clues about the big bangs of sudden collapse or the quiet politicking of incremental decay.

In the agential OEP tradition, the sources of regime change are located in interest group conflicts and domestic political environments (Frieden Reference Frieden2014; Simmons Reference Simmons1994). When the actual process of international regime change is theorized, this is often done through the concepts of network externalities (and switching costs) (Eichengreen Reference Eichengreen2008) or social learning/experimentation whereby ideas and policy paradigms change (Morrison Reference Morrison2016). However, the concepts of network externalities and social learning cannot provide a complete explanation for the variable temporal processes through which regimes change over time.

The stylized “punctuated equilibria” conception of historical change—periods of apparent regime stability ruptured by unforeseen exogenous shocks—in much of the exchange rate regime literature also obscures the variable modalities of regime change identified by economic historians such as Bordo and Capie (Reference Bordo and Capie1993) and Reis (Reference Reis1995). Important questions therefore remain unanswered: Is it possible to identify distinctive modes of interstate strategic interaction and governing dynamics? And could doing so help to explain why regimes fall in the ways that they do—or else endure?

To address these questions, I propose a via-media “agency-in-structure” framework. State efforts to externalize balance-of-payment adjustment costs represent a dynamic and continuing feature of international monetary relations (Cohen Reference Cohen2015; Frieden Reference Frieden2014). Further, leadership is an important source of power and privilege (Andrews Reference Andrews2006). Pressures for change are thus built into monetary regimes. However, as Newman (Reference Newman and Fioretos2017, 84) has noted, we also need to examine the “supply-side factors—institutions, rules, and processes that filter or channel [agency and] structural power.”

Here, recent efforts in HI to supplement stability orientated path-dependency analyses with dynamic models of endogenous institutional change prove valuable (Fioretos Reference Fioretos2017; Rixen, Viola, and Zürn Reference Rixen, Viola and Zürn2016). These studies lead us to inquire into dynamic processes governed by particular historical logics, including the—often symbiotic—relations between positive (self-reinforcing) and negative (self-undermining) institutional feedback effects that follow from structured patterns of strategic interaction; building a bridge to MR theory’s examination of how international regimes “change over time endogenously and systemically” (Blyth and Matthijs Reference Blyth and Matthijs2017, 210).

The aforementioned general propositions provide the analytical tools necessary for specifying the conditions under which international monetary regime failure is likely to occur and what form it will take. To build such an understanding, we must develop a model of international monetary relations that can explain how different regime types tend to structure different patterns of balance-of-payment conflict resolution, and then connect these dynamic patterns of strategic interaction to different pathways of institutional stability and change. The first step is to isolate dimensions of international regime structure that can explain pertinent differences in strategy among states seeking to resolve international monetary cooperation problems.

Negotiated and Spontaneous Orders

There are two basic ways to bring typological order to the heterogeneous landscape of international monetary regimes. One approach is to specify the monetary policy choices available to states in systems, usually focusing on the exchange rate regime (peg, band, managed float, etc.), the nature of reserve assets, and the degree of international capital mobility. The alternative approach, pioneered by Strange (Reference Strange1971), is to inquire into the political-organizational structure of regimes: under what conditions do they originate? How do participants stand in relation to each other? How are rules and norms made and implemented?

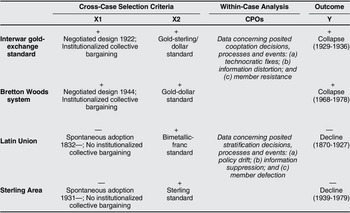

In the latter tradition, economic historians have identified two distinct international regime structures: top-down negotiated orders and bottom-up spontaneous ones (Flandreau Reference Flandreau2000; Gallarotti Reference Gallarotti1995, 218–236). Negotiated regimes emerge through deliberate political action; spontaneous ones through processes of trade and financial integration, without any conscious act of creation. The broad contours of international monetary history delineated by Eichengreen (Reference Eichengreen2008) can be neatly organized around this typology, as mapped in figure 2.

Figure 2 Negotiated/spontaneous orders: The international monetary system since 1850

Note: Solid lines are negotiated orders. Dotted lines are spontaneous orders. The floating rate (or so-called “non”) system is a hybrid (or mixed) order. *Sample (N=50) comprising countries on gold, silver, bimetallic, and paper standards.

Sources and coding: Refer to online appendix 2.

Like its bimetallic precursor, the pre-1914 gold standard was a classic spontaneous regime. It developed “more or less unconsciously” through a diffuse, market-based process that owed little to intergovernmental collaboration or the purposive application of state power (Gallarotti Reference Gallarotti1995, 228). The interwar gold-exchange standard, a negotiated order, looked very different, thanks to ongoing intergovernmental deal-making and planning (Eichengreen Reference Eichengreen1992, 153–187). This was followed by the “political miracle” achieved by delegates at Bretton Woods in 1944 that restored the interwar pattern of negotiated cooperation. But that system, too, would collapse by the mid-1970s and be replaced by a residual regime founded on the U.S. dollar and floating exchange rates.

The negotiated/spontaneous typology can also be used to classify regional international monetary orders, as in table 1. The Latin Union, for instance, developed spontaneously as member countries separately adopted Napoleonic bimetallism to attract French capital (Flandreau Reference Flandreau2000, 42). The Sterling Area emerged similarly. As a result, “the binding material of the group was economic and financial rather than political” (Crick Reference Crick1948, 3). By contrast, the Eurozone rests on a political commitment to monetary union made in the 1960s and realized through tortuous political exchanges.

Table 1 Negotiated/spontaneous regional monetary orders

Sources and coding: Refer to online appendix 3.Note: Non-exhaustive list of selected examples.

Intuitively, one might assume that negotiated regimes would be hierarchical and formal, and spontaneous ones would be horizontal and informal. Gallarotti (Reference Gallarotti1995) explicitly makes this association. However, in fact, both types can be hierarchical or horizontal, with power distributed between states asymmetrically or more equally. And, in both regime types, informal practices usually quickly supersede formal rules.

What best distinguishes the two types are their frameworks of international relations and corresponding differences in state and market arrangements. In negotiated regimes, national financial authorities—central banks and treasuries—are engaged in a political process aimed at realizing a collective institutional design. They are empowered from the outset in the domestic management of the system, and integrated internationally through institutionalized structures of cooperation and ongoing bargaining. By contrast, in spontaneous regimes, national financial authorities are engaged in an economic process of deepening international integration that is not designed or planned. They are marginalized in the domestic management of the system by established market-based practices, and they are not integrated internationally or repeatedly bargaining collectively, because of the diffuse process of regime formation. Figures 3a and 3b depict these Weberian ideal types.

Figure 3 (A) Negotiated international order. (B) Spontaneous international order

Note: Leader: leading state; MS: member state; IFI: international financial institution (e.g., IMF); IGN: intergovernmental network (e.g., G-10); TRN: transnational regulatory network (e.g., Basel Committee). These Weberian ideal types are conceptual combinations and accentuations of the given empirical phenomenon in real world cases constructed for the purpose of macroconfigurational analysis; Mahoney and Thelen Reference Mahoney, Thelen, Mahoney and Thelen2015, 5-8.

The Theoretical Framework

To understand and predict the development of international monetary regimes, we have to account for the dynamic politics of international economic adjustment within them. In this section, I assemble a framework that does this. The basic logic of my theory is that, over time, policy solutions selected under varying modalities of leadership and political contestation become entrenched in institutions and ongoing practices. The result is that international monetary regimes develop along differing historical pathways.

In an international monetary order, all the participating states are represented by national financial authorities—ministries of finance and central banks—that pursue both power for their respective nations in the international arena, and their own organizational goals in the domestic arena, such as political independence and market control.

At issue in our scenario is some unspecified balance-of-payment problem or deterioration in regime performance. The regime members disagree on a preferred solution. The leader can offer a policy solution or else exit the regime.

Following Hirschman (Reference Hirschman1970), I posit that the leader’s policy choice is motivated by concern for international system stability and avoiding domestic adjustment costs, and constrained by the possibility of member defection or resistance. The issue-specific characteristics of monetary power and interest also shape the strategic environment: in contrast to other areas of bargaining between states, the leader is limited in its ability to defect (compare Stone Reference Stone2011); the uncertainties are too great and the costs of creating new arrangements too high for unilateral defection to serve as an attractive instrument of leadership power. Leaders instead exercise power by manipulating member state and market behavior through strategies of cooptation or stratification that shape the costs attached to regime exit and the value of participating in collective regime management.

A leader pursuing cooptation includes members in international decision-making structures and policy solutions (Selznick Reference Selznick1949, 11). This leverages the market coordination capacities of foreign monetary authorities. The collective transactions dampen and mask balance-of-payment adjustment pressures, helping to stabilize the regime. Cooptation also engenders loyalty through a shared sense of regime ownership. The process of cooptation generates, as I will explain in further detail later, increasing returns from club goods and path-dependent cognitive effects that raise the costs of withdrawal over time. This reduces the likelihood of member defection, but increases the probability of resistance internal to the regime.

Stratification involves the opposite approach, excluding members from policymaking. The leader monopolizes policy—establishing a single focal point for market coordination—and members adjust independently. This promotes regime stability by avoiding costly collective bargaining over the allocation of economic adjustment costs. The pattern of bilateral dealings and side payments means policies are generally easily tweaked, and practices can be selectively amended or dropped. This allows for bespoke membership terms and embeds liberal norms of voluntarism. But path dependencies are still at work: the longer collective bargaining is avoided, the harder it becomes to reverse course and impose collective discipline downstream. The likelihood of member resistance is reduced, but the probability of quiet defection rises.

Structure, Strategy, and Policy

Leaders could try to promote regime stability through a subtle combination of cooptation and stratification. But they can escape neither self-interest nor historical structures that skew payoffs and influence strategic choices. This section explains the relationship between international structure—regimes’ historical properties, which constrain actors—and leadership strategy and policy choices.

Because negotiated orders integrate members, leaders of such orders tend to be biased toward cooptation as a means of facilitating collective transactions that help suppress calls for them to pay a fair share of adjustment costs, and instead shift their own adjustment costs onto members. A leader’s ability to requisition collective support is usually enhanced by the considerable costs members will have shared when establishing negotiated orders. The homogenization and regulation of relations among members created by negotiated designs also makes cooptation easier. Further, while leaders must share some gains with members, collective bargaining is not just a cost for leaders. The members can be organized to pool a reservoir of power and technocratic authority that can help stabilize the system and advance the leader’s private interests, if it is correctly deployed.

How do leading powers coopt members into the defense of unequal international monetary orders? To establish asymmetric patterns of economic exchange, leaders give patronage to national monetary authorities, in particular by advancing their organizational goals of independence and influence in domestic policymaking. Bargaining forums create an opportunity for arranging special forms of reciprocity that put power into the hands of national monetary authorities. These private benefit schemes can encourage monetary authorities to compromise their national interests and even overlook objective performance concerns about systems as a whole. Repeated bargaining over common policies can also build shared beliefs and conceptions of macroeconomic problems, generating member commitments to defend the system although their gains from it are less than equitable (McNamara Reference McNamara1998).

In negotiated orders, the national-level environment, too, encourages cooptation. The initial involvement of the state in forging negotiated regimes means financial authorities have significant power vis-à-vis international markets. They are thus not beholden to market discipline that would enforce their commitment to the system. To manage this problem, officials need to tie their own hands. Commitments to the negotiated interwar gold-exchange standard, for example, depended on statutory laws and international contracts; such formal devices had been largely absent in the spontaneous classical gold standard era (Eichengreen Reference Eichengreen1992).

In contrast, spontaneous orders push leaders to pursue stratification. In a spontaneous order, the leader’s structural power springs from the fact that members are not organized collectively. The leader can maximize its utility by avoiding collective bargaining and instead exploiting the system’s fragmentation and heterogeneity by setting different policies for different members. Price discrimination and secret side payments can yield allocative efficiency gains in international adjustment. We can identify this logic in the Sterling Area, for instance, by citing the special privileges Britain granted to Australia and South Africa as gold producers while at the same time leaning heavily on former colonies and dependencies.

Stratification is thus a “divide-and-rule strategy,” aimed at preventing “the formation of countervailing coalitions” (Nexon and Wright Reference Nexon and Wright2007, 261). How can this goal be achieved? The primary instruments of stratification are tactical policy restraint, including “non-decisions,” and the suppression of information (Bachrach and Baratz Reference Bachrach and Baratz1963, 632–642). Policy restraint and information suppression make issues “safe” from doctrinal debate at home and abroad. This reduces the likelihood that members will organize themselves and demand a say in policymaking. Instead, members compete among themselves for the best bilateral terms with the leader, who can thus exploit this competition to charge members different rates to stay within the system.

In spontaneous regimes, the national-level environment, too, is conducive to stratification. In these market-based orders, the state is marginal. The commitment of policymakers to established lines of conduct is therefore subject to market discipline, and they can be relied upon to support the system when they follow their discretion and produce policies in response to contingencies. Eichengreen (Reference Eichengreen1992) showed that this logic enabled occasional suspensions of the gold standard before 1914. Even if the state acquires greater capacity for market control over time, where indirect means of market control already exist, officials are free not to use that capacity.

Endogenous Macro-Institutional Effects

This section outlines the set of policy maladaptations and endogenous pressures arising under cooptation and stratification that drive negotiated and spontaneous regimes to develop and change in contrasting ways.

Under cooptation, leading and member states are engaged in opportunistically constructing collective arrangements that defer and obfuscate balance-of-payment adjustment problems. While cooptation promotes regime stability in the short run, it causes pressure to build up below the surface, through two counterproductive processes: technocratic fixes and the exchange of distorted information. The eventual member response is resistance.

First, technocratic fixes can dampen members’ demands for balance-of-payment adjustments to be made immediately with the leader sharing the cost, in particular by enabling monetary authorities to invent financial means (such as credit swaps) to defend status quo policy commitments. In this way, markets are calmed and politicians indulged. However, what often goes unrecognized at first is that temporary fixes soon become embedded in standard operating procedures, making policy reversals increasingly difficult, or even impossible. And, at the same time, technocratic fixes are fragile because they depend on a jointness of supply and continuing investments. Moreover, in a system propped up by technocratic fixes, political disputes and economic imbalances are likely to worsen under the surface, as economic adjustments are deferred, and the long-term problems necessitating them go unsolved. As the Economist observed of the Bretton Woods system in 1966:

Intricate currency problems have bedeviled the West for at least six years. Some hard choices have to be made. Governments as well as central banks prefer to duck them. So they turn them over to those clever chaps in Basle, and, hey presto, another short term credit is hatched, committing nobody and solving little. It is the financial equivalent of Immaculate Conception.Footnote 1

Secondly, cooptation is liable to distort patterns of information exchange. Individual and group misrepresentations of the health of the system can dampen adjustment pressures by “window dressing” macroeconomic indicators and affirming commitments to the status quo. The closed nature of international forums also leads officials to filter outside information supplied by markets and other outsiders, affirming the collective beliefs of the negotiating group and disregarding contradictory data. Such misrepresentations can strengthen the ability of regime members to overcome constraints on collective action and to solicit ongoing investments by bolstering beliefs that balance-of-payment disequilibria will resolve themselves rather than worsen over time. But the long-run maladaptation risk is that information exchange platforms will be diverted from the functional goal of reaching mutual agreement on how actual international economic adjustment might be achieved. The image they project of a robust regime with committed members risks becoming divorced from reality and susceptible to sudden refutation.

Technocratic fixes and collective misrepresentations seem enticing because leaders and members both benefit at first from the deferral of economic adjustment. But these benefits are not enjoyed equally. The longer unequal payoffs continue, the more member states will chafe and the more backlash their coopted monetary authorities will suffer at home. Members will eventually resist the established lines of policy, because voicing discontent should improve their leverage in negotiations, and because they are embedded in the rule-making process, so revising the rules and ideas will feel like a promising option (Goddard Reference Goddard2018; Hirschman Reference Hirschman1970, 82-83). As balance-of-payment disequilibria increase, and the costs of walking out on the joint institutions propping up the system surge, members can be expected to bargain harder. New agreements will become tougher to reach and markets harder to mollify. Eventually, maladaptation and resistance to the status quo reach a tipping point where negotiated regimes collapse: the leader, weary of sustaining a buckling foundation, redirects its power and interests, and the system falls apart.

Like the path of cooptation, the logic of stratification benefits the leader and system members in the short term, by deferring pressures to adjust economic balances of payment, and giving an impression of regime stability. But, again, two counterproductive long-term processes play out: policy drift and suppression of information. The adverse member response is silent defection.

First, strategic non-decision-making and policy restraint, designed to avoid collective bargaining, result in policy drift and a lack of reform (Hacker Reference Hacker2004). The inertia of stratification can provide an illusion of stability, because things continue as they have in the past and members seem placated. But, though it is difficult to see, the regime risks being quietly hollowed out through this policy stasis, as rules, practices, and ideas do not keep up with changing socioeconomic circumstances. The result is growing imbalances behind the scenes, and gradual institutional maladaptation.

Secondly, following the path of stratification, the leader will suppress the exchange of information to enable it to discriminate between members in terms of the prices they must pay to participate in the system. The logic is straightforward: if adjustment costs are to be manipulated through price discrimination on a sustained basis, the unequal terms of membership agreed via secret side deals must be kept confidential. The problem is not just that informational gaps and silos frustrate coherent policymaking, but also that silent blackspots make it hard for the leader to track changing member allegiances and ties. The suppression of information will deny leaders an important source of feedback about the needs of the system, potentially causing slowly accumulating problems and acts of defection to go unnoticed.

In this political setting, dissatisfied members are more likely to defect than to try to revise the status quo. After all, members are excluded from decision-making and have little scope for effecting change (Hirschman Reference Hirschman1970, 82-83). Moreover, by partially and quietly defecting, members can avoid forfeiting benefits. The leader may know that members are shirking, but the logic of stratification prevents discipline, especially in the form of efforts to raise exit costs, which would risk inspiring members to find their collective voice. A certain amount of defection is therefore tolerated. Over time, the rules, practices and ideas supporting the system become riddled with exceptions or abandoned entirely. This causes common interests to disintegrate and members to withdraw little by little. The outcome is gradual decline.

Summary

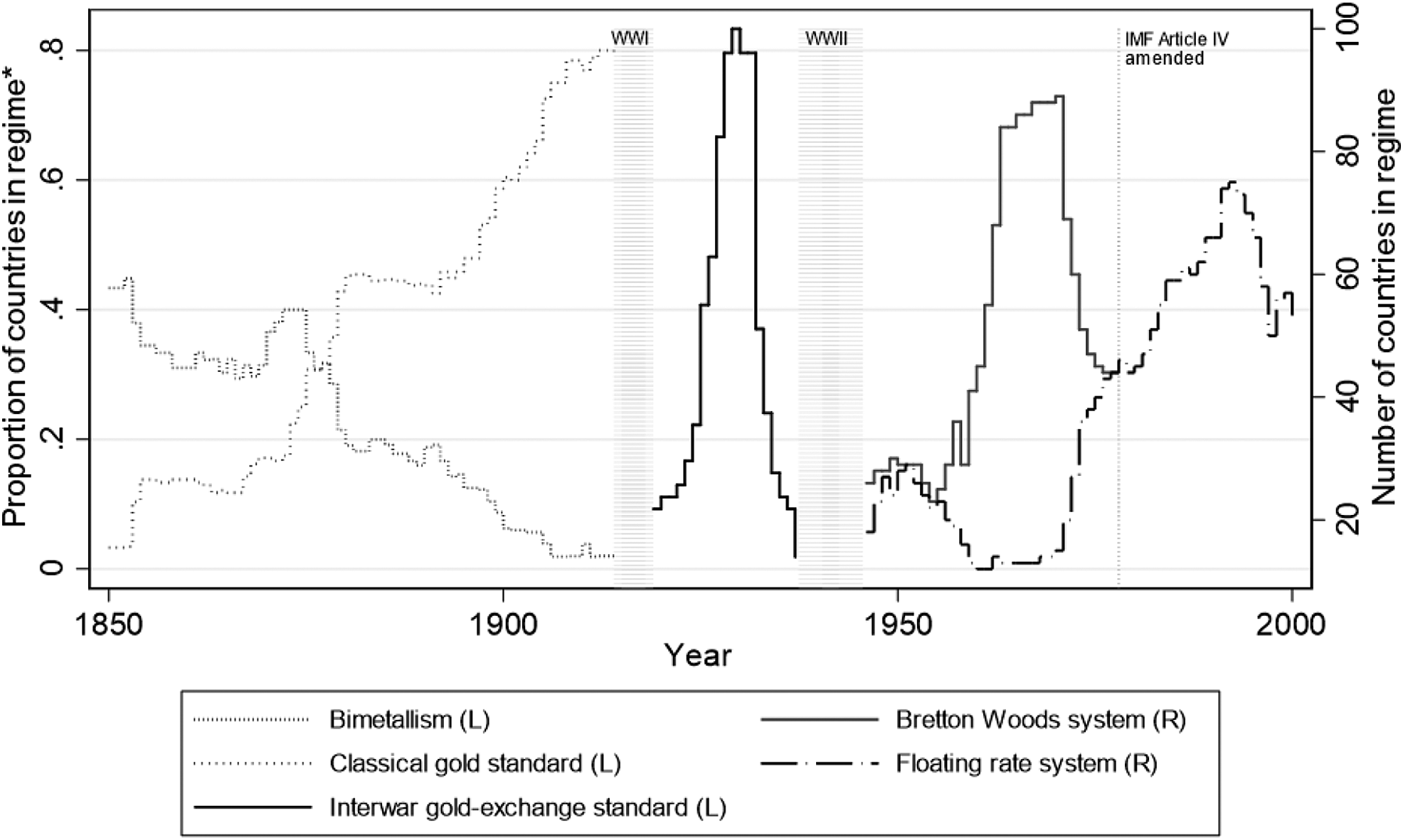

Under either strategy—cooptation or stratification—leaders prioritize short-run power. They seek opportunistic gains: manufacturing short-run stability through the avoidance of economic adjustment and ignoring long-run downsides in the form of policy maladaptation and political discontent. We need not turn to exogenous shocks (or irrational cognitive pathologies) to find sources of system failure: rational power political strategies, operating in specific historical structures over time, offer a sufficient explanation. Figure 4 summarizes.

Figure 4 Flow diagram of developmental pathways

Note: The conjectures in light gray text are not fully specified. Power symmetry can be a source of constant jockeying for position and destabilization.

Comparative-Historical Case Studies

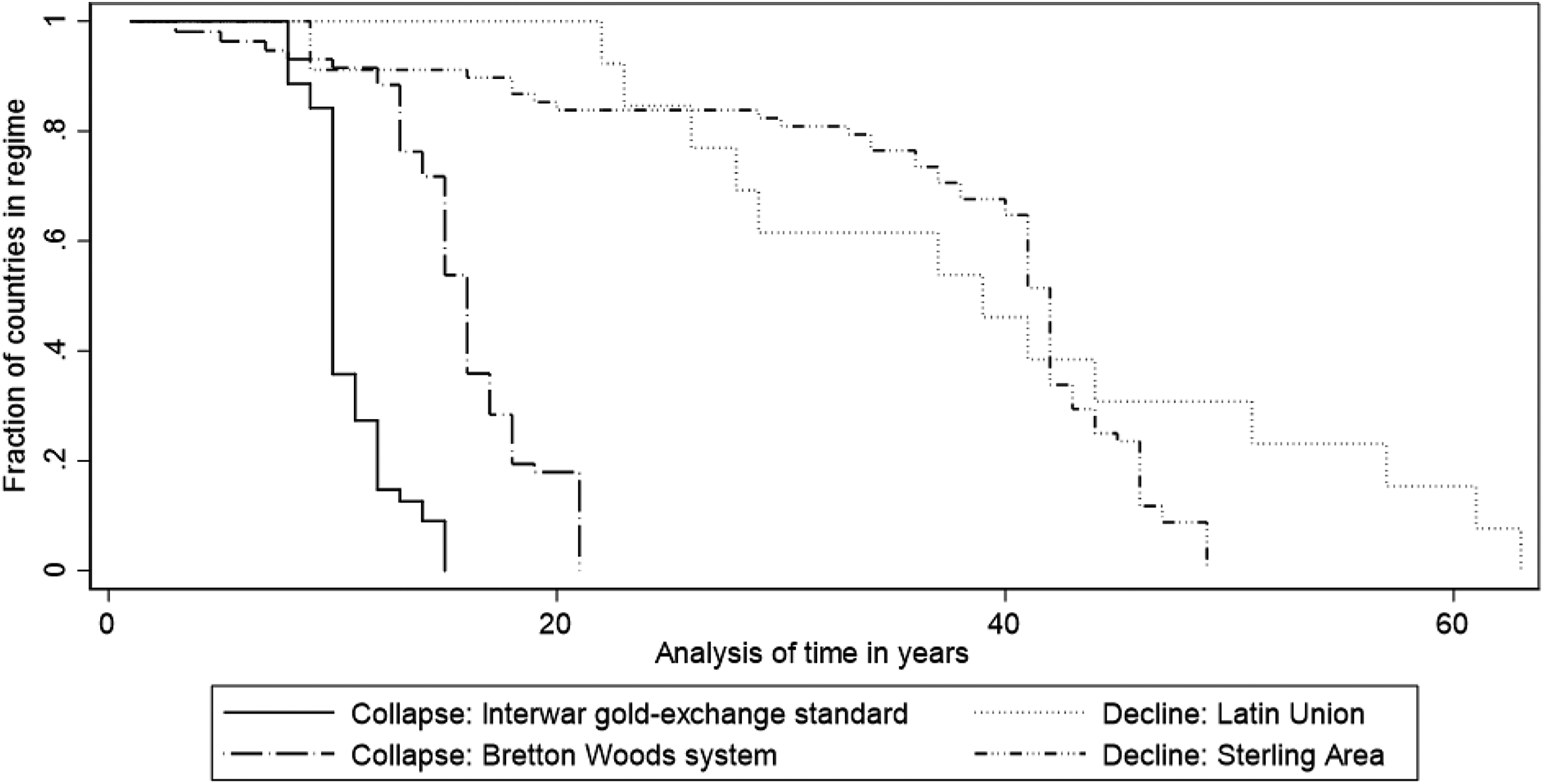

My theoretical framework gives rise to two propositions, which the historical record supports. First, negotiated systems, led through cooptation, face sudden demise once member resistance and policy maladaptation become overwhelming. The negotiated systems I analyze are the interwar gold-exchange standard and the postwar Bretton Woods system. Second, spontaneous systems, led through stratification, slowly decline through member defection and policy inertia. The spontaneous systems I analyze are the Latin Union and the Sterling Area. Table 2 sets out the design used to pair/contrast analytically equivalent contexts, and the causal process observations (CPOs) I expect to find within particular cases if the theoretical mechanisms postulated produced the divergent historical pathways.

Table 2 The case study design

Note: Plusses and minuses represent case scores on variables, coded dichotomously. X1 = the variable of theoretical interest (+ negotiated/- spontaneous historical structure); X2 = the key control variable (+ fixed exchange rate regime); Y = the outcome variable (+ collapse/- decline). The dates in brackets mark the period of regime breakdown. Refer to online appendix 4 for a methodological comment.

The Collapse of the Interwar Gold-Exchange Standard

The interwar gold-exchange standard has been remembered as a misguided and self-harming British conquest to restore the pre-1914 global financial order (Moggridge Reference Moggridge1972). To a certain extent, I agree: the Bank of England committed ardently to gold at prewar prices, imposing a decade of stagnation on British workers. But this does not entirely exonerate Britain of blame for the regime’s collapse, since it was the policies of cooptation, by means of which Bank and Treasury officials advanced the gold-exchange standard abroad, that incited policy maladaptation and political backlash beneath the façade of international financial stabilization.

Two accounts of the collapse of the gold-exchange standard that stress international factors oppose my claim that British cooptation caused the regime to collapse. The conventional macroeconomic wisdom is that the gold-exchange standard was disposed to collapse because it imposed “golden fetters” on its adherents, and transmitted economic shocks (Eichengreen Reference Eichengreen1992). An absence of international cooperation is central to this explanation. The other classic argument is that the interwar system suffered from a lack of leadership, because Britain was unable and the United States unwilling to provide it (Kindleberger Reference Kindleberger1973).

My counterargument is that both the substance of British leadership (not its supposed absence), and the specific character of internationally concerted actions (not a supposed failure to act concertedly), contributed to the system’s collapse in the 1930s. The gold-exchange standard was a negotiated construct of primarily British design. The architects in London became ever more committed to this order, not least following sterling’s foolish return to gold at an overvalued rate in 1925. The subversive acts of members and breakdown of cooperation in the late 1920s were, in important part, responses to a decade of British cooptation and the conditions it had produced.

The return to gold was identified in 1918 as sine qua non to restoring London’s centrality to world trade and finance, and to returning the Bank of England to its traditional position of dominance. However, faced with domestic stagnation and chaos in international exchanges, Britain needed to minimize the deflationary costs of a return to gold at prewar parities. The British brought this agenda to the Brussels (1920) and Genoa (1922) international monetary conferences.Footnote 2

The core of the British plan was to advance a managed gold-exchange standard (as opposed to an “automatic” gold standard), because this would increase demand for sterling as a reserve and trading currency, and cut in size the gold demanded by other countries, and so limit the adjustment costs imposed on the UK by the return to gold at prewar price levels.Footnote 3 The Genoa accord therefore sought to depress the international demand for gold, stabilize its purchasing power through coordinated credit policies, and establish central banks, freed from political pressure, across member countries. The United States and France accepted the plan only as a “temporary measure” to overcome the crisis conditions in Europe (Mouré Reference Mouré2002, 52-57).

The conduct agreed upon in Genoa—along with the distributional conflicts and contested ideas embedded therein—took practical form in the financial reconstruction and stabilization of European currencies. As Clarke (Reference Clarke1967, 36) noted, Montague Norman, the governor of the Bank of England, “pursued one variant or another of the Genoa proposals throughout most of the rest of the 1920s. Time and again he sought means by which to manage gold flows so that the movement of the metal might be made to support, or at least not interfere with, the aims of British monetary policy.”

British influence was felt through the Economic and Financial Organization of the League of Nations, and also through a network of central banks and exchange stabilization arrangements, within which the Bank of England held the focal position. Writing to the Vice President of the Reichsbank, Norman was candid about his expectation of special reciprocity: “I should like … to think that so far as the Reichsbank can, from time to time, assist us, either by action in one direction or refraining from action in another, I may rely with confidence upon your cooperation.”Footnote 4

Norman described the mechanisms of cooptation that tied monetary and financial authorities into asymmetrical relations: “A [foreign] central bank [could] acquire by external assistance … a certain freedom or independence within, and perhaps without, its own state.”Footnote 5 He had in mind the likes of League and Dawes loans, central-bank cooperation, and exchange-stabilization agreements. Concerted transactions helped to advance sterling and consolidated a powerful nexus of domestic and international bureaucratic interests around the gold-exchange standard and the ideas supporting it. However, cooptation also generated costs in the form of technocratic fixes, information distortions, and member resistance.

From the 1924 Dawes Plan onwards, conflicts over currency and doctrine were obscured in ambiguous contracts that left European central banks on uncertain dollar- and sterling-based standards. Tough questions regarding World War I reparations were also circumvented through technical fixes of unclear pecuniary value—such as the Dawes Plan Prosperity Index and the Transfer Protection Clause—reinforced by elaborate structures of external surveillance. As early as 1923, some British officials warned that they had only purchased monetary respite “without alleviating the real menace.”Footnote 6 League experts cautioned against letting “people believe that the real difficulty can be solved through a few technical tricks.”Footnote 7 Brown (Reference Brown1940, 779) noted that the “lack of balance” in the gold-exchange standard was “alleviated by a series of powerful, but impoverished and opportunistic, cooperative expedients to hold the system together.”

The regime also succumbed to collective information distortion. Gustav Cassel complained in 1923 that every round of international financial diplomacy left the world duped. “The economic problems of Europe,” he wrote, “are realities that cannot be removed from the world by a certain skill in verbal manipulation.”Footnote 8 Monetary officials individually and collectively made misleading statements to buy time in the hope that national reforms could be implemented to reverse international trends.Footnote 9 The League schemes and Dawes Plan were supporting a huge and complex structure of credit flows and reparations transfers; they could not be seen to fail.Footnote 10 Despite knowing all was not well, insiders threw good money after bad. The exchange of distorted information also created a false image of stability among participants in the regime. Remarkably, Brown observed that even the Young Plan reforms of the late-1920s were “negotiated under the fixed illusion of stability” (Reference Brown1940, 804).

Member resistance limited the options for further cooptation and the extension of the gold-exchange standard. The League was marginalized internationally,Footnote 11 and coopted monetary officials faced mounting domestic discontent. U.S. president Herbert Hoover (Reference Hoover1952, 9), reflecting on his time as Secretary of Commerce in the 1920s, dismissed Federal Reserve governor Benjamin Strong as a “mental annex to Europe.” Norman writing to Strong in 1927 noted that “all of us have one or other political background impediment: … [central bank cooperation] meanwhile [is] rather a pretence!” (Sayers Reference Sayers1976, 100). The febrile political atmosphere “contributed much to driving the central banks apart and thus helping to destroy any reasonable basis for international monetary and financial cooperation” (Meyer Reference Meyer1970, 3).

In rejecting international cooperation, member countries also rejected Britain’s intellectual justification for the system. Bank of England officials lamented credence being given in Europe “to the view that a gold exchange standard is merely a transition to the old ideas of the gold standard,”Footnote 12 rather than a permanently sustainable arrangement, as Britain saw it. Members, on the other hand, complained that London only paid lip service to the right of gold-exchange banks to freely convert sterling reserves into gold, and rarely permitted this in practice.Footnote 13

Ultimately, exposing the absence of settled principles on the “rules of the game”—an absence that had been covered up since Genoa—the U.S. Federal Reserve raised interest rates and France began to convert foreign exchange into gold in 1928.Footnote 14 Britain’s growing realization that it would have to bear the costs of staying on gold without further international props contributed to its adoption of a “self-help” policy in late 1930 and the eventual decision to abandon gold in September 1931. The system limped on under the auspices of the gold bloc until 1936, but its strength deteriorated precipitously.

Britain’s struggle to restore its prewar economic hegemony—under the camouflage of financial diplomacy—has not played a central role in explanations of the collapse of the interwar gold-exchange standard. Instead, scholarship has pointed to changing domestic conditions that made operating the gold standard impossible, and to a general lack of international leadership. While opportunism in leadership and endogenous institutional pathologies were far from the only sources of dysfunction in the disturbed postwar world, current explanations excessively downplay their significance. We gain a deeper historical understanding by tracing the policy maladaptation and member resistance bred by cooptation.

The Collapse of the Bretton Woods System

Writing decades after President Richard Nixon closed the gold window, Paul Volcker, who had been the leading U.S. Treasury official in the 1960s, was still baffled: “With the world enjoying the sort of economic expansion that it had never before experienced, why was there so little sense of commitment to an international monetary system associated with that performance?” (Volcker and Gyohten Reference Volcker and Gyohten1992, 29).

Economists have located major technical flaws in the gold-dollar system (Bordo and Eichengreen Reference Bordo and Eichengreen1993). But these accounts fail to explain why particular technical solutions were chosen—among numerous options—and why these led to further frustration. Political scientists have emphasized shifts in the international distribution of power, and changing conditions in the United States, both emerging from the conflict in Vietnam and from Great Society social programs, that undermined the regime (Gowa Reference Gowa1983). However, these arguments separate the logic (and analysis) of regime development and historical change. A complete account of the collapse of the Bretton Woods order must explain the process leading to Nixon’s decision in August 1971 and its aftermath.

I present such an interpretation. I show that in order to sustain benefits derived from monetary leadership in a negotiated regime, the U.S. Treasury and Federal Reserve instituted technocratic fixes and orchestrated information distortions when the system came under huge stress in the early 1960s. Despite the shared gains enjoyed by monetary authorities in Japan and Europe, the costs imposed on member countries provoked domestic and international resistance well before the regime’s collapse. Member agitation and growing international economic imbalances increasingly constrained U.S. authorities, who ultimately reassessed American interests and brought the system to a dramatic end.

Under the gold-dollar regime, the United States cajoled recalcitrant members into maintaining a system that benefited its own interests. The basic source of instability and conflict was the mounting U.S. deficit, financing for which rested on Congress’s 1934 pledge to maintain the free convertibility of dollars into gold at a fixed parity. But confidence in the pledge waned in the late 1950s because the U.S. deficit became inconsistent with its gold stock (Bordo and Eichengreen Reference Bordo and Eichengreen1993, 47–49). Still, through collective bargaining in forums such as the International Monetary Fund (IMF), the Group of Ten (G–10), the Bank for International Settlements (BIS), and the Organization for Economic Cooperation and Development (OECD), the United States persuaded Western Europe and Japan into prolonging their accumulation of uncovered dollars.

The integrated organization of G–10 member states made cooptation seem an obvious strategy for U.S. officials.Footnote 15 “The participants [already] saw themselves as carrying a very special and important, if arcane, responsibility to protect the stability of the international monetary system” (Volcker and Gyohten Reference Volcker and Gyohten1992, 29-30). But members were never comfortable: they knew that the collective schemes being advanced were steadily exacerbating asymmetrical pressures on the U.S. balance of payments, allowing Washington to avoid regime discipline and become ever more inflationist. The logic of cooptation helped to suspend members’ discontent.

As in the 1920s, cooptation nurtured member loyalty. A 1963 report to the BIS described how bargaining built commitment through central banks’ mutual self-empowerment. “In the process of almost daily consultation with one another” officials managing national exchanges found themselves “thinking along more or less similar lines.” They agreed that “short term credits, swaps, the international exchange of information, gold-market interventions, and domestic financial controls” that put power into their own hands should be “permanent features of the system.”Footnote 16 In a telling contrast, less developed countries, which were not subscribed to the institutionalized structures of cooperation, displayed no great sense of loyalty to the United States and vocalized strong protests against the gold-dollar regime throughout the 1960s.

Yet, coopted member states and the regime as a whole also paid a price for cooptation. Europe and Japan repeatedly surrendered to U.S. imperatives in the gold-dollar order. A massive network of domestic and international controls on financial transactions and contrived policies was implemented to cover U.S. deficits, despite officials believing “the object of current international economic policy [should be] to attempt to eliminate these controls.”Footnote 17 As Best (Reference Best2004, 283) observed, when the “Bretton Woods system struggled through an escalating series of monetary crises, state and global policymakers chose … technical expediency, opting for limited reforms.” Among the most important technical tools were the gold pool and Federal Reserve swaps.

The example of the gold pool illustrates the causes and consequences of technocratic fixes. Established under the auspices of the BIS in November 1961 to help stabilize the London gold market, the pool coordinated efforts by the Federal Reserve Bank of New York (FRBNY), the Bank of England, and certain other European central banks. The FRBNY’s Charles Coombs claimed the United States sought “not to avoid discipline” or “avoid gold losses but to temper them” when shocks occurred.Footnote 18 For a time, the pool’s collective purchases and sales of gold placated exchange markets.Footnote 19 Under the surface, however, transactions internal to the pool eroded the link between U.S. gold reserves and pressures on the United States to make international economic adjustments.Footnote 20

As early as 1963, the BIS spelled out the long-term limitations of the scheme. “The ‘gold pool’ arrangements … constitute an acceptance of the de facto partial inconvertibility of the dollar. It is hard to see how this can be a permanent state of affairs.” The report admitted that while the “inconvenience of certain financial policies can be avoided” via the gold pool and “this may be justifiable in the short term … in the longer term it could be disastrous, not least of all for the US.”Footnote 21 This warning proved prophetic. Intended as a temporary fix, when the pool was eventually overwhelmed in the crisis of March 1968, “the die … was cast for a monetary system without gold.”Footnote 22

Swaps—reciprocal currency arrangements between the FRBNY, central banks, and the BIS—also supported the dollar at the cost of system maladaptation risks. The Federal Reserve warned in 1961 that “a great deal more harm can be done, with good intentions, by intervening to save the patient some pain than by letting him realize he is sick,”Footnote 23 yet swaps went forward. As feared, “with an eye to affecting policymakers” as well as markets, they were used to window dress central-bank reserves and mask international economic imbalances.Footnote 24 In time, this manipulation undermined efforts to coordinate market stability via swaps.Footnote 25

The Bretton Woods system also succumbed to collective information distortion. Information presented by WP3 of the OECD was deployed to obscure adjustment pressures. Participants in WP3 played along with this ploy, because they all benefited in the short run. In the words of one official, “The object of consultations would not be to prevent countries from doing what they wished to improve their own economic situation but to give the impression that any decisions taken had been taken in concert.”Footnote 26 Collective misrepresentations took pressure off the dollar and other currencies, but the BIS warned that WP3 had “fooled not only the public but also the ministers.”Footnote 27 The BIS’s managing director later wrote, “From 1965 things started to happen that reduced monetary collaboration … almost to a façade” (Guindey Reference Guindey1977, 37).

Unequal payoffs within and among countries incited political backlash: ministers took hold of policy and cut monetary officials’ control (Russel Reference Russell1973, 464). Beginning in 1965, France openly challenged America’s leadership. In 1968, the governor of the Bank of Italy warned that, “while his bank was still in control of the Italian situation, it might not be for much longer, since politicians were moving into the monetary policy field.”Footnote 28 It became harder for central banks to complete stabilizing transactions. Potential solutions, such as the creation of IMF special drawing rights, were delayed and scaled back. The mounting discontent presaged Nixon’s move to a policy of “benign neglect.” In August 1971, the United States exercised its ultimate power play, embargoing gold and undermining the gold-dollar edifice.

The Rubicon had been crossed. The Smithsonian Agreement of December 1971 sought to restore confidence in the Bretton Woods system. But countries were openly pulling in different directions throughout 1972. In February 1973, the United States devalued the dollar by 10%. Within a month, all major currencies began to float against the dollar. The machinery of international meetings kept moving forward, but it became ever more dissociated from the Bretton Woods framework.

This should not be surprising in hindsight. What finally ruptured in August 1971 was not, after all, the finely balanced system imagined at Bretton Woods, but a patchwork of technocratic fixes and distortions that had evolved in deference to U.S. power and interest. Established theories do not offer a systematic perspective on this historical rupture. The conventional wisdom holds that system failure was inevitable due to technical problems and exogenous change wrought by mobile capital and rising powers. But attending to records of actual policy deliberations, we find alternative paths not chosen, and that U.S. efforts to remain at the top of the financial hierarchy through cooptation contributed to the sudden destabilization of the Bretton Woods system.

The Decline of the Latin Union

The “entangling engagements”Footnote 29 of the Latin Union—a long-forgotten monetary regime led by France and including Belgium, Greece, Italy, and Switzerland as members of the more formally constituted Latin Monetary Union (LMU), plus other countries stretching from the Balkans to Central America—took nearly half a century to untangle. From its foundation in the mid-1800s, the Latin Union would survive dramatic fluctuations in bullion prices, war between France and Germany, a depression, and the Great War, only to be abandoned with little fanfare in 1927. What explains its gradual process of disintegration?

For a long time, it was believed that Latin Union countries simply fetishized silver; more recent assessments attribute the system’s inertia to political divisions in France and other bimetallic states (Einaudi Reference Einaudi2001). I present a different perspective: France was engaged in leadership by stratification.

The system’s slow and costly decline, I contend, was a function of its spontaneous origins. Constrained by these origins, French ministers, particularly through the main years of decline between 1868 and 1885, adopted temporizing measures and preferred to impose secret bilateral adjustments on other nations one by one. This pattern of action, while supporting French power, gradually undermined the Latin Union.

I say that the Latin Union emerged spontaneously because the process of joining the Latin Union, before and after the 1865 LMU treaty, followed an atomized pattern of countries separately adopting a franc-related currency, sometimes on the promise of possible admission to the LMU (Flandreau Reference Flandreau2000, 36). Members shared domestic Napoleonic monetary standards and committed to coinage standards and limits known as “Latin Criteria,” all in order to enable free international circulation of currency and access to French capital.

The spontaneous origins of the Latin Union created a diffuse set of international relations. Even after problems in the bimetallic world caused by a collapse in the price of silver precipitated the treaty of 1865, the Latin Union continued to operate on a minimally institutionalized basis. The 1865 LMU treaty neither created a supranational architecture nor fostered central-bank cooperation. Thanks to this “lack of common institutions, the French Ministry of Foreign Affairs became in fact the coordinating institution of the Union” (Einaudi Reference Einaudi2001, 51). The French exercised a de facto policy monopoly.Footnote 30

As leader of the Latin Union, France faced a dilemma as it sought to shore up weakening economic ties without resorting to coercive controls. The literature characterizes French policies between the late 1860s and 1885 as misguided efforts to “wait and see” (Willis Reference Willis1901, 141). But, in fact, at almost every decision point, Paris refrained from positive actions in order to avoid international bargaining over fundamental issues related to bimetallism and French monetary conditions (Einaudi Reference Einaudi2001, 89–118).

France “used its influence for its own agenda and, continually and ruthlessly, overruled the approaches of other members” (Fendel and Maurer Reference Fendel and Maurer2015, 114). Through successive non-decisions, France averted a possible push by members for the gold standard, avoided a destabilizing international debate about the Napoleonic standard, made domestic policy at its chosen pace, augmented the franc’s prestige, and retained advantages for its products in European markets.

The system was maintained through private side dealings and discrimination. France secretly tolerated Italian and Greek profligacy, since they were more in favor of bimetallism than Belgium or Switzerland. France also agreed to various arrangements with non-LMU countries (Einaudi Reference Einaudi2001, 98-105). By offering partial membership, France kept countries with unstable public finances out of the core regime while maximizing its sphere of influence.Footnote 31 As French officials put it, the aim was to “link our monetary system, even if imperfectly, [to countries that might be] drawn into other monetary spheres,”Footnote 32 without “limiting our freedom of action.”Footnote 33

Member loyalty was encouraged by the norm that association should be voluntary, reflecting the regime’s liberal economic foundation (Flandreau Reference Flandreau2000, 42). Bespoke membership terms also generated support for the leader. Remarkably, France avoided an open member revolt even through the suspension of specie payments in the 1870s, though the foundations of its economic dominance were decaying and economic nationalism was surging within member states. However, the individual and collective gains from stratification came at a cost: the Latin Union gradually succumbed to policy stagnation, information fragmentation, and defection.

Jealously protective of their power of initiative over policy, the French refused to impose necessary discipline on the Latin Union and update its practices, resulting in policy drift. According to Einaudi (Reference Einaudi2001, 98; also, Flandreau Reference Flandreau2000, 42), because France refrained from any “big stick policy,” it lacked leverage over members whose choices undermined the possibility of deeper union. Fendel and Maurer (Reference Fendel and Maurer2015, 106) observe that “the absence [from the LMU treaty] of some appropriate requirements on how to deal with a changing economic environment proved to become a major stumbling block for the union.”

The Latin Union faced a growing catalogue of problems created by incomplete solutions to earlier ones. In this context, asymmetry—and uncertainty—of information became damaging. Yet France never established a credible system of information exchange. Of the Latin Union, Einaudi (Reference Einaudi2001, 193) writes that no “foreign government had complete access to the information the French had, hence they could not assess entirely the weight of the French claims” about the strength of the system.

Member defection from the Latin Union took various forms. The lack of collective discipline eventually produced a jury-rigged system of multiple currencies and dual exchange rates. It was only when members looked to lessen their silver holdings that France took firmer action. In 1885, France amended the LMU treaty to demand the redemption of silver coins at face value in gold in the event of liquidation. The Latin Union continued to limp towards its final dissolution in 1927, but by the Great War it had lost much of its significance.

“It could not be doubted by anyone possessed of political insight that the action of France had been too tardy and too hesitating” wrote Chicago economist Willis (Reference Willis1901, 143). But the pattern of action leading to the Latin Union’s decline is not unintelligible in terms of rational calculation. France made a careful effort, by means of restraint and temporizing action, to avoid concerted member resistance. This enabled the Latin Union to survive drastic economic dislocations and rising nationalism. But, by prioritizing the short-term gains of stratification, the French authorities unwittingly channeled the Latin Union into a gradual and inescapable process of dissolution.

The Decline of the Sterling Area

The Sterling Area—an international economic order led by Britain and including many Commonwealth and independent states—emerged from World War II as the world’s largest multilateral monetary and trading system. It has been largely neglected by scholars, but Schenk notes that its longevity was “remarkable in itself” (it existed from 1931 until the late 1970s) and “offers an interesting case of prolonged disintegration of monetary relations” (Reference Schenk2013, 179).

The Sterling Area’s stubborn resilience and slow dissolution has long puzzled commentators. Existing explanations look to a “Commonwealth myth” that supposedly motivated the British political class (Strange Reference Strange1971). Analysts similarly present the members of the British-led system as dupes, in thrall to their old imperial master (Kirby Reference Kirby1981, 120). But we need not rely on these theories, which amount to guesses about motives. Archival records tell the story: policymakers made rational power-orientated choices following the logic of stratification.

The strategy of stratification can explain behaviors and outcomes in the Sterling Area’s main years of decline from 1947 to 1967, and into the 1970s. British leaders derived power from their control over policy, which they used to establish different policies with respect to different member countries. Member fragmentation and its benefits were sustained through policy restraint and information suppression. This divided members by appeasing them to the point where they would not seek collective bargaining. However, in the long term, this strategy produced policies with negative externalities and led to member defection, gradually undermining the system.

The Sterling Area was not planned. Instead, Sterling Area members were spontaneously united in their dependence on British markets, in their use of sterling as a reserve currency and in trade with each other, in their implementation of common exchange controls against the outside world, and in their pooling of dollar reserves. The Bank of England promoted the system as a liberal and voluntary “banking club” that benefited from a natural pattern of international payments.

However, British officials had to deal with a series of crises after World War II, including the convertibility fiasco of 1947; devaluation in 1949; the postwar dollar shortage; international humiliation in Suez; near constant exchange pressures and multiple crises; and, finally, the collapse of the gold-dollar order. Furthermore, decolonization weakened Sterling Area members’ political ties with Britain, and the value of new U.S. and European import and export markets encouraged members to realign economically with those regions. Geopolitical instability and rising nationalism make the slowness of the decline all the more remarkable. One might reasonably have expected the system to buckle.

British policymakers achieved system longevity by means of stratification, not by updating rules and institutions. The authorities ignored repeated calls for formalization because they understood that a more integrated system would encourage collective bargaining abroad and attract unwanted scrutiny at home. In 1954, with the Sterling Area under acute pressure, the British Treasury’s Leslie Rowan observed that “what is at stake here is that in future the reserve policy, and therefore sterling, [might] not be run by the UK but … by some sort of Sterling Area body.”Footnote 34 In the same secret memorandum, the Bank of England’s George Bolton wrote that “the establishment of such a committee would, I think, be very unwelcome to us and we should, I believe, be prepared to sacrifice much to avoid agreeing to it.”Footnote 35

This was a brief in support of policy restraint: not an ideal choice, but seemingly the best available for Britain. As Rowan put it, “If we expect Sterling Area countries … to continue to hold larger balances in London than they would do of ‘their own free will,’ and to peg to sterling … [it] is too much to expect that they will be content to see the sterling exchange rate and sterling reserves manipulated without any voice in the policy with regard to sterling.”Footnote 36 In other words, minimizing possible member resistance demanded a deliberate choice not to instigate it.

The fragmentation of the membership, and Britain’s monopolistic control of the system, were crucial to the management of member reserve diversification into gold and dollars—a process that undermined confidence in sterling. In 1956, the Treasury and Bank considered initiating collective negotiations to manage the problem of diversification, but officials reasoned that this would result in a “costly share-out [of financial resources and political control] by the United Kingdom.”Footnote 37 Instead, the UK dealt with members separately through informal bilateral agreements. This strategy slowed, but did not stop, the process of diversification.Footnote 38

The decision was part of a clear pattern. Throughout the extended drama of decline—and across policy issues including the sterling-balances problem,Footnote 39 devaluations of sterling, trade diversification,Footnote 40 decaying and leaking exchange controls,Footnote 41 permissive attitudes towards departures,Footnote 42 and an outflowing tide of capital (Schenk Reference Schenk1994, 89-93)—British calculations favored stratification. The British discriminated among regime members to minimize the burdens of adjustment that they would have to shoulder themselves. By the Treasury’s own admission, Britain, together with Australia and New Zealand, were “bailed out,” primarily by “Middle East oil states and in some cases the Colonies.”Footnote 43

The UK’s combination of strategic inaction and secret discrimination avoided scrutiny. But an irony followed: for as long as the power of initiative rested solely with the UK, no decisive action could be taken to arrest the decay of the Sterling Area, for risk of jeopardizing that very power. The practices essential to the regime were gradually hollowed out: relational ties decayed, information was suppressed, policies drifted, and members defected, until, finally, Britain had nothing left to uphold.

The problem of policy drift manifested itself in a loss of collective direction. There never developed an internationally shared understanding of the problems facing the Sterling Area. As Conan (Reference Conan1952, 157) noted, “The fundamental difficulty was the belief among members of the overseas sterling area that they were not consulted on decisions of high importance to the system as a whole and did not share equally in the formulation of policy. This naturally tended to impair the cohesion of the sterling system.”

Maladaptation was exacerbated by impairments to the exchange of information. There was no meaningful collective platform for information exchange between members of the Sterling Area, and Britain suppressed information so countries could not compare the sizes of their sterling holdings with those of others.Footnote 44 Members were left guessing about the strength of sterling. From the British perspective, information deficiencies were an undeniable problem—but not as great a problem as a potential loss of monopoly control over policy.

The lifeblood of the Sterling Area was drained through member defection. Already by the mid-1950s, some members were beginning to “edge out while professing continued membership.”Footnote 45 Monetary authorities appeared to use periods of calm between exchange crises to gradually and secretly diversify out of sterling.Footnote 46 “Diversification was gradual, hidden, and constrained,” as Kennedy (Reference Kennedy2019, 309) explains. While a few countries, such as Iraq and Burma, openly diversified, according to the Treasury the largest such moves to diversify came “from countries which never say a word to us about it.”Footnote 47

The UK paid an ever-higher price for the continuation of the maladapted system. Insiders who recognized the progression of dysfunctional policies and inaction were often at a loss to explain past decisions.Footnote 48 Outside commentators were, and remain, no less vexed. Strange, accounting for the widespread dysfunction in the Sterling Area, claimed a “Commonwealth myth” or “top-currency syndrome” was the primary cause of official “blindness or impotence toward the particular, national interests of Britain.” Supposedly, this myth or syndrome provided a “powerful rationalization for a do-nothing strategy” (Reference Strange1971, 322, emphasis added). Eichengreen (Reference Eichengreen2010, 134) concludes that members must have been motivated by loyalty to the UK.

These accounts are incomplete and sometimes misleading. The system’s durability was politically manufactured, and good strategic reasons underlay leadership choices and member responses. True, when a once-coherent and relatively functional system becomes riddled with maladaptive exceptions and noncompliance, it might seem obvious that tighter controls over defectors, and swifter collective reactions to external changes, would have been warranted. However, optimizing reform is no simple proposition when key sources of structural power are at stake. British officials faced just this problem. They made the best of the fragmented and minimally institutionalized regime they inherited, but in doing so they unintentionally condemned the Sterling Area to slow decline.

Rethinking Regime Change

Most recent studies of international monetary politics implicitly assume that each country is an island. Domestic politics and institutions matter. Systemic considerations are marginalized. Is this the best approach to understanding international monetary regime change? If, as I have argued, leaders are not especially farsighted or concerned with the rationality of systems, if the exigencies of international distributional conflict are key sources of policy and dysfunction, and if macro-historical structures mediate how those conflicts manifest themselves and with what effects, then the prevailing OEP approach appears incomplete.

Exploring the basic—but overlooked—contrast between episodes of sudden collapse and gradual decline, we find regime failure resulting not from the conventionally identified exogenous shocks, but instead from politically rooted, progressively accumulating, endogenous problems of opportunistic leadership and international governance. This finding turns the conventional wisdom of hegemonic stability on its head. In future work, I plan to consider why some systems don’t fail at all. My current sense is that power symmetry may in fact be a key factor in successful cases, such as the classical gold standard and the European Payments Union.

Does my argument imply that leading state officials should be blamed for regime failure? Not necessarily. The strategies of cooptation and stratification reflect what leading powers want at first. However, officials are usually responding defensively to powerful economic events. Moreover, the scope for choice soon atrophies, as policies become bound up in the system-level operations and practices maintaining regimes. It may only be in hindsight that officials become properly aware of the existence and properties of the institutional pathways that they have been simultaneously laying and travelling along.

This dynamic historical perspective challenges the standard “snapshot” view of financial crises and regime change. Enormous attention has been devoted to explaining the policy responses of states in a handful of major crises that punctuate the past. But if we only look at how things shake out in the final reckoning of a regime, we miss a great deal about what leads to particular historical turning points, including how policy actions in earlier, often forgotten, crises contribute to outcomes.

We also need to capture how exogenous shocks intertwine with history’s long-run branching processes. The trend of global convergence had stalled well before the SARS-CoV-2 pandemic struck. No one can pretend that structural vulnerabilities—including opportunistic Eurozone fixes and conspicuous global governance gaps—were not built into the status quo ante. As my analysis shows, our understanding of how the world economy actually fits together—and is coming apart—can be enriched by thinking through how big transnational structures and processes intersect with sudden events and reactive individual strategies.

Supplementary Materials

To view supplementary material for this article, please visit http://dx.doi.org/10.1017/S1537592720002315.