25 results

On stochastic control under poissonian intervention: optimality of a barrier strategy in a general Lévy model

- Part of

-

- Journal:

- Journal of Applied Probability , First View

- Published online by Cambridge University Press:

- 09 January 2025, pp. 1-24

-

- Article

- Export citation

The impact of pinning points on memorylessness in Lévy random bridges

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 62 / Issue 1 / March 2025

- Published online by Cambridge University Press:

- 15 October 2024, pp. 172-187

- Print publication:

- March 2025

-

- Article

-

- You have access

- HTML

- Export citation

Generalised shot-noise representations of stochastic systems driven by non-Gaussian Lévy processes

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 56 / Issue 4 / December 2024

- Published online by Cambridge University Press:

- 21 March 2024, pp. 1215-1250

- Print publication:

- December 2024

-

- Article

-

- You have access

- HTML

- Export citation

Predicting the last zero before an exponential time of a spectrally negative Lévy process

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 55 / Issue 2 / June 2023

- Published online by Cambridge University Press:

- 16 January 2023, pp. 611-642

- Print publication:

- June 2023

-

- Article

- Export citation

Non-asymptotic control of the cumulative distribution function of Lévy processes

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 54 / Issue 3 / September 2022

- Published online by Cambridge University Press:

- 15 June 2022, pp. 913-944

- Print publication:

- September 2022

-

- Article

- Export citation

Probability of total domination for transient reflecting processes in a quadrant

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 54 / Issue 4 / December 2022

- Published online by Cambridge University Press:

- 14 June 2022, pp. 1094-1138

- Print publication:

- December 2022

-

- Article

- Export citation

Subexponential potential asymptotics with applications

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 54 / Issue 3 / September 2022

- Published online by Cambridge University Press:

- 13 June 2022, pp. 783-807

- Print publication:

- September 2022

-

- Article

- Export citation

Unified signature cumulants and generalized Magnus expansions

- Part of

-

- Journal:

- Forum of Mathematics, Sigma / Volume 10 / 2022

- Published online by Cambridge University Press:

- 09 June 2022, e42

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

On operator fractional Lévy motion: integral representations and time-reversibility

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 54 / Issue 2 / June 2022

- Published online by Cambridge University Press:

- 06 June 2022, pp. 493-535

- Print publication:

- June 2022

-

- Article

- Export citation

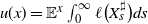

Valuing vulnerable Asian options with liquidity risk under Lévy processes

-

- Journal:

- Probability in the Engineering and Informational Sciences / Volume 37 / Issue 3 / July 2023

- Published online by Cambridge University Press:

- 07 February 2022, pp. 653-673

-

- Article

- Export citation

Non-Gaussian fluctuations of randomly trapped random walks

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 53 / Issue 3 / September 2021

- Published online by Cambridge University Press:

- 08 October 2021, pp. 801-838

- Print publication:

- September 2021

-

- Article

- Export citation

Double hypergeometric Lévy processes and self-similarity

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 58 / Issue 1 / March 2021

- Published online by Cambridge University Press:

- 25 February 2021, pp. 254-273

- Print publication:

- March 2021

-

- Article

- Export citation

A note on the optimal dividends paid in a foreign currency

-

- Journal:

- Annals of Actuarial Science / Volume 11 / Issue 1 / March 2017

- Published online by Cambridge University Press:

- 10 November 2016, pp. 67-73

-

- Article

- Export citation

Simulation and approximationof Lévy-driven stochastic differential equations

-

- Journal:

- ESAIM: Probability and Statistics / Volume 15 / 2011

- Published online by Cambridge University Press:

- 05 January 2012, pp. 233-248

- Print publication:

- 2011

-

- Article

- Export citation

Asymptotic behavior of the hitting time, overshootandundershoot for some Lévy processes

-

- Journal:

- ESAIM: Probability and Statistics / Volume 12 / 2008

- Published online by Cambridge University Press:

- 13 November 2007, pp. 58-93

- Print publication:

- 2008

-

- Article

- Export citation

Convex rearrangements of Lévy processes

-

- Journal:

- ESAIM: Probability and Statistics / Volume 11 / June 2007

- Published online by Cambridge University Press:

- 31 March 2007, pp. 161-172

- Print publication:

- June 2007

-

- Article

- Export citation

Convergence to infinitely divisible distributions with finite variance for someweakly dependent sequences

-

- Journal:

- ESAIM: Probability and Statistics / Volume 9 / February 2005

- Published online by Cambridge University Press:

- 15 November 2005, pp. 38-73

- Print publication:

- February 2005

-

- Article

- Export citation

Fast deterministic pricing of optionson Lévy driven assets

-

- Journal:

- ESAIM: Mathematical Modelling and Numerical Analysis / Volume 38 / Issue 1 / January 2004

- Published online by Cambridge University Press:

- 15 February 2004, pp. 37-71

- Print publication:

- January 2004

-

- Article

- Export citation

Periodic Ornstein-Uhlenbeck processes driven by Lévy processes

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 39 / Issue 4 / December 2002

- Published online by Cambridge University Press:

- 14 July 2016, pp. 748-763

- Print publication:

- December 2002

-

- Article

- Export citation